Tax Letter For Donations Without Asking In Riverside

Description

Form popularity

FAQ

Technically, if you do not have these records, the IRS can disallow your deduction. Practically, IRS auditors may allow some reconstruction of these expenses if it seems reasonable.

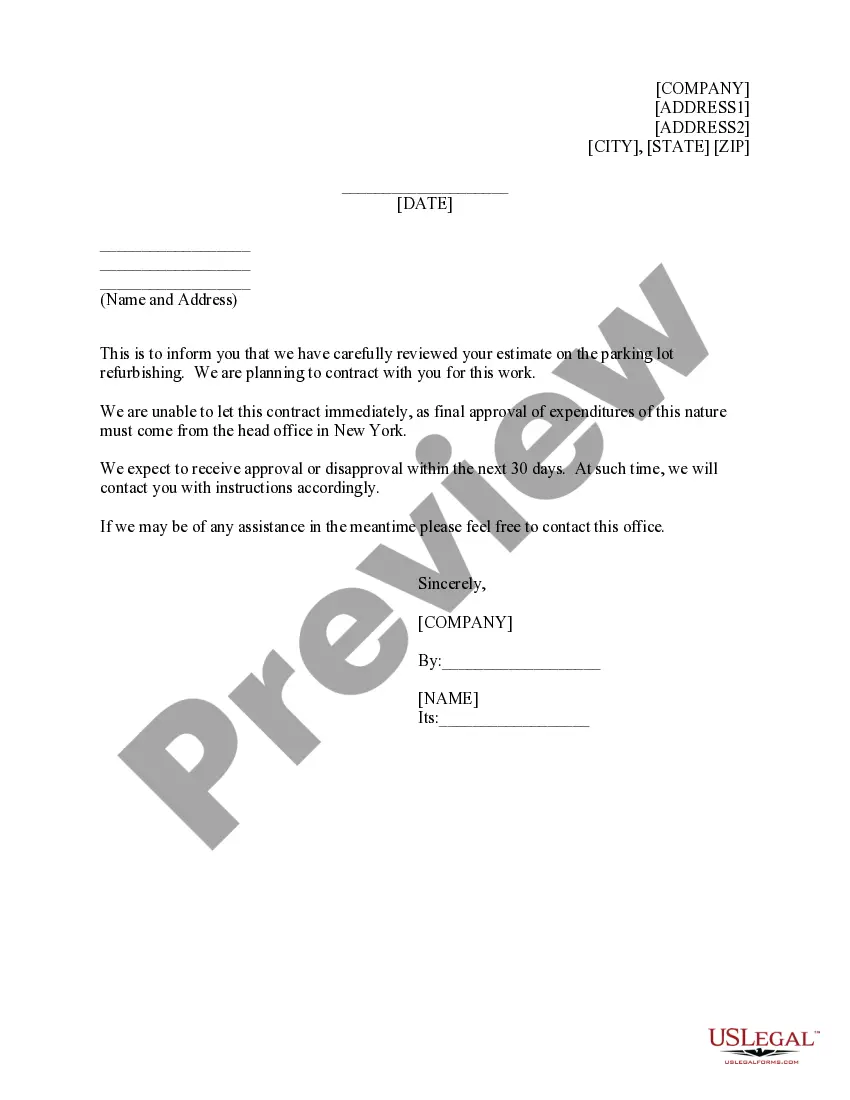

I'm writing to ask you to support me and my cause/project/etc.. Just a small donation of amount can help me accomplish task/reach a goal/etc.. Your donation will go toward describe exactly what the contribution will be used for. When possible, add a personal connection to tie the donor to the cause.

How can nonprofits accept anonymous donations? Step 1: Amend your gift acceptance policy to clarify the rules around your anonymous donations. Step 2: Use a modern donation platform that supports an anonymous giving feature. Step 3: Acknowledge anonymous donations on your social media accounts.

After donating / How can I change my donation message or make my donation anonymous? If you've donated to a friend or family member's Fundraising page, you can change your donation message and display name at any time, as well as hiding the donation amount from the Fundraising page.

Welcome to Silent Donor! All of the donations you send through our platform will be 100% anonymous and will not contain any of your personal information. We have built a large international network that allows for you to give anonymously almost anywhere!

Answer: Donors can donate anonymously in JustGiving on the Your Message screen of the donation by marking the "Hide my name and photo from public view" box or removing their name from the comment box.

Charitable contributions or donations can help taxpayers to lower their taxable income via a tax deduction. To claim a tax-deductible donation, you must itemize on your taxes. The amount of charitable donations you can deduct may range from 20% to 60% of your AGI.

However, you should be able to provide a bank record (bank statement, credit card statement, canceled check or a payroll deduction record) to claim the tax deduction. Written records, like check registers or personal notations, from the donor aren't enough proof. The records should show the: Organization's name.

A donation acknowledgment letter is a type of donor letter that you send to donors to document their charitable gifts and donations. Sometimes your donation receipt functions as a donor acknowledgement. However, that's not always the case.