Sample Mortgage Statement Format In Kings

Description

Form popularity

FAQ

This may suggest you are unprepared for the financial responsibility lastly do not express urgencyMoreThis may suggest you are unprepared for the financial responsibility lastly do not express urgency in securing a mortgage. It may indicate desperation.

Unexplained income and spending Unexplained deposits in your bank statement may be flagged as illegitimate income sources. Strange expenses will also raise questions because a lender may suspect you are hiding something. Unexplained expenditure also suggests that you are not in control of your finances.

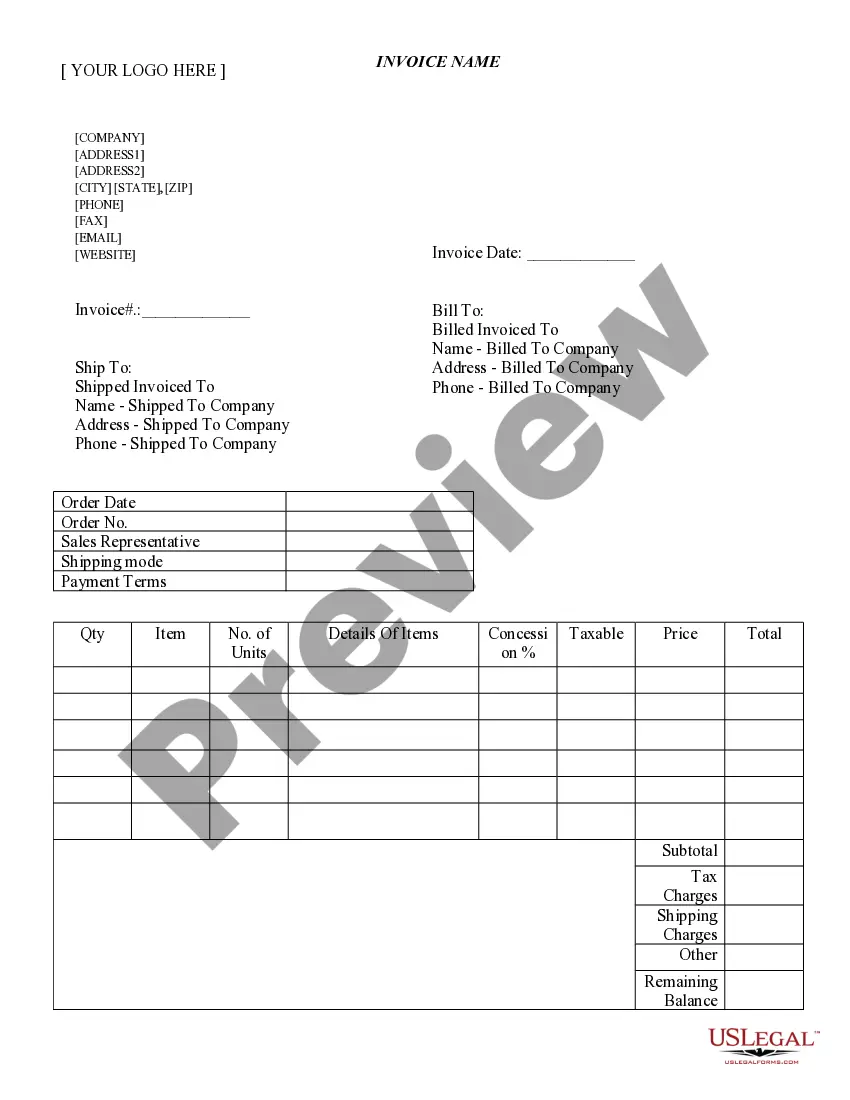

A mortgage statement is an accounting of all of the details about your mortgage, including the current balance owed, interest charges, interest rate changes (if you have an adjustable-rate mortgage) and a breakdown of your current and past payments.

One common red flag is bounced checks or insufficient funds (NSFs). These show a pattern of poor financial management and raise concerns about the borrower's ability to handle regular payments like a mortgage. Another red flag is large, undocumented deposits.

The letter should include an explanation regarding the negative event, the date it happened, the name of the creditor and your account number. It should also include an explanation of why you don't see this problem happening again.

Include details about the property, such as its address, type, and any additional information required by the template. Provide a breakdown of your monthly mortgage payments, including the principal, interest, taxes, and insurance amounts.

It is supplied by the homeowner's current lender detailing the financial standingof the mortgage. This includes the balance, the interest rate, time remaining as well as other pertinent information.

What is a mortgage statement? A mortgage statement is an accounting of all of the details about your mortgage, including the current balance owed, interest charges, interest rate changes (if you have an adjustable-rate mortgage) and a breakdown of your current and past payments.

A mortgage statement is a document prepared by a mortgage holder and provided to the borrower. A mortgage statement will show the current mortgage balance, current interest rate, amount remaining on the mortgage term and amortization and the contact information for the mortgage holder.

We'll send you a mortgage year-end statement once a year. If you have an offset mortgage, you'll also receive monthly statements. When you receive your year-end statement depends on when your mortgage started.