Payoff Statement Request With Headers In Middlesex

Description

Form popularity

FAQ

Contact Us Your questions and comments are very important to us. Call us at 617-666-4700, visit us in-the-square, or complete the form below.

First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

Your MIDDLESEX SAVINGS routing number can be found at the bottom left corner of a check. Here's how to find your routing number and account number on any check issued by your bank.

If you need to change the owner's name on one of your Middlesex Savings Bank accounts, we're here to help. This process can be complicated and carries certain tax implications if the account earns interest. Please visit one of our branches or call us at 1-877-463-6287 for assistance.

Most Common Email Formats at Middlesex Savings Bank Middlesex Savings Bank Email FormatsExample First.Last@middlesexbank John.Doe@middlesexbank Last.First@middlesexbank Doe.John@middlesexbank Last@middlesexbank Doe@middlesexbank FLast@institutionforsavings JDoe@institutionforsavings3 more rows

Middlesex Federal Savings is a full-service community bank headquartered in Davis Square Somerville, Massachusetts. It was established in 1890 as West Somerville Cooperative Bank. More than 130 years later, Middlesex Federal has grown from its modest beginnings.

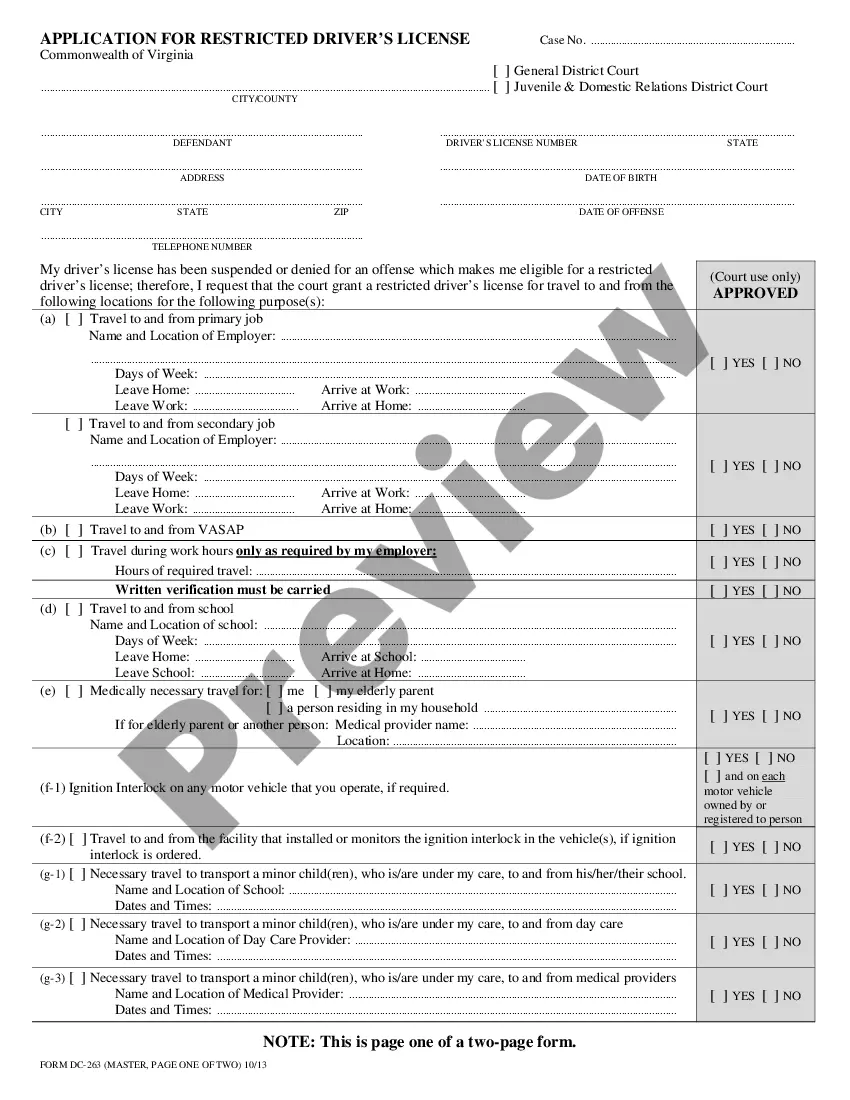

(c) A beneficiary, or his or her authorized agent, shall, on the written demand of an entitled person, or his or her authorized agent, prepare and deliver a payoff demand statement to the person demanding it within 21 days of the receipt of the demand.

TILA requires that a mortgage lender or servicer send ''an accurate payoff balance within a reasonable time, but in no case more than seven business days'' after receiving the borrower's request. 15 U.S.C. § 1639g.

First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

To view the payoff for your mortgage using online banking Select your mortgage account, then select Request payoff quote. Choose the day you'd like the payoff through, then select Request payoff quote. Note: The payoff quote is valid only through the date selected. Choose how you'd like to receive the quote.