Payoff Mortgage Form Sample For Mortgage In Suffolk

Description

Form popularity

FAQ

You will need to work with your lender and your provincial or territorial land title registry office to get the mortgage discharged. You may also require the services of a lawyer or notary. There are fees involved with this, and the costs will vary depending on where you live.

A Discharge of Mortgage is like a signed letter from a lender saying a mortgage is clear from a property's title. There are several instances where a mortgagor needs to request this particular form.

Let's go over five not-so-secret but super helpful tips for making that happen. Make extra house payments. Make extra room in your budget. Refinance (or pretend you did). Downsize. Put extra income toward your mortgage.

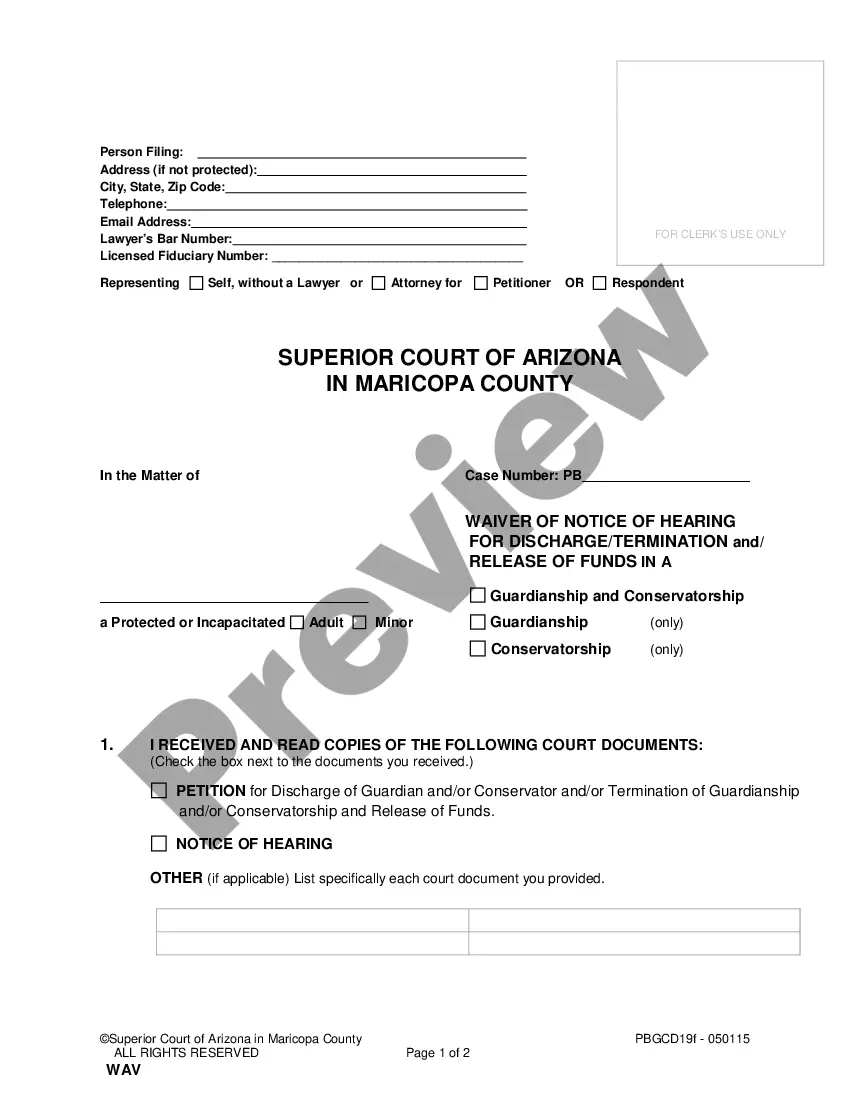

The Record & Return To box (number 6) on the Suffolk County Recording and Endorsement Form must be properly completed for the timely return of your recorded mortgage. NOTE: Must be printed on legal size (8 1/2 x 14) paper. Mortgage Tax is computed by a formula based on 1.05% of the amount of the mortgage.

If a Transcript of Judgment has been filed with the County Clerk, once the Debtor pays off the Judgment, the Creditor has a legal responsibility to prepare and sign a Satisfaction of Judgmentfor the benefit of the Debtor, so that all liens and record of Judgment can be removed from the County Clerk's office.

Satisfactions of Mortgage should be recorded in the Office of the County Clerk of the county in which the mortgage has been recorded.