Donation For Land In Texas

Description

Form popularity

FAQ

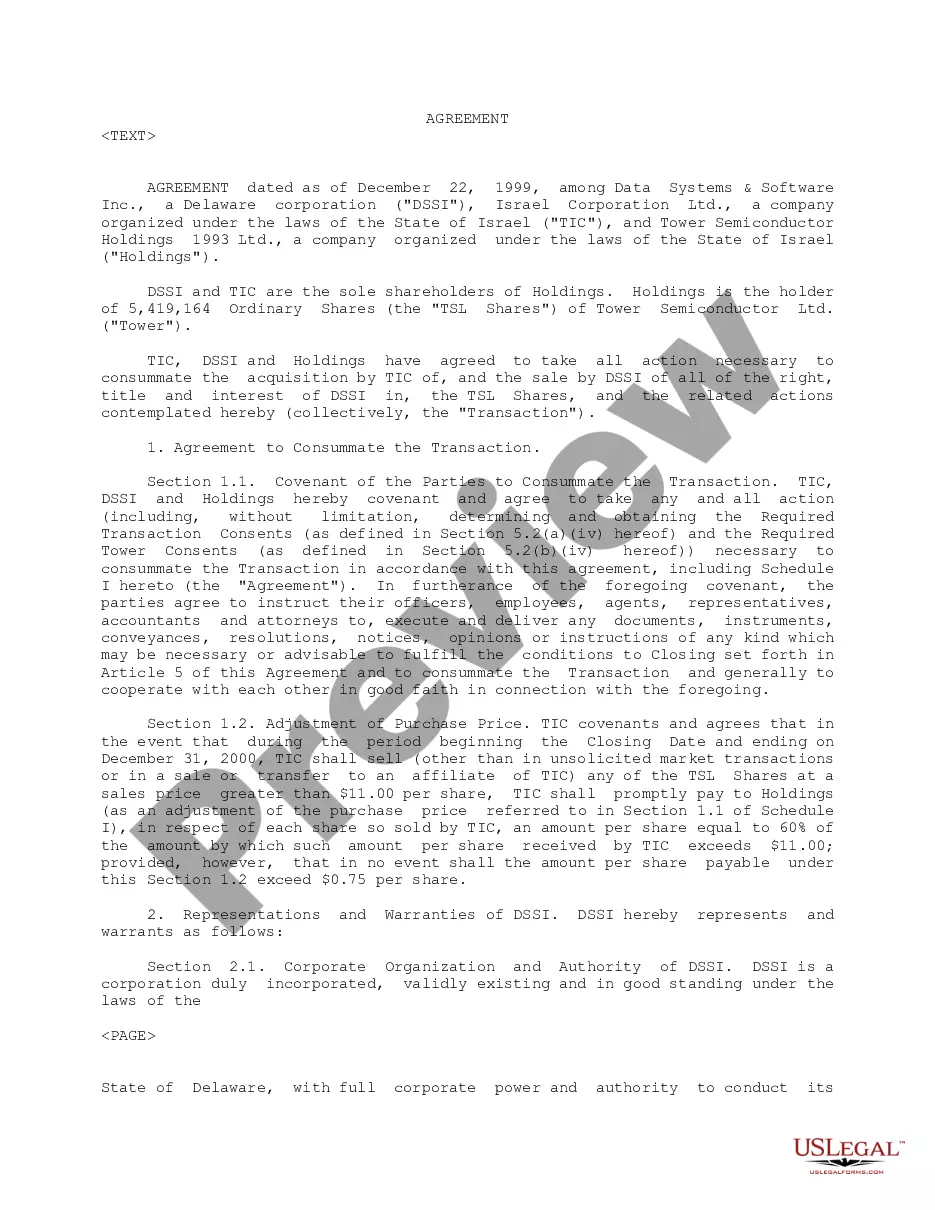

Individuals may deduct qualified contributions of up to 100 percent of their adjusted gross income. A corporation may deduct qualified contributions of up to 25 percent of its taxable income. Contributions that exceed that amount can carry over to the next tax year.

If you give property to a qualified organization, you can generally deduct the fair market value (FMV) of the property at the time of the contribution.

Income tax strategies—Donations to 501(c)(3) public charities qualify for an itemized deduction from income. Because the tax rate is then applied to a reduced income, this can minimize your overall tax liability.

Under the theory of adverse possession, you can claim ownership of property that belongs to someone else. Under Texas law, your possession of the property must be exclusive, open, continuous, and without the permission of the property owner for 3-10 years, depending on the circumstances.

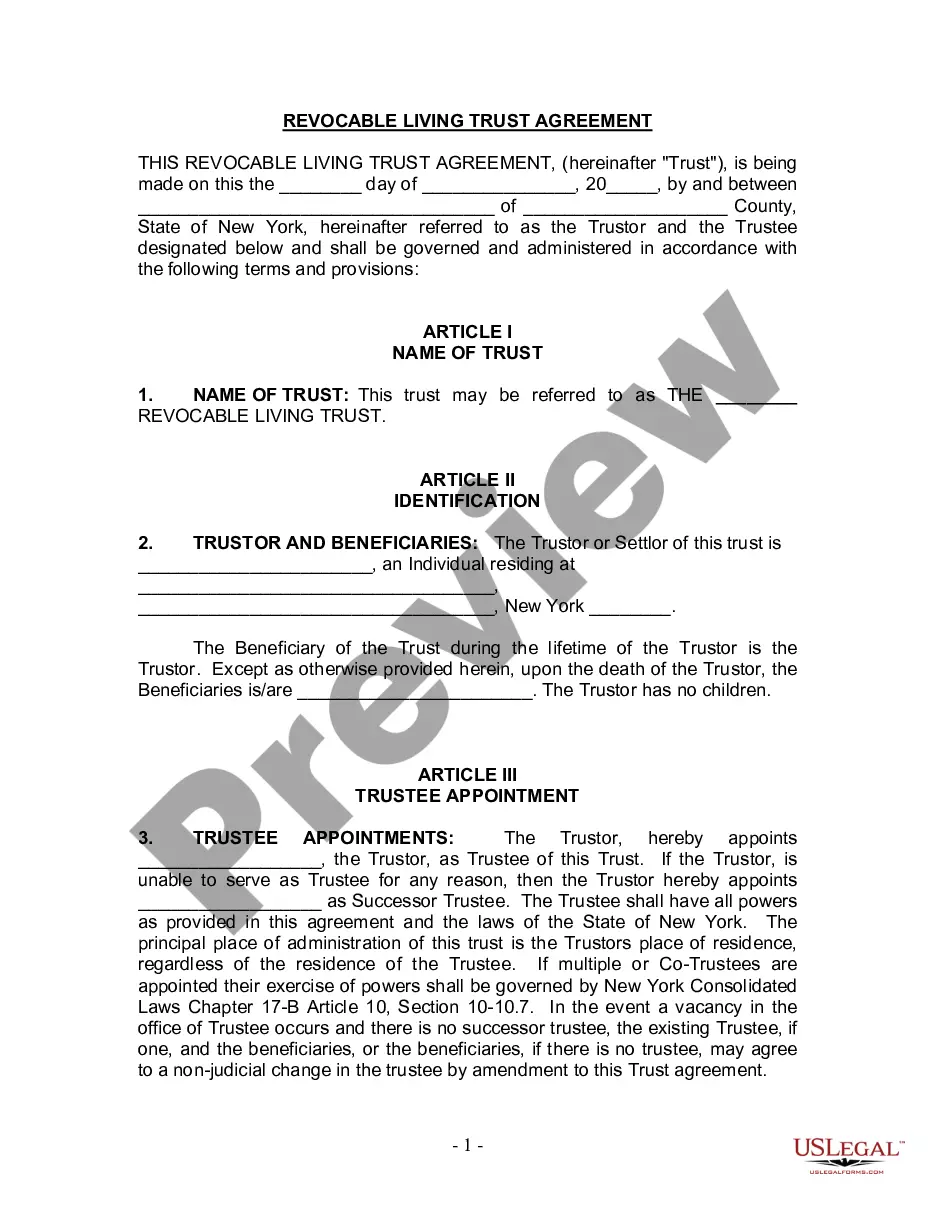

Gift deeds in Texas are valid, but there are requirements above and beyond those of a regular deed. A gift deed is a document that transfers title to land. It can be informal, but the grantor's intent must be to immediately divest himself of the property where he no longer has control over the land.

Make it urgent. Giving now is better than giving later, so make sure your language reflects that. Be clear and direct. Craft a great subject line. Keep it optimistic. Say thank you in advance. Use "you" in your asking for a donation wording. Use action verbs. Follow the numbers.

You can give Texas real estate to anyone, or to any entity, including a church or charity.

Texas also has no gift tax, meaning the only gift tax you have to worry about is the federal gift tax. The gift tax exemption for 2025 is $19,000 per recipient, which is an increase over the $18,000 mark set for 2024.