Donation For Land In Oakland

Description

Form popularity

FAQ

Michigan Property Donation – The Process Contact Real Estate with Causes; either choose your property type and complete the online donation form or call (888)-228-7320 and a professional volunteer representative will help you donate.

It involves drafting key legal paperwork, having your land appraised, finding an eligible land trust or nonprofit to enforce the easement, and consulting with a CPA to maximize your tax deduction. Fortunately, Giving Property specializes in working with donors to make the process as easy as possible.

In general, a person can get title to land owned by someone else by using the land exclusively, out in the open, without permission by the owner, and continuously and without interruption for the time period contained in state law for 15 years.

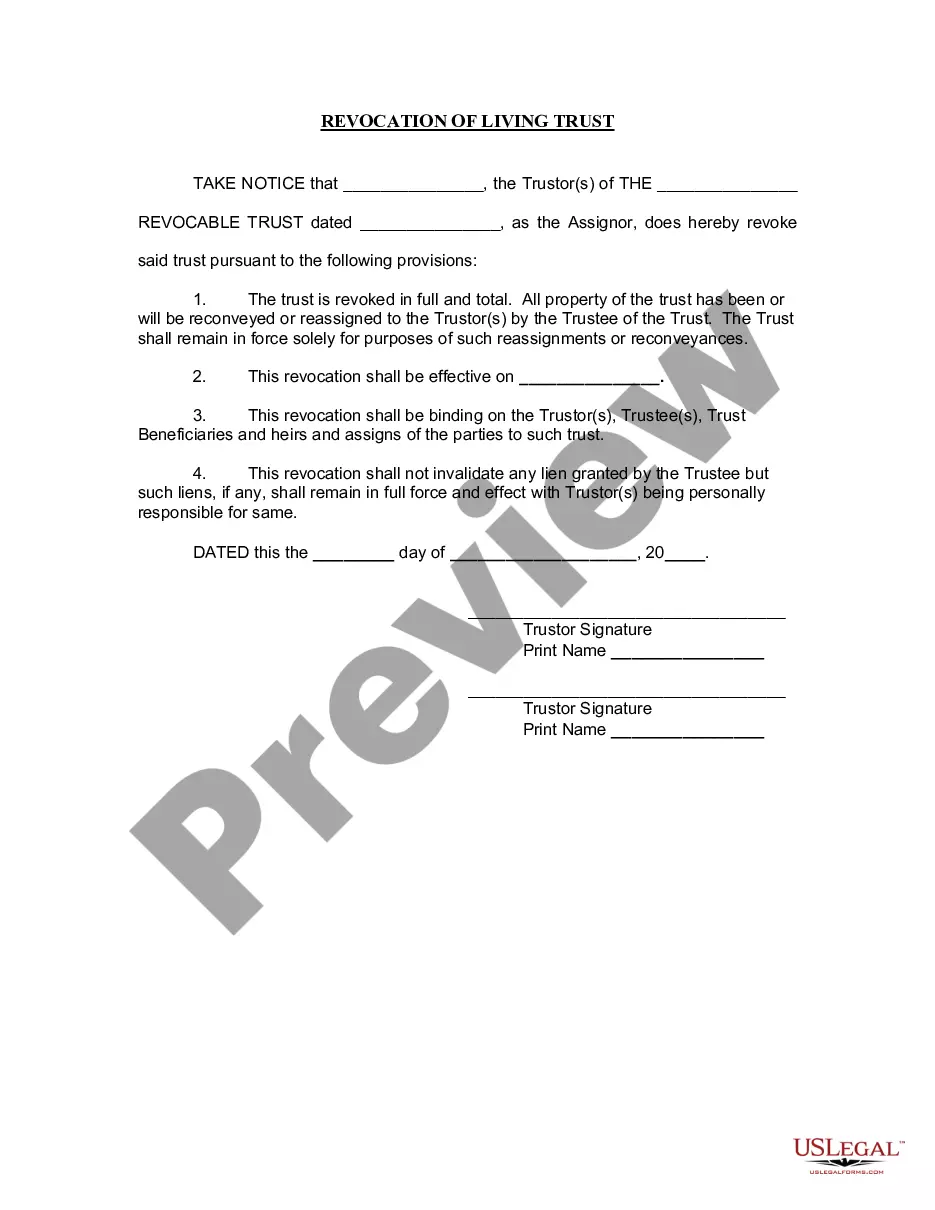

A land trust is a legal entity that assumes control over property and other real estate assets at the behest of the property's owner. It's a living trust, which is generally revocable, meaning the terms of the trust can be changed or terminated at any time.

It involves drafting key legal paperwork, having your land appraised, finding an eligible land trust or nonprofit to enforce the easement, and consulting with a CPA to maximize your tax deduction. Fortunately, Giving Property specializes in working with donors to make the process as easy as possible.

If you give property to a qualified organization, you can generally deduct the fair market value (FMV) of the property at the time of the contribution.

The contributions must be made to a qualified organization and not set aside for use by a specific person. If you give property to a qualified organization, you can generally deduct the fair market value (FMV) of the property at the time of the contribution.