Retirement For Elderly In Chicago

Description

Form popularity

FAQ

The number of credits you need to receive retirement benefits depends on when you were born. If you were born in 1929 or later, you need 40 credits (10 years of work). If you stop working before you have enough credits to be eligible for benefits, the credits will remain on your Social Security record.

The retirement benefits application process follows these general steps, whether you apply online, by phone, or in person: Gather the information and documents you need to apply. Complete and submit your application. We review your application and contact you if we need more information. We mail you a decision letter.

Infrequent workers: Individuals who have insufficient earnings to qualify for Social Security, but are not late-arriving immigrants. Non-covered workers: Individuals with sufficient earnings, but who work in non-covered employment (primarily state and local government employees).

A: The requirements to be eligible for a monthly pension based on the minimum formula (2.4% of Final Average Salary per year accrual rate) are: 30 years of service, payable at age 50 or greater. 20 years of service, payable at age 55 or greater. 10 years of service, payable at age 60 or greater.

To be eligible for service retirement, you must have at least five years of CalPERS-credited service and be at least age 50, 52, or 55 depending on your retirement formula . If you have a combination of classic and PEPRA service, you may be eligible to retire at age 50 . (See page 12 for more about PEPRA .)

To receive a pension benefit, you must have a minimum of 10 years of credited service with SERS. You may retire at: Age 67, with 10 years of service credit.

Chicago can be a good city to retire in, depending on your preferences and lifestyle. Here are some key factors to consider: Pros: Cultural Amenities: Chicago offers a rich cultural scene, including museums, theaters, music venues, and festivals.

While Illinois ranked among the more affordable states, Chicago ranked among the most expensive metros to retire in. Here, you'll need roughly $948,000 in order to afford a 25-year retirement. If you moved north to the Milwaukee-Waukesha area, you could save about $100,000, the analysis found.

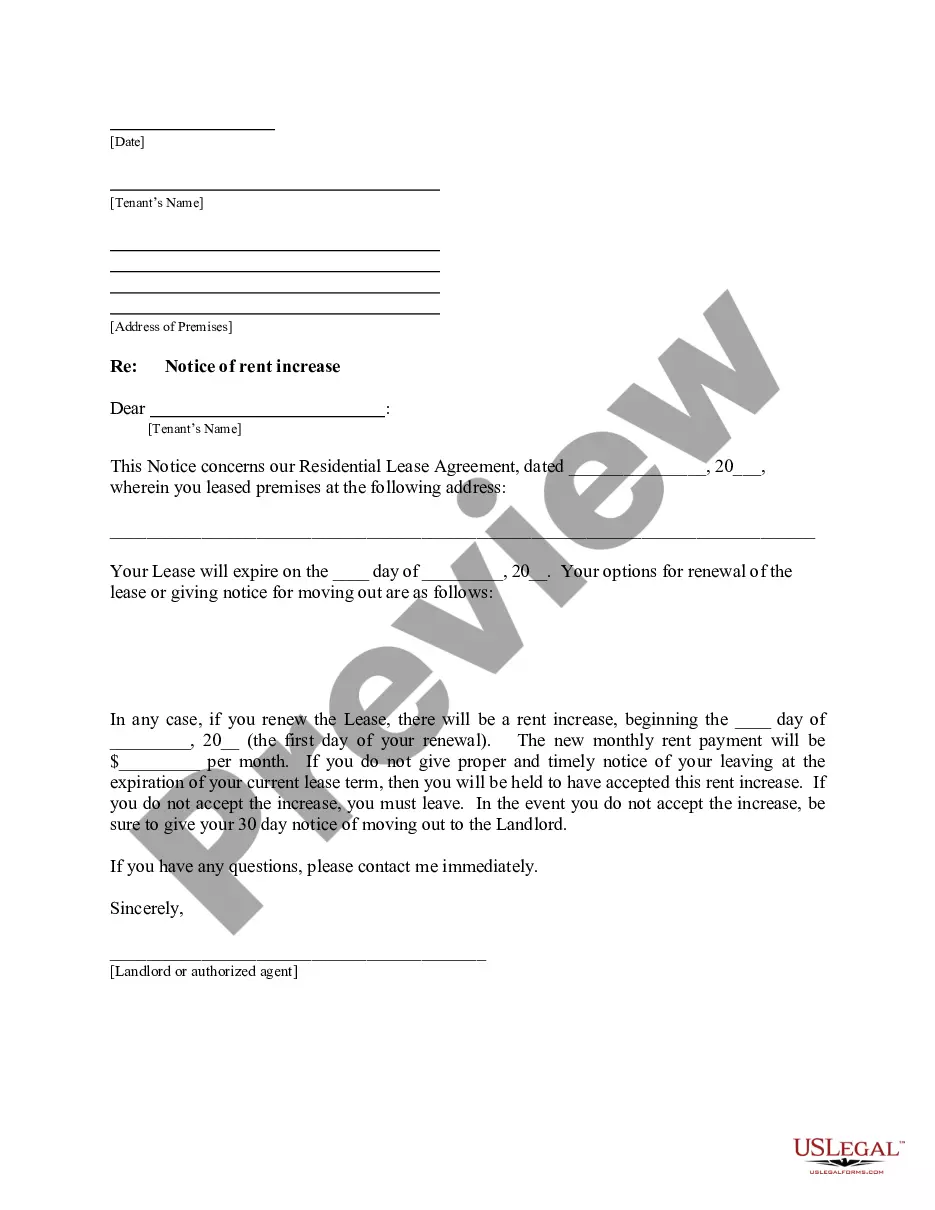

Residents (or their spouse) must be at least 62 years old. They must be able to fulfill rent by themselves or with whatever assistance they can provide privately, and households must meet income requirements as determined by the U.S. Department of Housing and Urban Development. All rents are subsidized.