Gift Letter For Money With Parents Template Uk In Riverside

Description

Form popularity

FAQ

A letter of explanation is simply a tool that helps your lender's team understand your financial situation more fully. Giving exactly the information they request with the appropriate level of detail helps the team reviewing your application truly understand your financial picture.

A letter from your parents and a copy of the bank statement may be enough. However, if your parents give more than that in a single year, they will be required to file a gift tax return on Form 709, assuming they are American citizens.

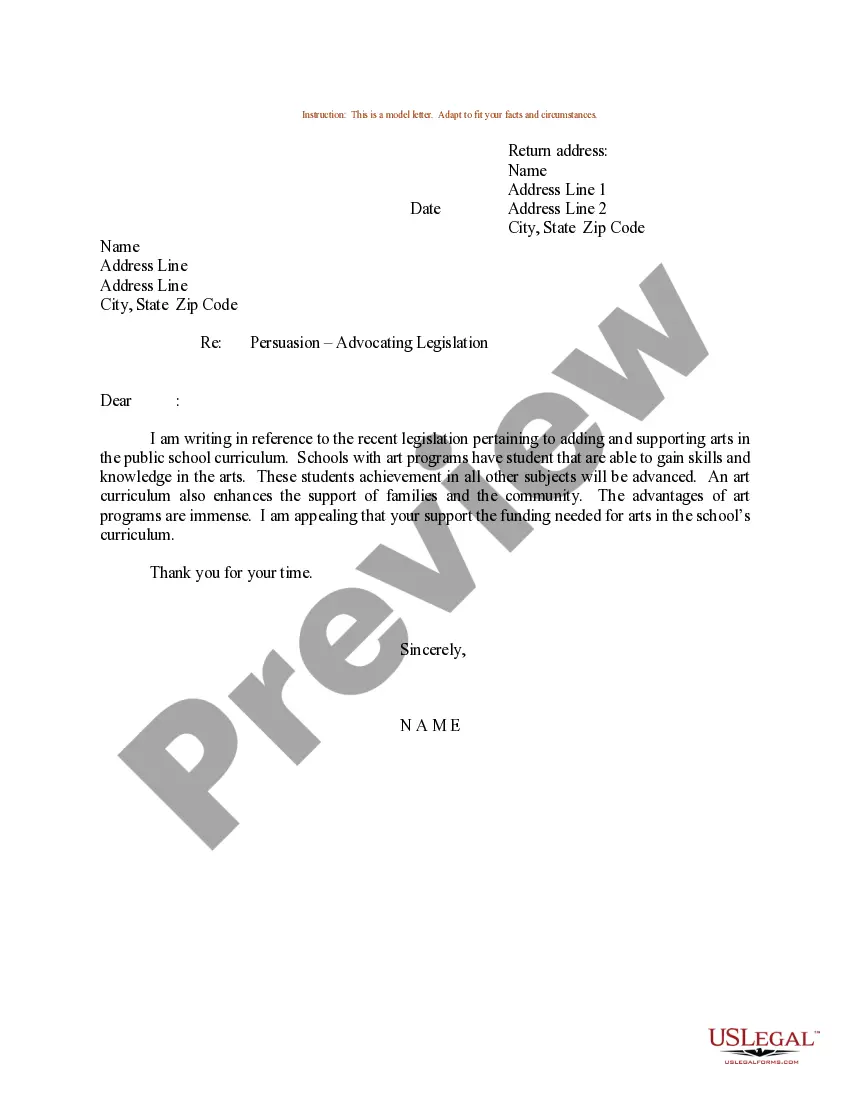

How Do I Write a Gift Letter? The donor's name, address and phone number. The donor's relationship to the client. The dollar amount of the gift. The date when the funds were (or will be) transferred. A statement from the donor that no repayment is expected. The donor's signature.

Express Joy: ``I'm so happy to give you this!'' Share the Thought Behind the Gift: ``I saw this and thought of you because...'' Wish Them Happiness: ``I hope this brings you as much joy as you bring to my life.'' Encourage Enjoyment: ``I hope you enjoy it!'' Keep it Simple: ``Just a little something for you.''

Something that is given as a present: Thousands of people bought the book as a Christmas gift. something that you give without getting anything in return: You must convince the tax man that your gift is entirely for charitable purposes.

Most gifted deposit letters will require the following: The name of the receiver of the gifted deposit. The source of your gifted deposit. The relationship between you and the donor/s. The value of the gifted deposit. That the donor expects no repayment. That the donor makes no claim to the property.

Documentation Requirements The gift letter must: specify the actual or the maximum dollar amount of the gift; include the donor's statement that no repayment is expected; and. indicate the donor's name, address, telephone number, and relationship to the borrower.

This letter proactively allows you to explain any bumps you may have encountered on your financial journey such as gaps in employment or substantial withdrawals from your bank account. Done correctly (and timely) an LOE could be your chance to hopefully speed up the process of getting your mortgage approved.

(Date) Dear (Donor): I have received your "Offer of Gift," dated ___________________, by which you, on behalf of the (Name of Company), offered to convey (Description of Property) to the United States of America as a gift. I accept with pleasure your gift and conveyance of the (Property), pursuant to 10 U.S.C. 2601.

A gift letter must contain the donor's name, the gift's value, confirmation that the gift is not to be repaid, and the donor's signature. For tax year 2024, the annual exclusion on a gift per person per year is $18,000, an increase of $1,000 over 2023, ing to the Internal Revenue Service (IRS).