Escrow Agreement Format In Florida

Description

Form popularity

FAQ

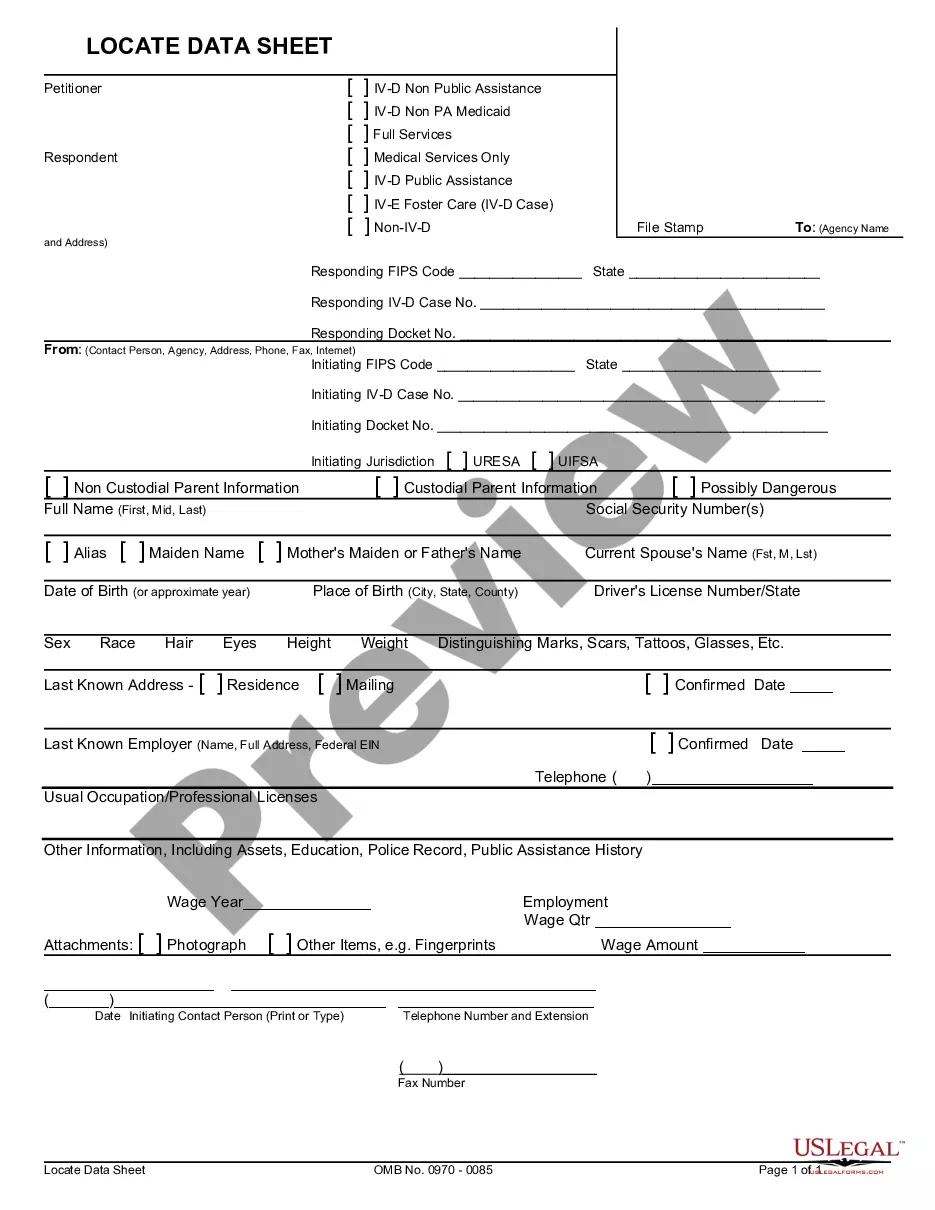

The Escrow Holder: prepares escrow instructions. requests a preliminary title search to determine the present condition of title to the property. requests a beneficiary's statement if debt or obligation is to be taken over by the buyer. complies with lender's requirements, specified in the escrow agreement.

Escrow Laws in Florida Florida also provides strict regulations regarding: The process of releasing funds from an escrow account. The timeframe of depositing funds in an escrow account. Provision or establishment of monthly reconciliation reports.

In an escrow agreement, one party—usually a depositor—deposits funds or an asset with the escrow agent until the time that the contract is fulfilled. Once the contractual conditions are met, the escrow agent will deliver the funds or other assets to the beneficiary.

The Escrow Closing Notice applies to closed-end consumer credit transactions secured by a first lien on real property or a dwelling. The term "dwelling" uses the existing definition in Regulation Z, which includes vacation, second, and manufactured homes.

Keeping the Escrow Funds: A third-party will oversee the escrow account until the closing date. This is done in ance with Florida Statutes § 651.033, which state that a certified financial institution must hold the escrow funds for the duration of the transaction. There's a clear logic behind this law.

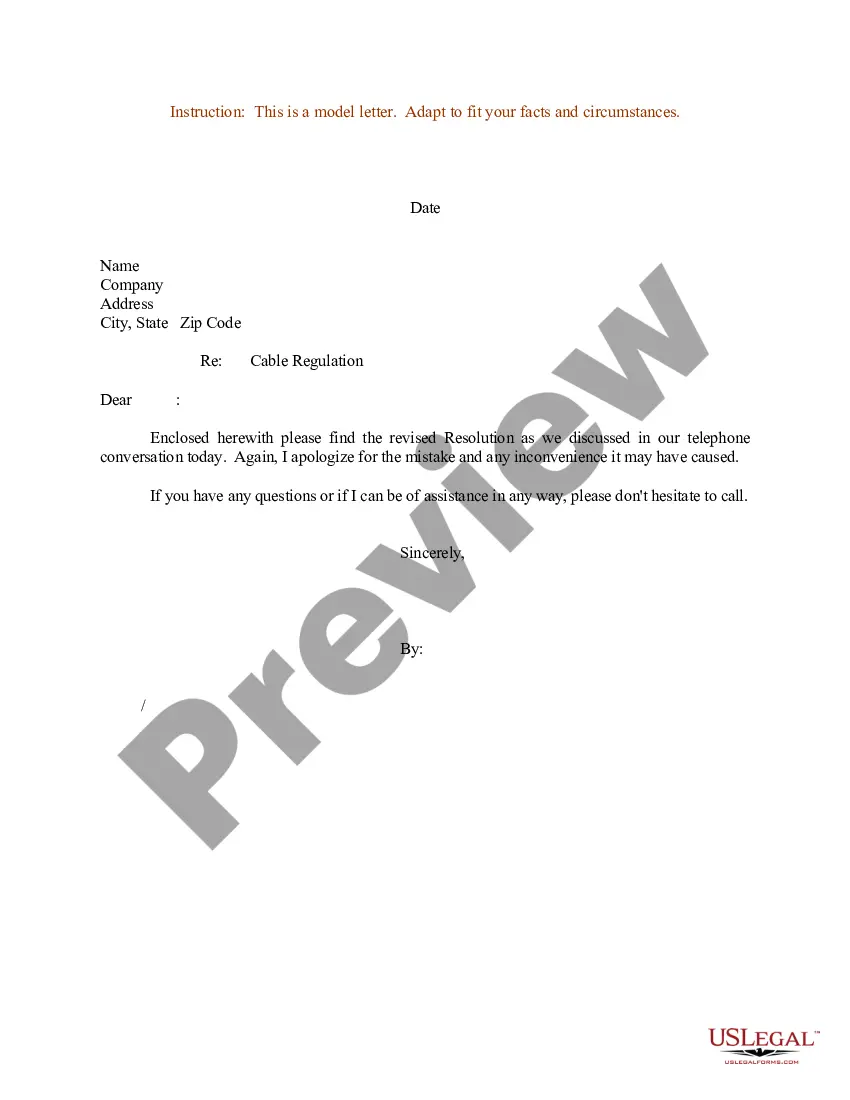

The escrow letter is typically issued by a title company and states that all necessary documents and funds related to the transaction have been received and will be processed when the transaction is completed.

(a) The escrow account must be established in a Florida state-chartered bank, savings bank, or trust company, or a federal savings or thrift association, bank, savings bank, or trust company, which is acceptable to the office, or such funds must be deposited with the department and be kept and maintained in an account ...