Lien Payoff Letter Template With Sample In Philadelphia

Description

Form popularity

FAQ

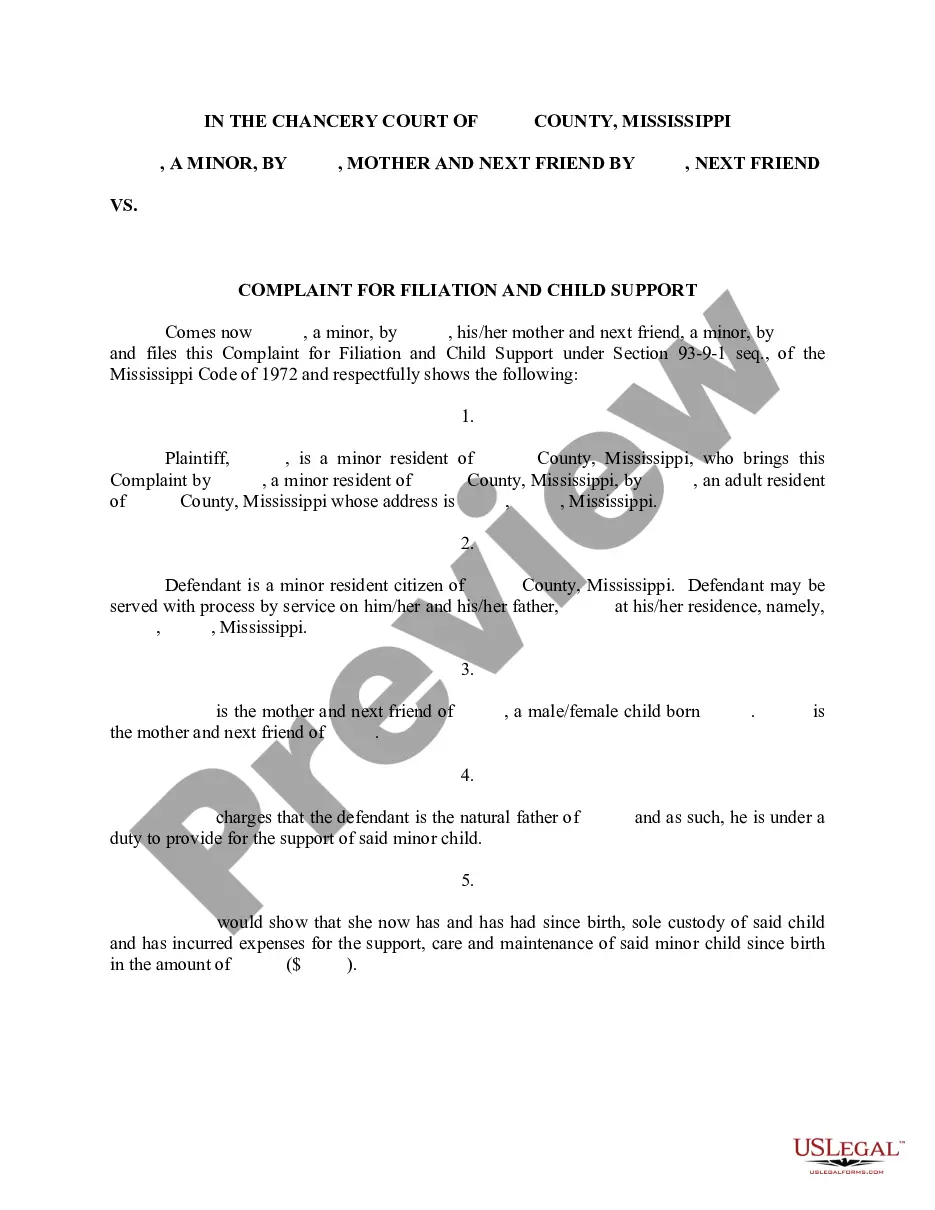

A payoff request allows a third party to receive the current balance due to release a lien or facilitate a business transfer (bulk sale transfer or liquor license). To release a lien or facilitate a bulk sale transfer, businesses must be in good standing to receive a payoff request.

All such claims shall be filed on or before the last day of the third calendar year after that in which the taxes or rates are first payable, except that in cities and school districts of the first class claims for taxes and other municipal claims, which have heretofore become liens pursuant to the provisions of this ...

To add, remove, or change a name on a deed, have a lawyer, title company, or other real estate professional prepare the deed. Then, record the new deed with the Department of Records. Note: We recommend that you do not prepare a deed on your own. We also recommend that you get title insurance.

Steps to File a Valid Pennsylvania Mechanics Lien Send Preliminary Notice Within 30 Days. Send Pre-Lien Notice at Least 30 Days Before Filing. File Your Lien Claim at Prothonotary's Office. Serve Notice of Filing on the Owner. Start Suit to Enforce Lien Within Two Years. File a Lien Bond to Remove the Lien.

How can I obtain information about liens and judgments? Where can I obtain property tax information? You can obtain tax information from the Office of Property Assessment (OPA) 601 Walnut Street .phila/OPA or the Department of Revenue located in the Municipal Services Building., 1401 JFK Blvd, concourse level.

In Pennsylvania, lien searches can be conducted by reviewing public records maintained by relevant government agencies, including local Prothonotary Offices or Pennsylvania Recorder of Deeds Offices. Besides mortgages, which are filed in the latter, most liens are filed in the former.

To obtain a judgment lien, you must first record the judgment with the court of common pleas in the county where the debtor owns property. The lien will stay in effect for five years, but can be renewed, if the debtor does not sell the property within that time period.

The department files liens in the county Prothonotary's Office where the taxpayer resides or does business. Liens, along with most other court records, are public documents.