Receipt Donation Form Sample With Acknowledgement

Description

How to fill out Sample Letter For Acknowledgment Of Receipt Of Gift Or Donation - Appreciative?

Creating legal documents from the ground up can sometimes feel a bit daunting.

Certain cases may require extensive research and significant financial resources.

If you’re looking for a simpler and more cost-effective solution for drafting Receipt Donation Form Sample With Acknowledgement or other forms without excessive hassle, US Legal Forms is readily available for you.

Our online database of over 85,000 current legal documents covers nearly every aspect of your financial, legal, and personal matters. With a few clicks, you can swiftly obtain state- and county-compliant forms carefully assembled for you by our legal specialists.

Select the most appropriate subscription option to purchase the Receipt Donation Form Sample With Acknowledgement. Download the document, then complete, validate, and print it. US Legal Forms has a solid reputation and over 25 years of experience. Join us today and make form completion a straightforward and efficient process!

- Utilize our website whenever you need dependable services to quickly locate and download the Receipt Donation Form Sample With Acknowledgement.

- If you’ve used our services before and already have an account with us, simply Log In, choose the template, and download it, or re-download it anytime from the My documents section.

- No account? No problem. It takes just a few minutes to register and browse the catalog.

- However, before you dive straight into downloading the Receipt Donation Form Sample With Acknowledgement, consider these suggestions.

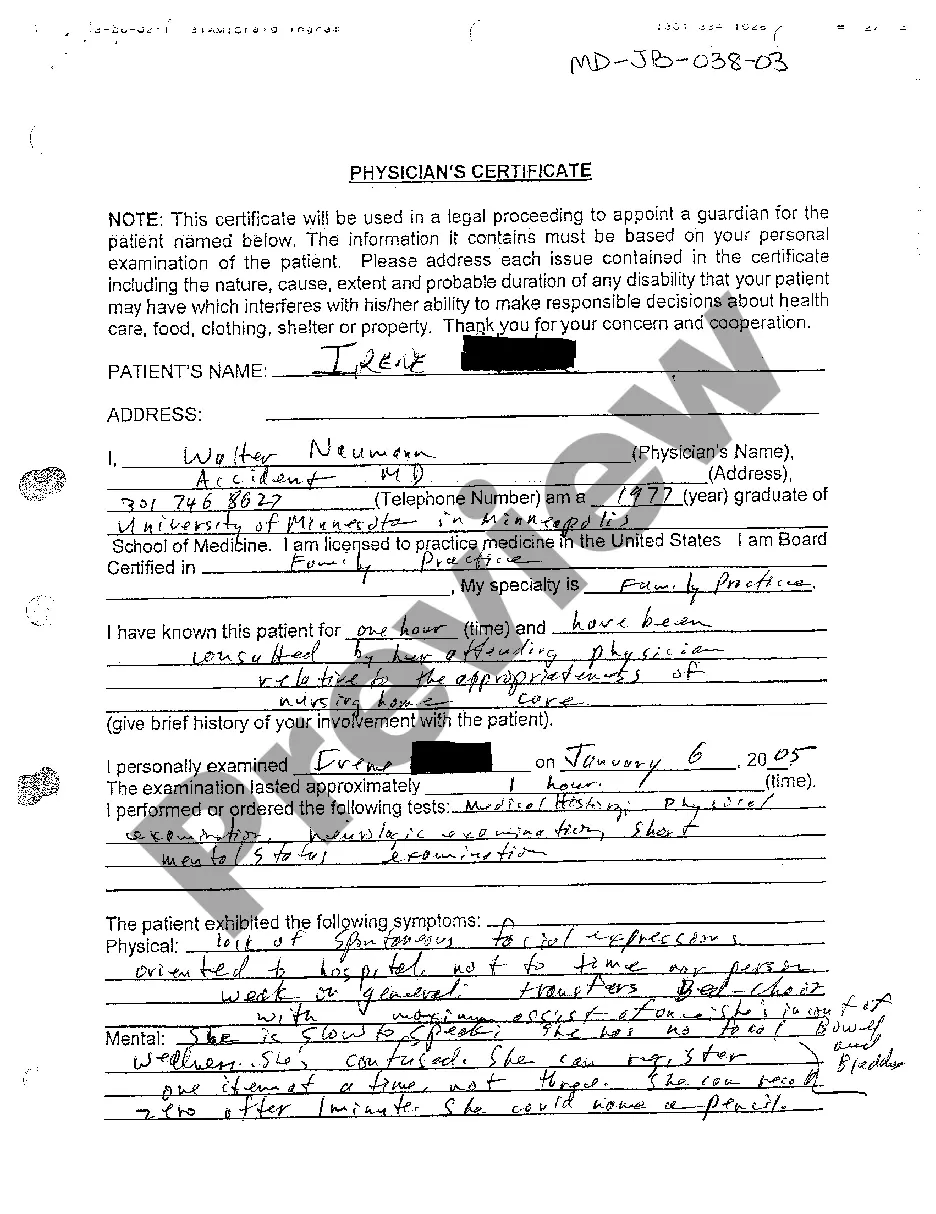

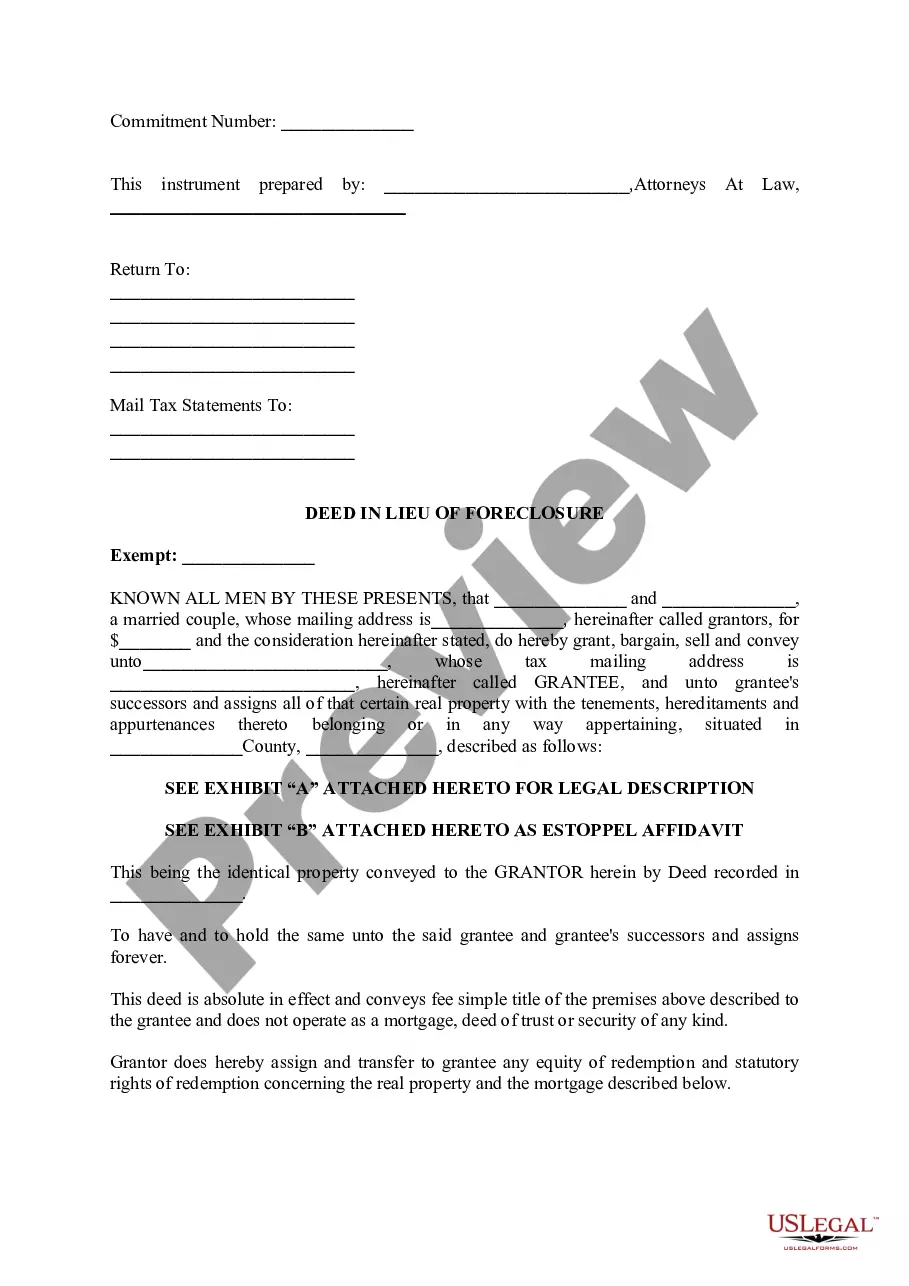

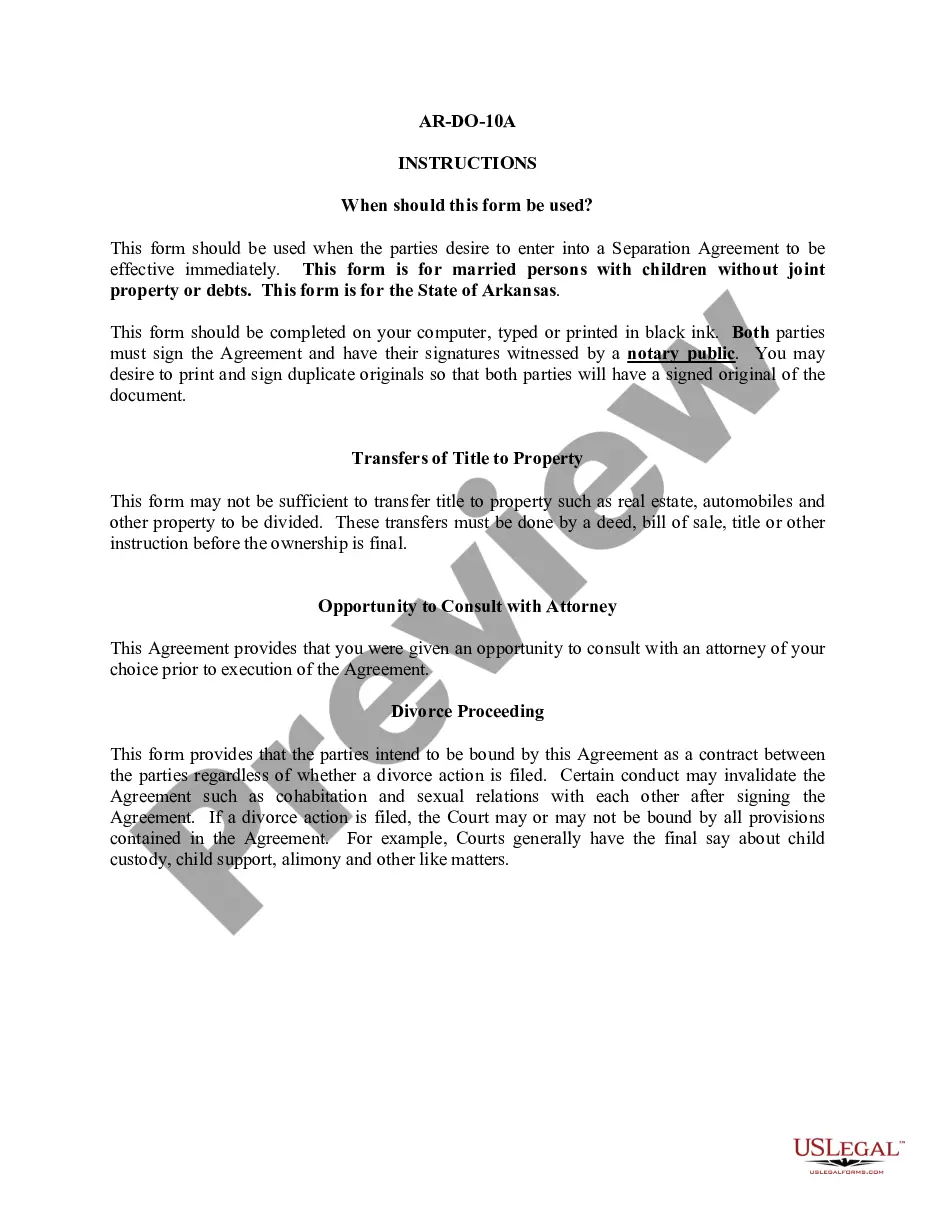

- Review the form preview and descriptions to ensure you have located the form you need.

- Verify that the form you choose complies with the laws and regulations of your state and county.

Form popularity

FAQ

Example 2: Individual Acknowledgment Letter We're super grateful for your contribution of $250 to [nonprofit's name] on [date received]. As a thank you, we sent you a T-shirt with an estimated fair market value of $25 in exchange for your contribution.

A donation receipt summarizes the financial details of a contribution like donor name, amount paid, and transaction date. An acknowledgment is a formal letter that summarizes a contribution while also thanking the individual for their support.

On [DATE], you donated [DESCRIPTION ? WITHOUT MONETARY VALUE]. This gift is greatly appreciated and will be used to support our mission. In exchange for this contribution, you received [GOODS OR SERVICES ? WITH ESTIMATE OF FAIR MARKET VALUE].

Each donor receipt should include the name of the donor as well. Many donor receipts also include the charity's address and EIN, although not required. The donor, however, should have records of the charity's address. Donor receipts should include the date of the contribution.

You should always have the following information on your donation receipts: Name of the organization. Donor's name. Recorded date of the donation. Amount of cash contribution or fair market value of in-kind goods and services. Organization's 501(c)(3) status.