Deed Of Donation Without Land Title In Hillsborough

Description

Form popularity

FAQ

It involves drafting key legal paperwork, having your land appraised, finding an eligible land trust or nonprofit to enforce the easement, and consulting with a CPA to maximize your tax deduction. Fortunately, Giving Property specializes in working with donors to make the process as easy as possible.

Donations are subject to donor's tax, as specified under the National Internal Revenue Code (NIRC). As of the latest amendments under the Tax Reform for Acceleration and Inclusion (TRAIN) Law, the donor's tax rate is 6% of the value exceeding PHP 250,000, regardless of the relationship between the donor and the donee.

Donor's Tax: One of the main costs in a Deed of Donation is the donor's tax. Under the current Philippine Tax Code, donations between parents and children are taxed at a flat rate of 6% of the fair market value (FMV) or zonal value of the property, whichever is higher.

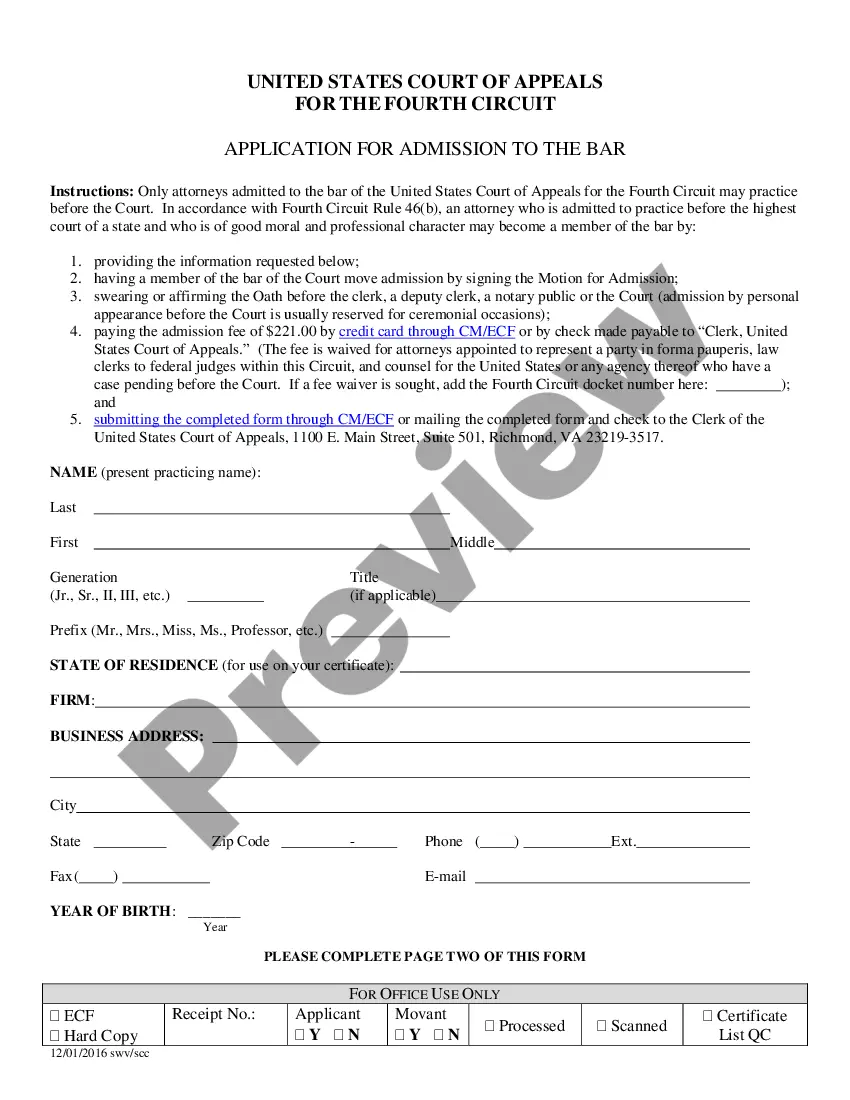

Notary Fees By Notarial Act StateAcknowledgmentJurat CA California $15 CO Colorado $15 CT Connecticut $5 DE Delaware $547 more rows •

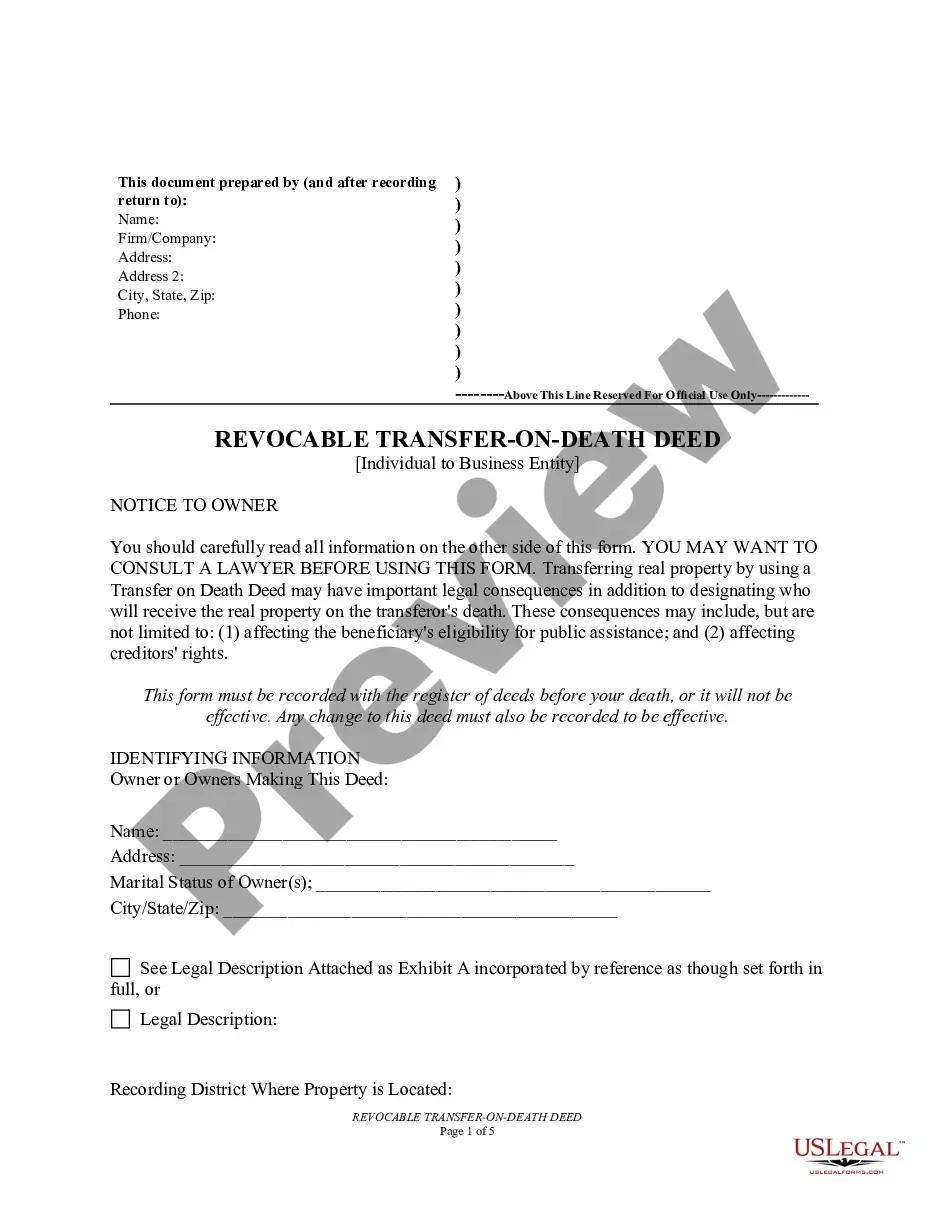

In summary, while a deed of donation does not have an automatic expiration, it can be subject to revocation or invalidity under specific circumstances, primarily due to failure to meet conditions, ingratiude of the donee, or legal limitations.

Correct, Add or Remove Names on Deed s Once your document is prepared, you will bring the original signed and notarized deed to the Clerk's Office; it can also be submitted by mail, but not by email.

The Clerk of Court Recording Department records, indexes, and archives all documents that create the Official Records of Hillsborough County. Approximately 25 million documents have been recorded in the Official Records since 1846 and 2,000 new documents are recorded each day.

Tampa, Florida 33619-0917 Submit paper title or a completed HSMV 82101 if unable to locate paper title. Your customer should sign a completed form HSMV 82139 Notice of Lien. Submit the completed form HSMV 82139 and a check (see fees) to the Tax Collector's office. The lien will be added to show you as lienholder.

Online via an Official Records portal: Most Florida circuit clerk offices provide an Official Records Search portal on their websites, which interested persons can access to find liens on a property, including tax liens registered by taxing authorities.

A person can file a quitclaim deed by (1) entering the relevant information on a quitclaim deed form, (2) signing the deed with two witnesses and a notary, and (3) recording the deed at the county comptroller's office. In Florida, quitclaim deeds must have the name and address of both the grantor and the grantee.