Sba Loan Assumption With Seller In Montgomery

Description

Form popularity

FAQ

Ing to the SBA Form 1086, non-PPP loans and payments are due at the Fiscal and Transfer Agent (FTA) on the third calendar day of the month, or the next business day if the third is not a business day. The SBA allows a grace period of two business days after the due date.

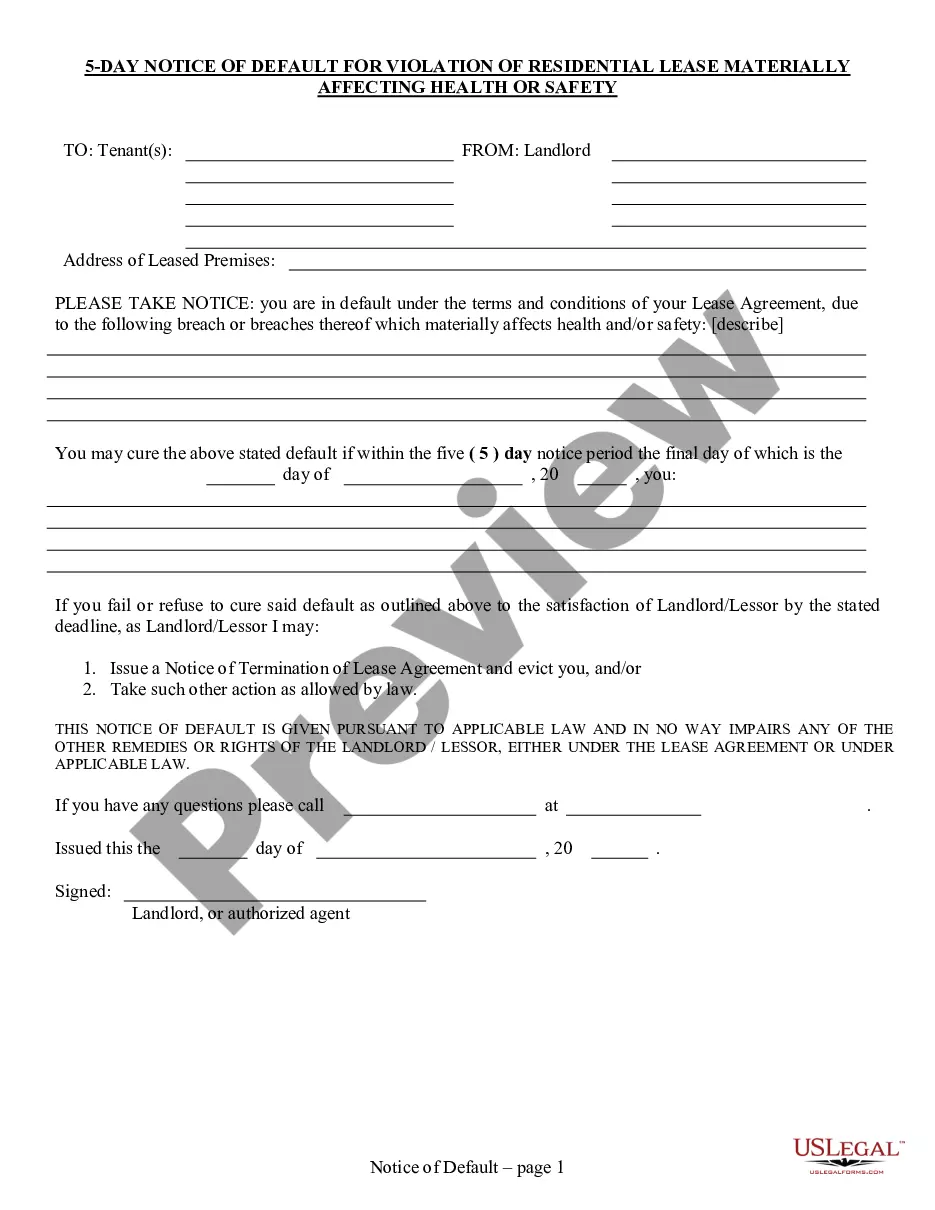

This is a standard form of notice of default and demand for payment provided by a lender to a borrower and a guarantor, if applicable, when a borrower is in default under its mortgage and the lender is ready to accelerate its mortgage and demand repayment.

A debt assumption involves two simultaneous transactions; the first transaction cancels the original debtor's obligation, and the second transaction creates a new debt contract between the creditor and the new debtor, or assumer.

The purpose of an assumption agreement is to ensure the seller is freed from their obligations, while the buyer agrees to take on these obligations. Legally, the seller could still be held liable if they don't have a proper assumption agreement in place that absolves them of those responsibilities.

Individuals who own 20% or more of a small business applicant must provide an unlimited personal guaranty. SBA Lenders may use this form.

It usually takes between a month and 45 days to close on a traditional mortgage, but you can expect an assumable mortgage to take a little longer — around 45 to 90 days.