Sample Letter Payoff Mortgage File Format In Pima

State:

Multi-State

County:

Pima

Control #:

US-0019LTR

Format:

Word;

Rich Text

Instant download

Description

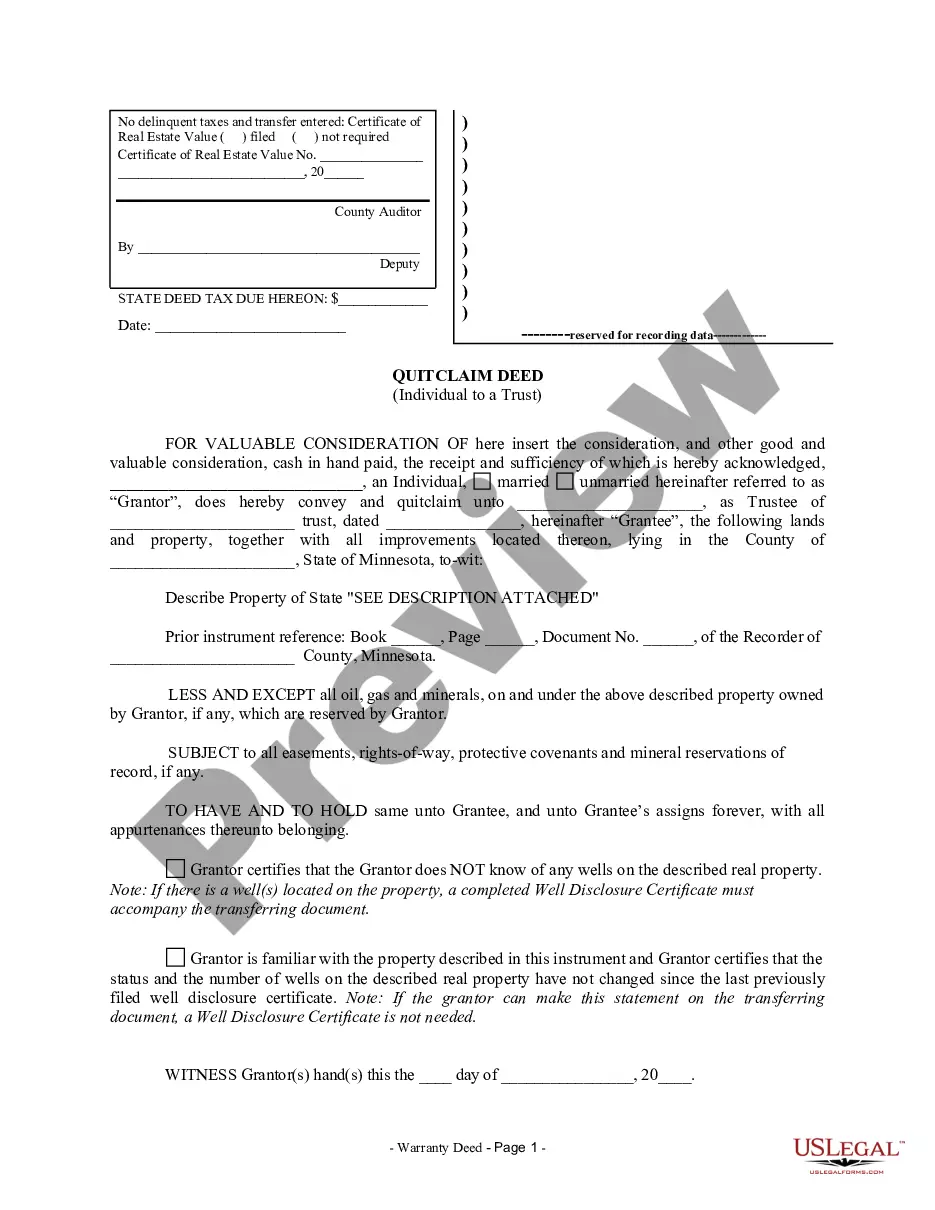

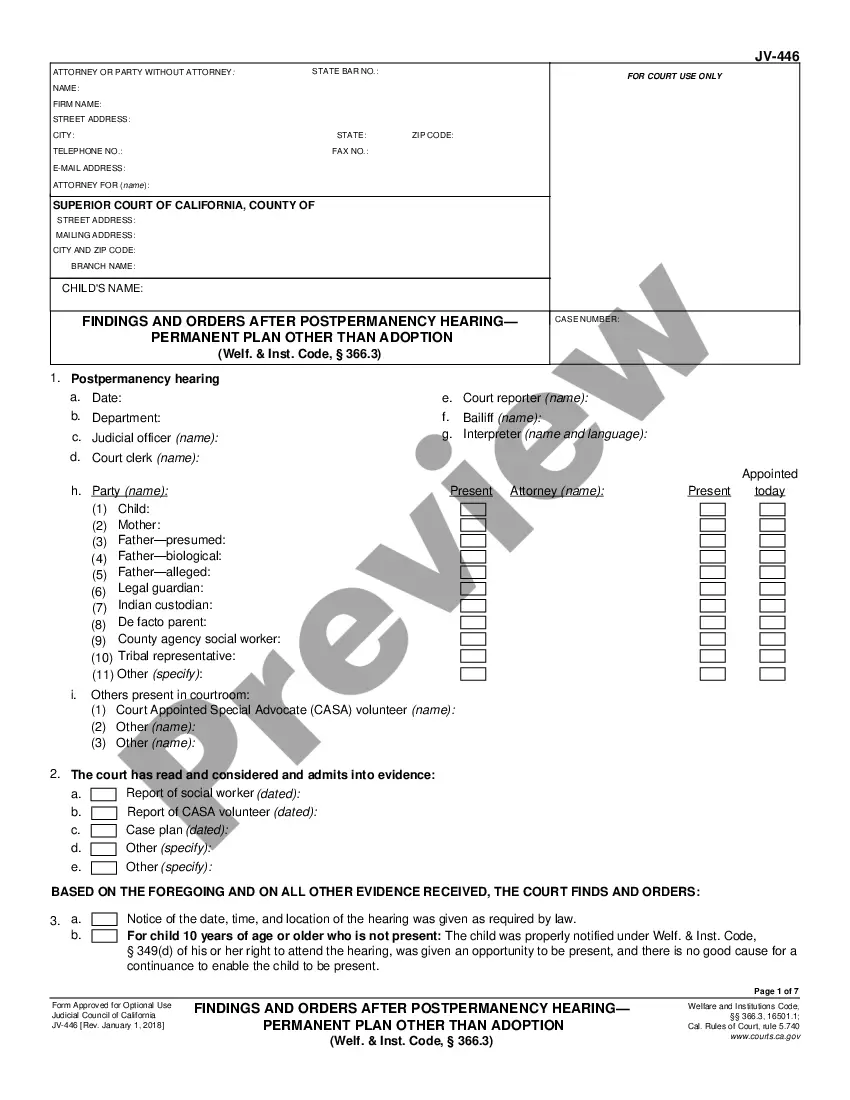

The Sample Letter Payoff Mortgage file format in Pima is a template designed for communicating with lenders regarding the outstanding mortgage balance. This form serves as a formal request for payment status and details the accrued interest and necessary insurance provisions affecting the loan payoff. Key features include customizable fields for dates, borrower and lender information, and explicit instructions for updating loan payoff figures based on the negative escrow requirement. Users should fill in the dates, names, and loan specifics, ensuring all relevant details are accurately represented. The form helps attorneys, partners, owners, associates, paralegals, and legal assistants to streamline communication with lenders, enabling timely resolution of mortgage payment issues. Its clear structure and straightforward language allow users with varying levels of legal knowledge to effectively adapt the form to fit their specific circumstances. This template not only facilitates professional correspondence but also serves to safeguard the interests of the parties involved while promoting a cooperative resolution.

Form popularity

FAQ

Under federal law, the servicer must generally send you a payoff statement within seven business days of your request, subject to a few exceptions. (12 C.F.R. § 1026.36.)

There's a process to getting the mortgage payoff statement. First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

Generally, only escrow, title, or mortgage companies submit a lien or business transfer payoff request.