Sample Nonprofit Gift Acknowledgement Letter With No Experience In Oakland

Description

Form popularity

FAQ

How do you write a fundraising letter? Key steps Start with a personalized greeting. Explain your mission. Describe your current initiative. Outline your project's needs and what you hope to accomplish. Add meaningful photographs or infographics. Show the tangible impact associated with specific donation amounts.

15 Best Practices For Your Nonprofit Thank You Letter Use the donor's name. Nothing says, “This is a form letter” more clearly than failing to include a donor's name. Send it promptly. Send it from a person. Show impact. Be warm and friendly. Use donor-centered language. Avoid empty jargon. Reference their history.

In your message to the donor, you can acknowledge that you received the gift from their donor advised fund but omit any mention of their ability to claim a tax deduction for the gift. It may be helpful to remind the donor that your acknowledgment is not a tax receipt. But do say thank you!

Craft a concise, direct donation message by clearly stating your cause, the impact of donations, and specific calls-to-action with emotional language. For example: "Your $25 gift provides a week of meals for a family in need. Text FEED to 55555 to More Meals today!"

1. Emphasize your organization's mission and overall goals. 2. Highlight the impact of previous donations. 3. Use general language to describe how funds will be used. 4. Avoid specifics that might limit fund allocation. 5. Ensure transparency and accountability. 6. Provide clear donation instructions. 7.

The Formula... Intro Thank you for.... Tell then what you are going to do with the gift (or experience, action, etc.) Say what it means to you and how much it meant to receive Add a personal sentence about what their action/gift/experience meant to you. End with a line of gratitude. Close and sign

The format is roughly as follows: Dear (So-and-So), Thank you very much for the (name gift). It was just what I needed, as I (explain how you'll use the gift). The point is to express your appreciation for the thoughtfulness of the gift. Thoughtfulness means the gift-giver has chosen something espe...

While we recommend sending donation acknowledgment letters to all of your donors, you are legally obligated to send documentation to donors who have given a gift of $250 or more. The IRS requires nonprofit organizations to provide a formal acknowledgment letter to these donors for tax purposes.

An acknowledgment letter or section typically includes the following: Title and date: Clearly state the purpose of the acknowledgment and the date. Recipient details: Addressing the relevant person or organization. Opening statement: Politely acknowledging receipt.

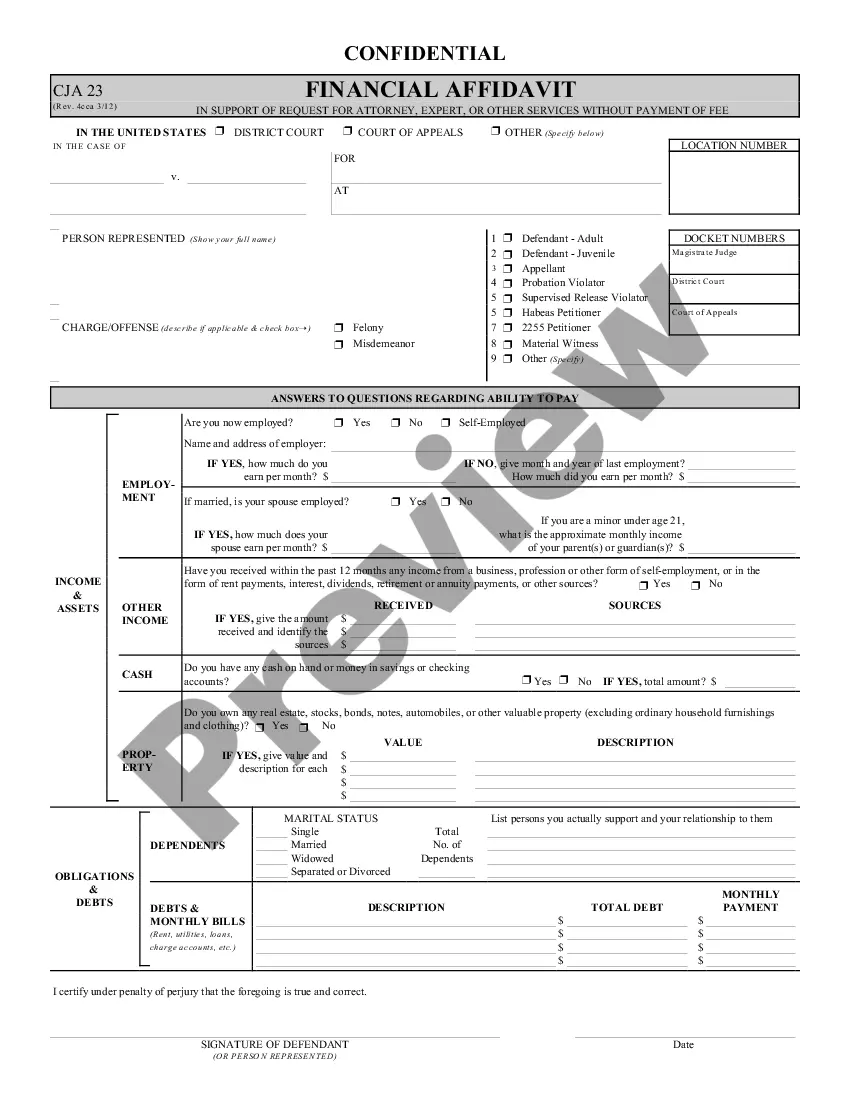

What do you need to include in your donation acknowledgment letter? The donor's name. The full legal name of your organization. A declaration of your organization's tax-exempt status. Your organization's employer identification number. The date the gift was received. A description of the gift and the amount received.