Depreciation Excel Sheet As Per Companies Act In Georgia

Description

Form popularity

FAQ

Value this is the salvage value making f4 absolute. And what's the life. This is c5 you make itMoreValue this is the salvage value making f4 absolute. And what's the life. This is c5 you make it absolute. And you close it. So this is the amount will the the assets will be depreciated.

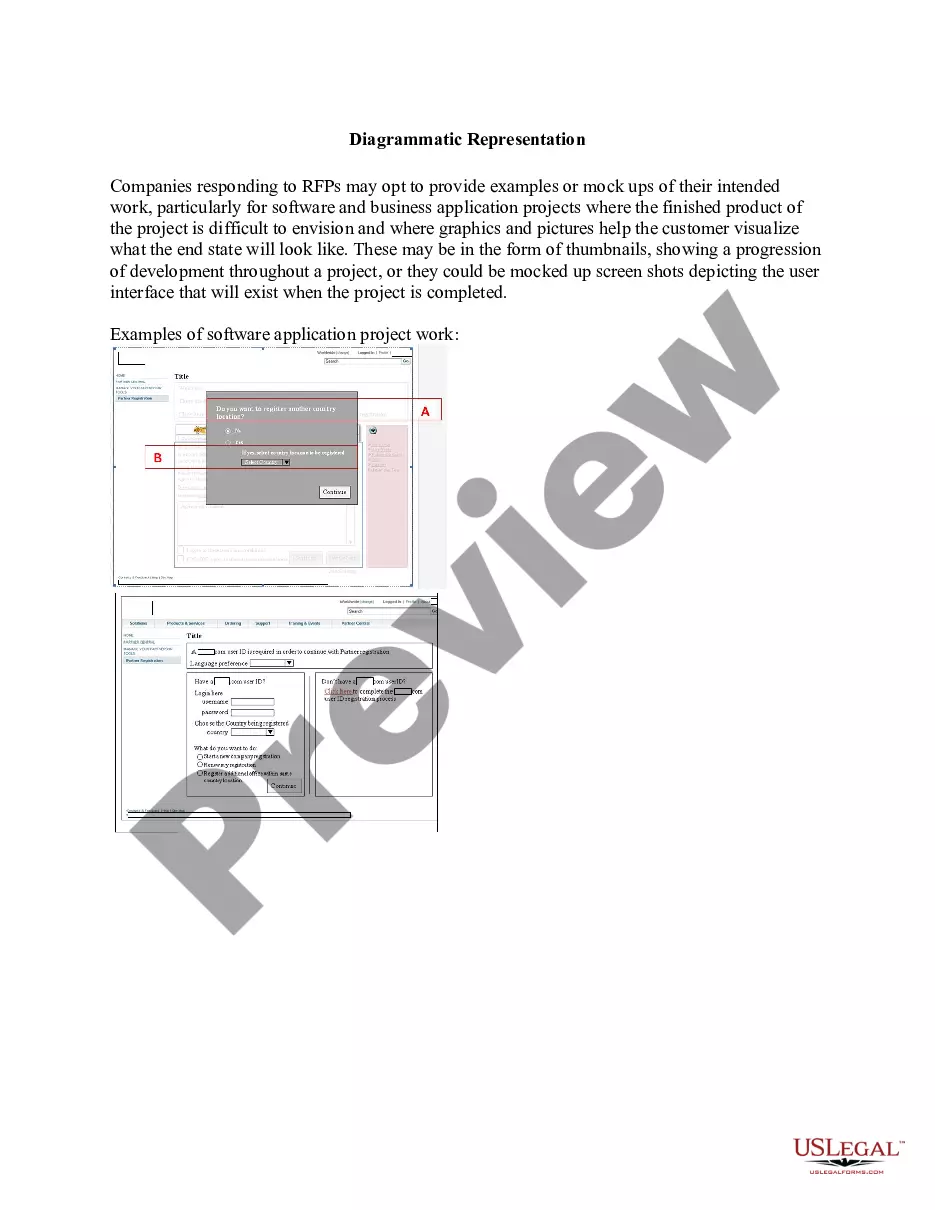

Fill data automatically in worksheet cells Select one or more cells you want to use as a basis for filling additional cells. For a series like 1, 2, 3, 4, 5..., type 1 and 2 in the first two cells. Drag the fill handle . If needed, click Auto Fill Options. and choose the option you want.

On the Formulas tab, in the Calculation group, click Calculation Options, and then click Automatic.

You'll need three columns: The first column registers the depreciation deduction (aka depreciation expense) you plan to take each year. The second column shows the depreciation that has accumulated at the end of each year. The third column logs the book value of the asset at the end of each year.

Depreciation is charged in a fair proportion of the depreciable amount in every accounting period during the expected useful life of the asset. As everything loses value over time, we are able to treat depreciation as an expense because it is beneficial to the company, which owns the depreciable assets.

60% depreciation rate is applicable for the following types of plant and machinery. However, the same has been reduced to 40% with effect from 1.4. 2017. Computers and computer software.

Computer and Laptop depreciation rate as per Income Tax Act falls under the asset class of Plant and Machinery. The rate of deduction considered here is 40%. However, you must follow all the clauses under Rule 5(2) to be eligible for a 40% depreciation rate.

Each period's depreciation amount is calculated using the formula: annual depreciation rate/ number of periods in the year. For example, in a 12 period year, if an asset's expected life is 60 months, the annual depreciation rate for the asset is: 12/60 = 20%, and the depreciation rate per period is 20% /12 = 0.0167%.

Step 1: Assemble the Column Headers in Row 1 of the Spreadsheet. Create a new Excel spreadsheet file and assemble the following information in Row 1 of the spreadsheet. Step 2: Enter the Depreciation Expense Formulas. Step 3: Enter the Accumulated Depreciation Formulas.