Receipt Donation Form Sample For Charitable Trust India In North Carolina

Description

Form popularity

FAQ

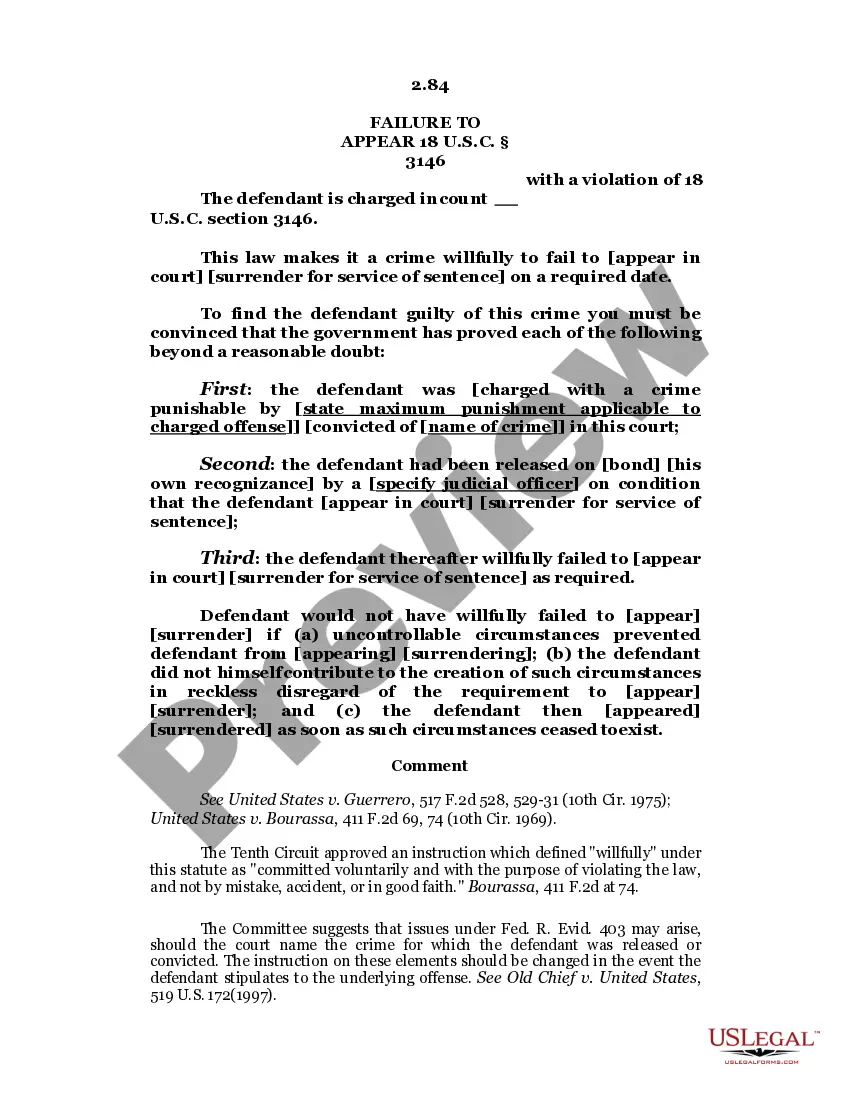

Technically, if you do not have these records, the IRS can disallow your deduction. Practically, IRS auditors may allow some reconstruction of these expenses if it seems reasonable. Learn more about handling an IRS audit.

Who Gets Audited the Most? Adjusted Gross IncomeAudit Rate $500,000-$1,000,000 0.3% 1,000,000-$5,000,000 0.5% $5,000,000-$10,000,000 1.4% Over $10,000,000 2.9%7 more rows

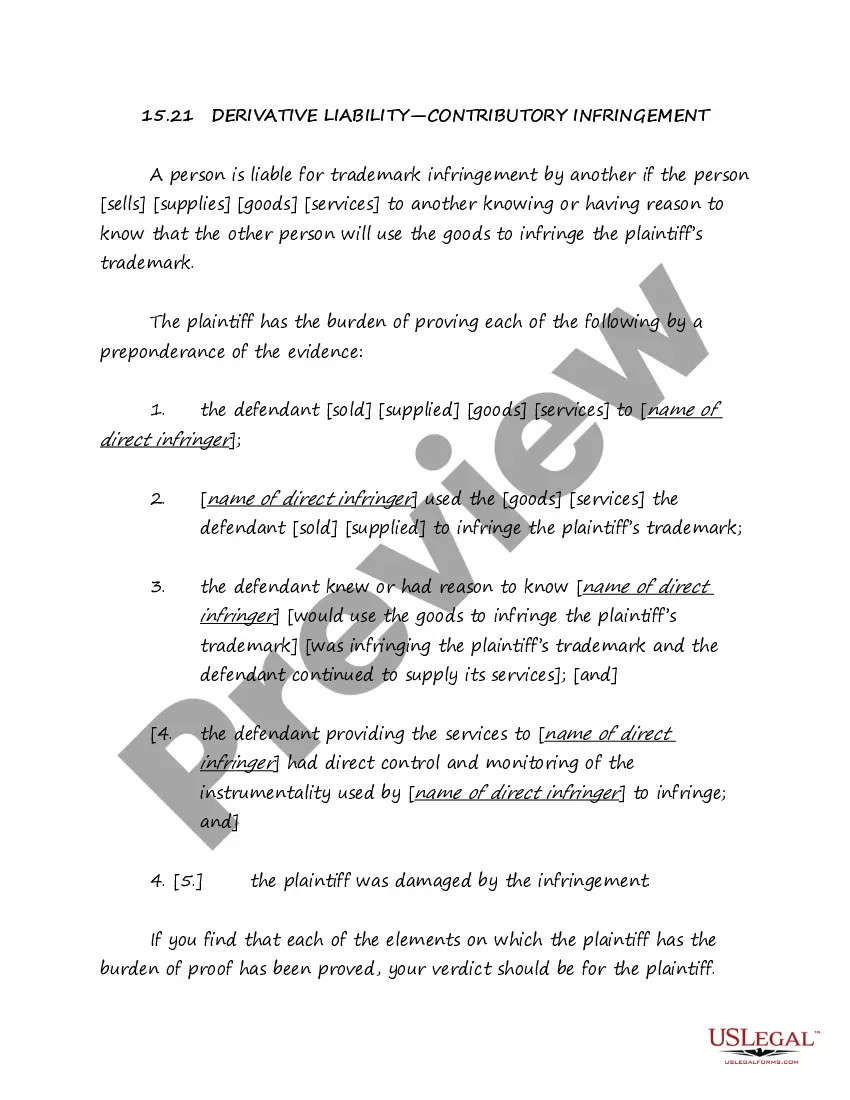

The Income Tax Department issues no specific donation receipt format. The only requirement is to mention the trust name, address, registration number, PAN, donation amount in words and figures, date of donation, name of the donor, and mode of payment.

Not reporting all of your income is an easy-to-avoid red flag that can lead to an audit. Taking excessive business tax deductions and mixing business and personal expenses can lead to an audit. The IRS mostly audits tax returns of those earning more than $200,000 and corporations with more than $10 million in assets.

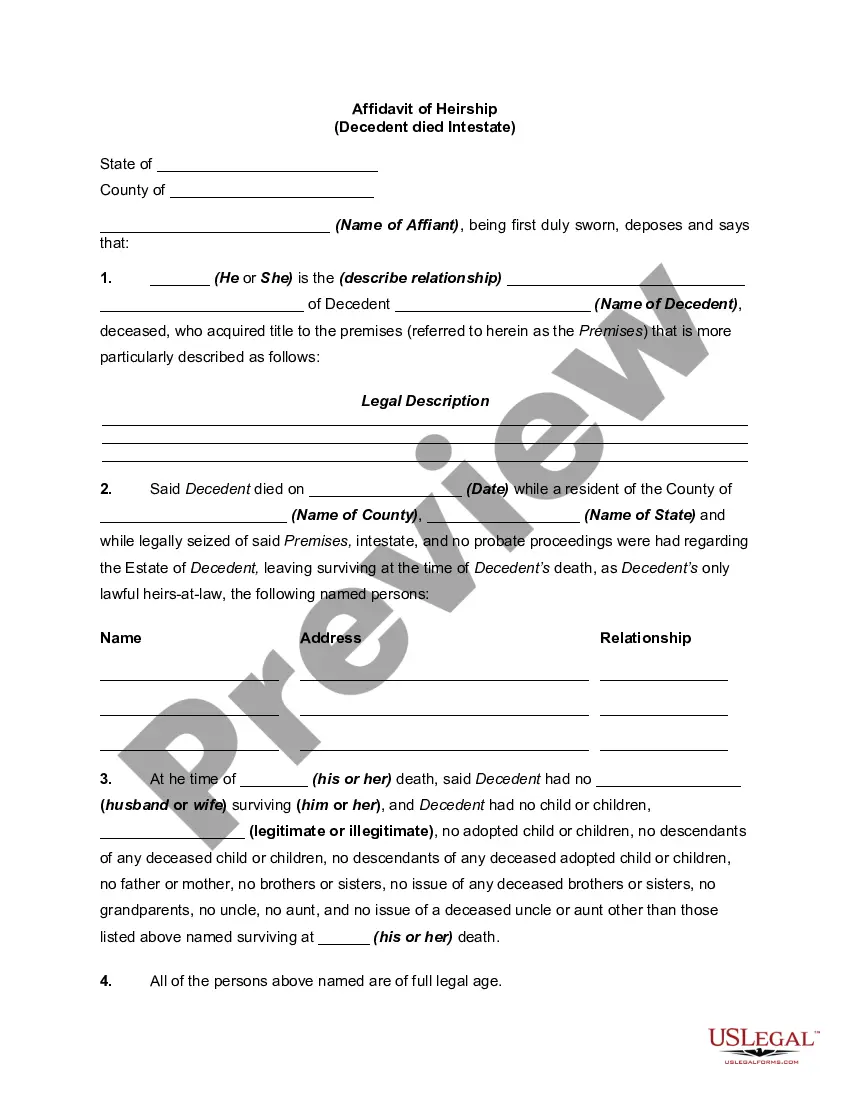

A donation receipt format for a charitable trust in India must include the donor and donee's name, address, contact information, the date, the name of the organisation, the amount, the reason for payment, the receipt number, and the name of the receiver.

How do you write a fundraising letter? Key steps Start with a personalized greeting. Explain your mission. Describe your current initiative. Outline your project's needs and what you hope to accomplish. Add meaningful photographs or infographics. Show the tangible impact associated with specific donation amounts.

The Income Tax Department issues no specific donation receipt format. The only requirement is to mention the trust name, address, registration number, PAN, donation amount in words and figures, date of donation, name of the donor, and mode of payment.

A donation receipt format must include the donor's name, address and contact number, date, name of the organisation, amount, reason for payment, receipt number, and name of the receiver.

A gift of stock is a donation of property. If a charity receives a gift of publicly traded stock, the charity should send the donor an acknowledgement letter that describes the stock (i.e., “Thank you for your donation of 100 shares of XYZ Corporation”) but does not place a monetary value on the shares.

Ing to the IRS, donation tax receipts should include the following information: The name of the organization. A statement confirming that the organization is a registered 501(c)(3) organization, along with its federal tax identification number. The date the donation was made.