Erisa Law Explained In King

Description

Form popularity

FAQ

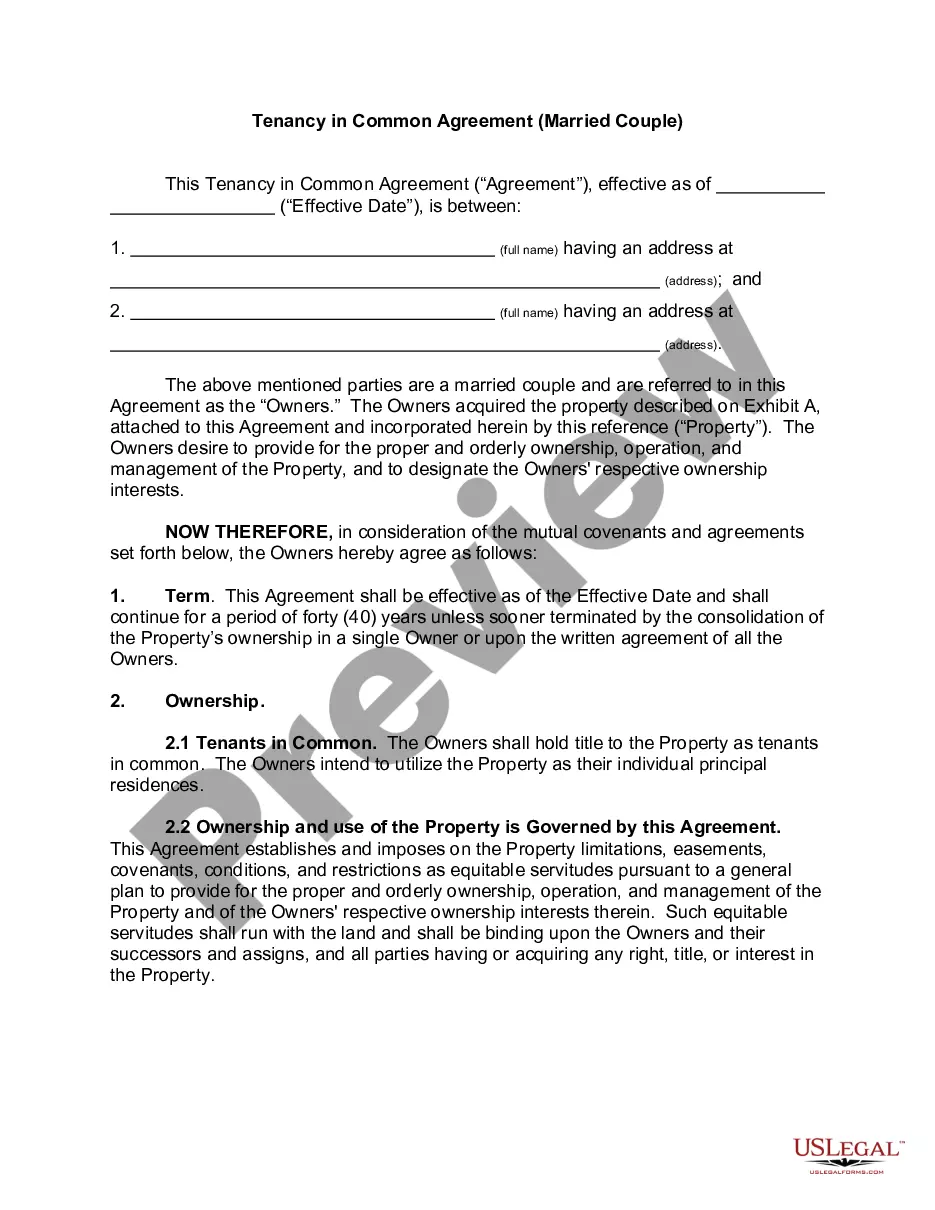

A common rule of thumb is any employer that offers a group-sponsored health plan must comply with the ERISA notice and disclosure, and possibly, reporting requirements unless an exemption applies.

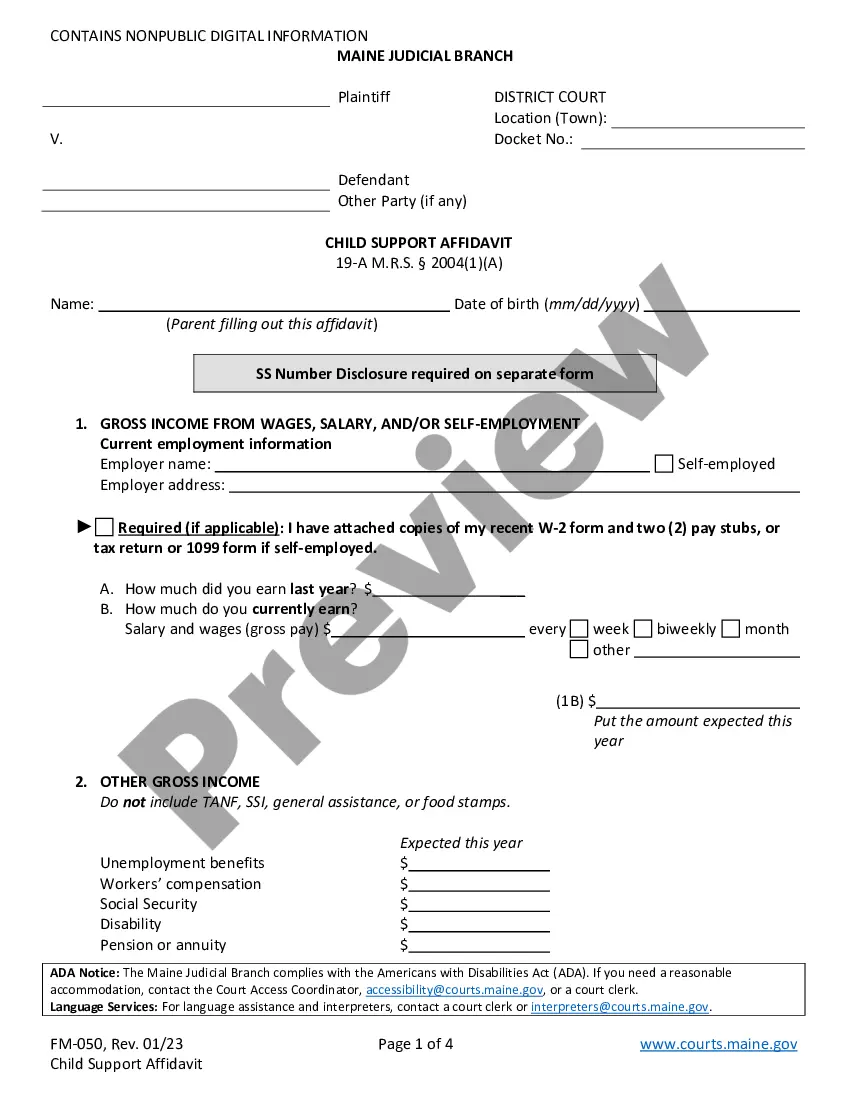

Basic ERISA compliance requires employers provide notice to participants about plan information, their rights under the plan, and how the plan is funded. This includes ensuring plans comply with ERISA's minimum standards, recordkeeping, annual filing and reporting, and fiduciary compliance.

ERISA governs the claim only if ERISA covers the plan involved in the claim. ERISA applies to most employee benefit plans, including employee health and retirement plans. ERISA does not cover certain plans, such as government plans and church plans.

Common ERISA violations include denying benefits improperly, breaching fiduciary duties, and interfering with employee rights under the plan.

Under the ACA, employers with a certain number of employees must offer affordable health insurance coverage to their eligible employees. ERISA provides the framework for employers to meet these obligations, ensuring that employers properly administer health benefit plans and adhere to the ACA's coverage requirements.

All private employers and employee organizations, such as unions, that offer health plans to employees have to follow ERISA. Only churches and government groups are exempt. If you offer your employees health coverage, you'll have to follow certain rules and procedures as a result of ERISA.

The provisions of Title I of ERISA, which are administered by the U.S. Department of Labor, were enacted to address public concern that funds of private pension plans were being mismanaged and abused.

The Employee Retirement Income Security Act of 1974 (ERISA) is a federal law that sets minimum standards for most voluntarily established retirement and health plans in private industry to provide protection for individuals in these plans.

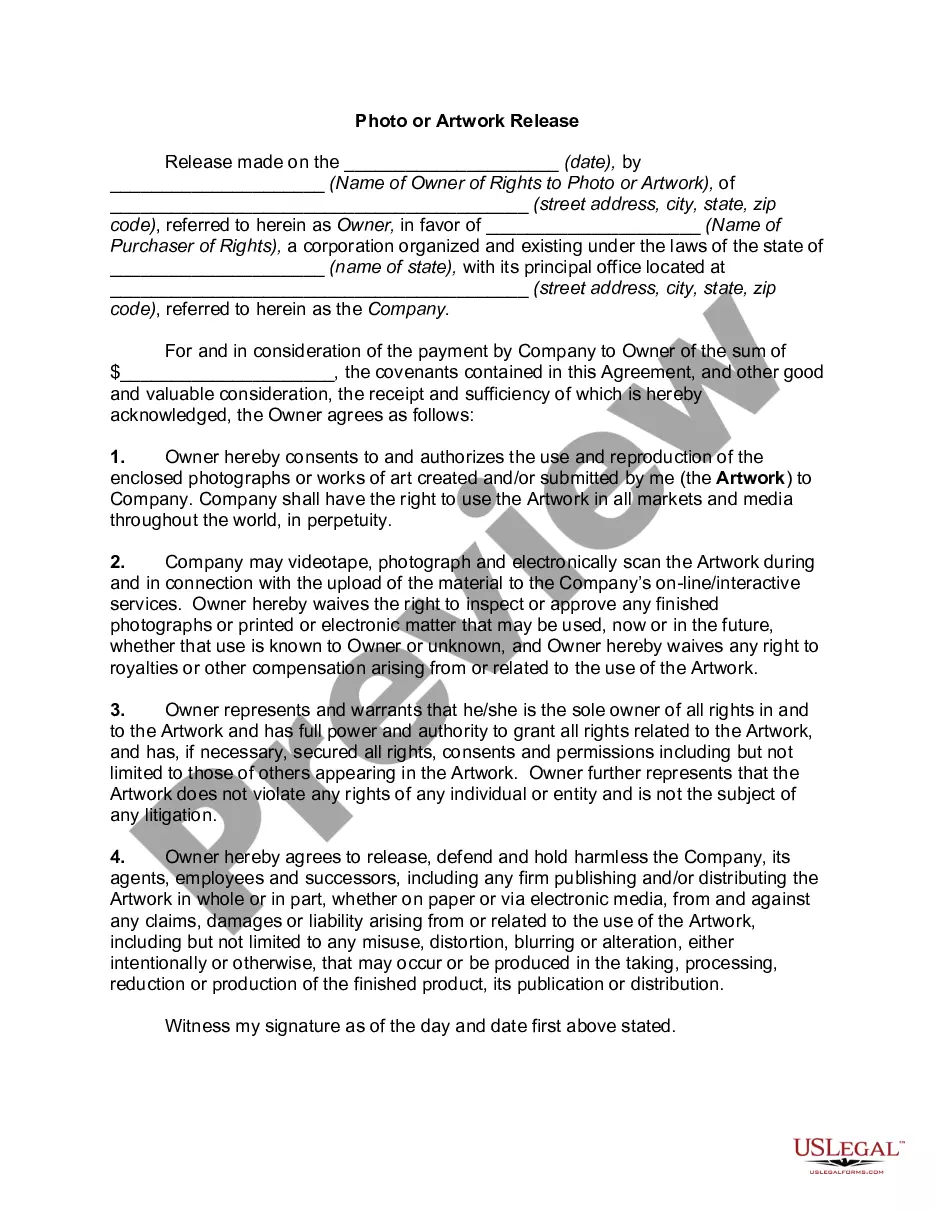

Active enforcement activities include investigations, lawsuits, and the dissemination of information. Documents published by EBSA include the Reporting and Disclosure Guide for Employee Benefit Plans.

Common ERISA violations include denying benefits improperly, breaching fiduciary duties, and interfering with employee rights under the plan.