Time Extension For In Bexar

Description

Form popularity

FAQ

The circuit breaker provision limits the amount the appraisal district can increase your property value. The appraised value of qualifying real property is limited to an increase of no more than 20% per year unless new improvements, excluding ordinary maintenance, have been made.

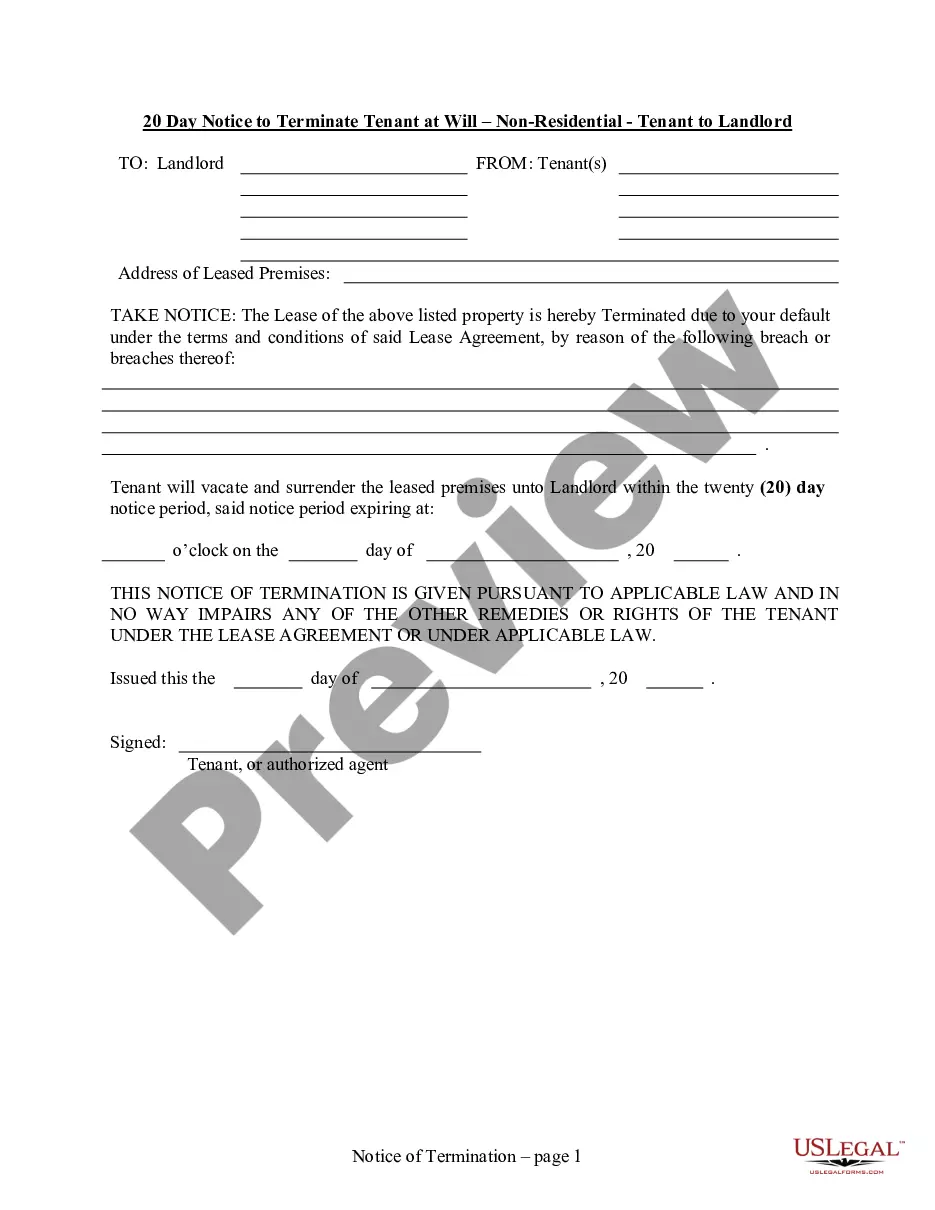

The Writ of Possession allows for the possession of the property, after a deputy has posted written notice notifying the tenant a writ has been issued. By law, we are required to give a minimum of 24 hours notice before enforcing the writ.

Beginning in 2024, all real property valued at $5,000,000 or less will have a 20 percent circuit breaker cap on the appraised value, with the exclusion of land receiving the agriculture-use special appraisal and homestead properties that receive the 10 percent limited appraised value cap.

A Property Tax Circuit Breaker is a tax refund in the United States given to low income individuals and families whose property tax liability is a large percentage of their yearly income. The term was coined by John Shannon of the Advisory Commission on Intergovernmental Relations in the 1960s.

State laws, rather than local county laws, dictate whether you are eligible to change your name, but you must initiate your civil suit by filing documents with the Bexar County District Clerk. The Civil Filing Main Line phone number is (210) 335-2621. The Bexar County District Clerk's Office is located at 101 W.

What is a Circuit Breaker Limitation? Effective January 1, 2024, a 20% limit on the annual increase will be set on the appraisal of non-homestead real property.

Beginning in 2024, real property valued at $5 million or less will benefit from a 20 percent limitation on the net appraised value of the property used to calculate property taxes.

filing is mandated for almost all documents filed by ATTORNYS. xceptions can be found in the Texas Rules of Civil Procedure. Selfrepresented litigants may efile, but it is not mandatory.

Requests can be emailed to cs@bcad or mailed to PO Box 830248, San Antonio, TX 78283.

How To eFile. Choose an electronic filing service provider (EFSP) at eFileTexas. An electronic filing service provider (EFSP) is required to help you file your documents and act as the intermediary between you and the eFileTexas system. For eFiling questions you may call 210-335-2496 or 855-839-3453.