Board Directors Resolution Withdraw Money From Bank In Kings

Description

Form popularity

FAQ

RESOLVED FURTHER THAT, the said bank be and is hereby informed and authorized to honor all cheques, bill of exchange, promissory notes, hundis, and any other instruments drawn, accepted, made and signed on behalf of the company, by the following authorized signatories, up to the limits prescribed below.

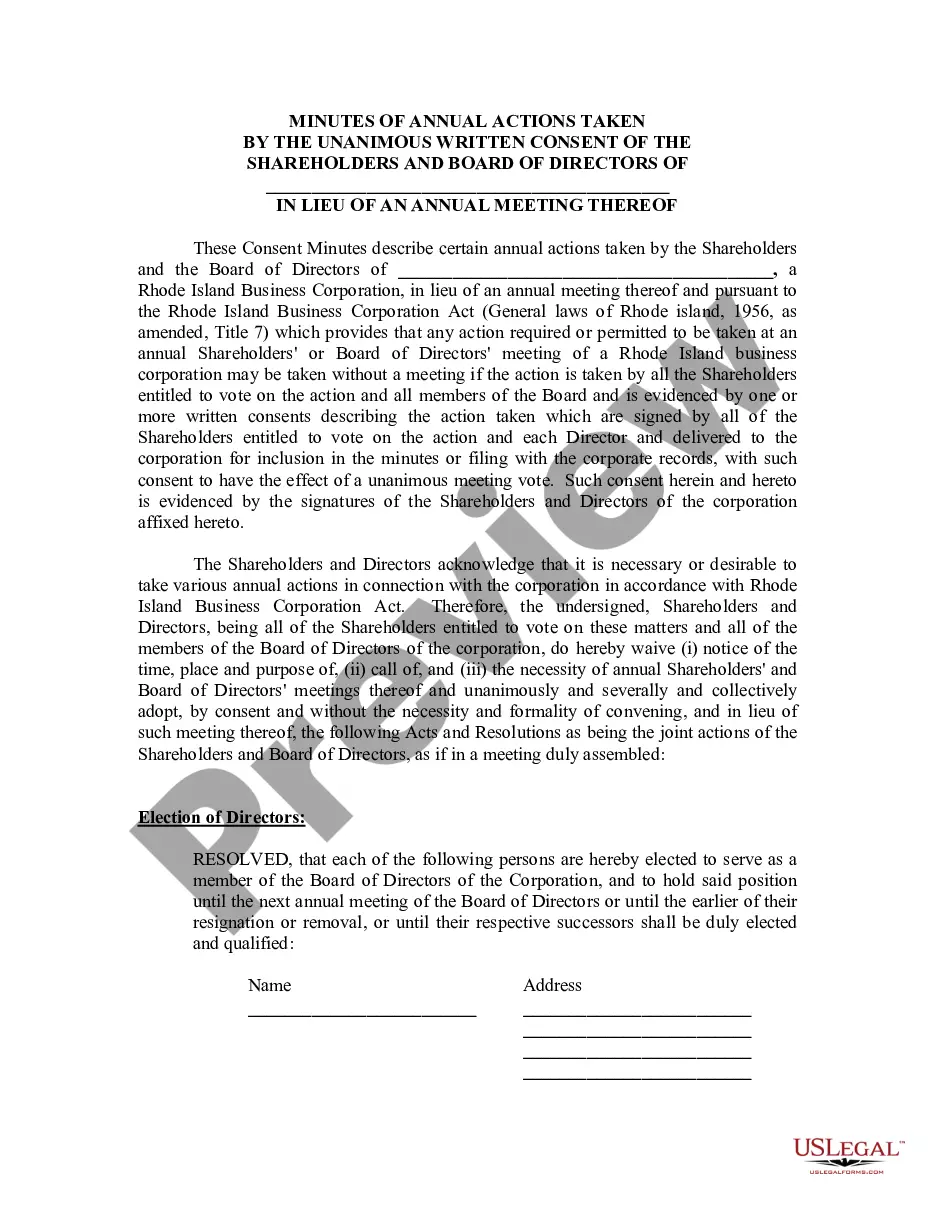

How to write a board resolution Put the date and resolution number at the top. Give the resolution a title that relates to the decision. Use formal language. Continue writing out each critical statement. Wrap up the heart of the resolution in the last statement.

“RESOLVED THAT in supersession with all the previous resolutions in respect of operating a bank account having Bank Account No. ______ with _______ Bank at its __________branch, the Current mode of operation for above mentioned account be & is hereby changed & replaced by following authorized signatories.

A bank resolution occurs when authorities determine that, contrary to normal insolvency proceedings, resolution would better protect financial stability, depositors and minimise the recourse to public funds (so called public interest assessment).

When drafting a banking resolution, here are the key elements to include: Title of the Document. Statement of Board Agreement. Detailed List of Authorized Individuals. Specific Powers Granted to These Individuals. Time Frame for the Resolution's Validity. The Signature of the Company's Board of Directors or Members.

Simply put, a banking resolution is a formal authorization to open a corporate bank account, whether for profit or nonprofit. This document identifies any member of the nonprofit with permissions to perform transactions and account procedures while outlining what role and privileges are granted to these individuals.

Board members of a corporation usually draft a banking resolution at their first board meeting. A Limited liability company (LLC) should also have a banking resolution. This simplifies the process of opening a bank account. Banks often require banking resolutions from companies.

Resolution is the restructuring of a bank by a resolution authority through the use of resolution tools in order to safeguard public interests, including the continuity of the bank's critical functions, financial stability and minimal costs to taxpayers.

An LLC banking resolution is often one of the most necessary, as a business cannot generally create a bank account without one. Depending on the rules of the bank, you may be required to fill in an additional proprietary form before creating a business bank account.