Lien Release Letter Format In Minnesota

Description

Form popularity

FAQ

We would like to release the lien in respect of the below mentioned units pledged in our favour by the Investor, and we therefore, request you to kindly release the lien marked on the below mentioned units.

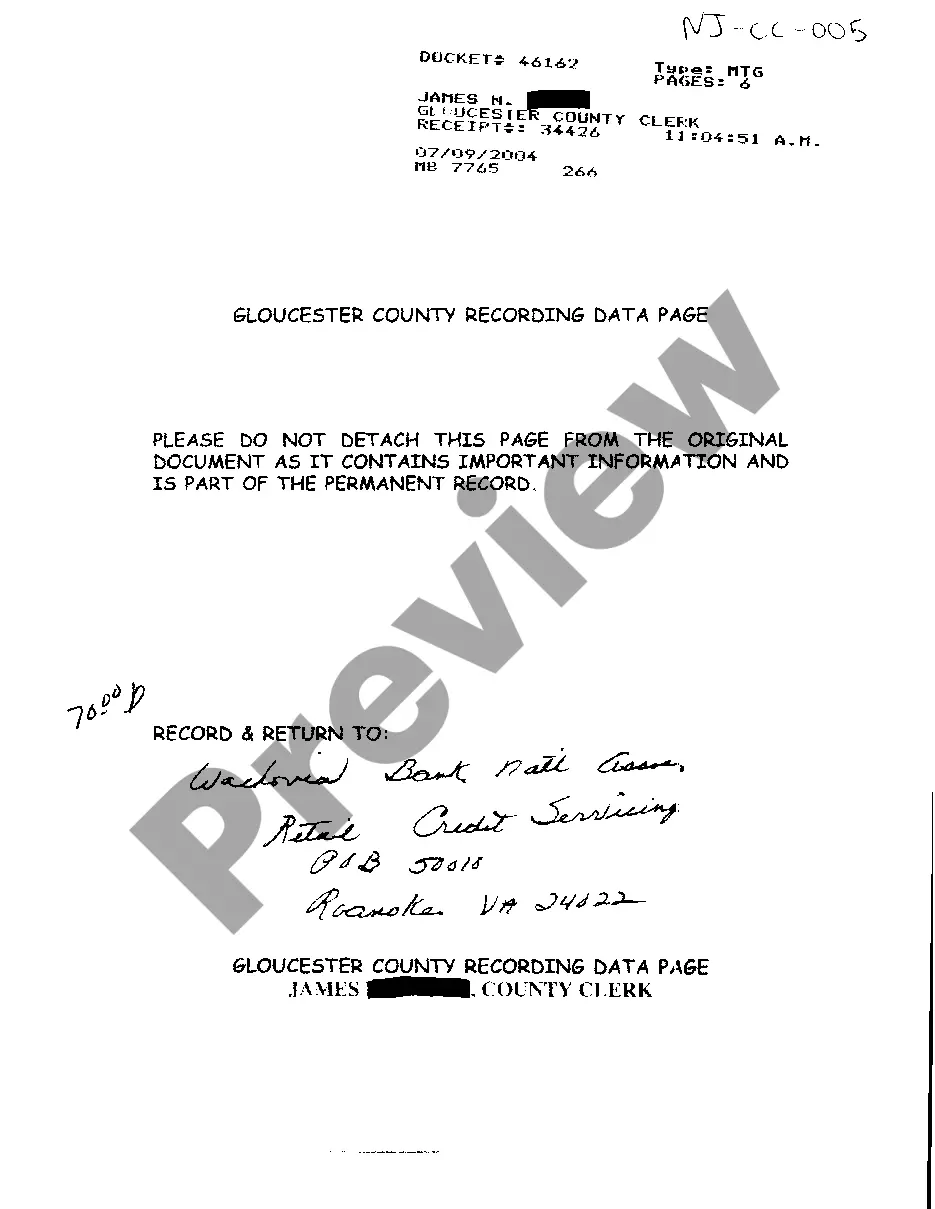

In order to release the lien and remove the bank's name from the certificate of title, you must have an original lien release document from the bank, or have the bank sign the original certificate of title.

Obtaining a Lien Release 1 Confirm the FDIC has the authority to assist with a lien release. 2 Compile Required Documents and Prepare Request for a Lien Release. 3 Register/Mail request to FDIC DRR Customer Service and Records Research.

If the title has a lien holder listed on it, the original signed lien release card or a notarized lien release from the lending institution listed on the title is required. If the lien release has been lost or not received, contact the lien holder to get a duplicate. Any alteration or erasure to the title will void it.

Obtaining a Lien Release 1 Confirm the FDIC has the authority to assist with a lien release. 2 Compile Required Documents and Prepare Request for a Lien Release. 3 Register/Mail request to FDIC DRR Customer Service and Records Research.

In order to release the lien and remove the bank's name from the certificate of title, you must have an original lien release document from the bank, or have the bank sign the original certificate of title.

To remove a lien from your title, you will need: Your MN title. If your address is the same, leave the title blank. If your address has changed, fill out the address boxes in the middle section of the title. A lien release from your secured party. Call us at (952) 496-8432 for total amount.

Legally, the only states that mandate the notarization of lien waivers are Mississippi and Wyoming. Texas previously required notarization, but that hasn't been the case since 2022.

In Minnesota, an action to enforce a mechanics lien must be initiated within 1 year from the date of the lien claimant's last furnishing of labor or materials to the project. If a claimant records their lien close to Minnesota's 120-day filing deadline, they will have about 8 months to enforce the claim.