Director Appointment In Case Of Death In Allegheny

Description

Form popularity

FAQ

Most of the records at the Register of Wills office are available and open to the public. However, we do hold Orphans Court files, including adoptions, which are not open to the public.

If there are no assets in the decedent's name alone, the will does not need to be probated. There are cases where distribution can occur without a will being probated. Any bank or other savings organization may release up to $10,000 to family members when: The decedent's accounts do not exceed $10,000.

In Pennsylvania, the probate process is not complicated. It involves having an Executor or Administrator appointed to administer the estate and eventually distribute estate assets to the beneficiaries. If the decedent had a will, then the assets will be distributed ing to the terms of the will.

You can find out at the county clerk's office where the executor filed the paperwork. Once you know where the probate is, search that county's . gov website for the deceased person's name. You can also get access to information related to the Will if it has gone through the probate process and become public record.

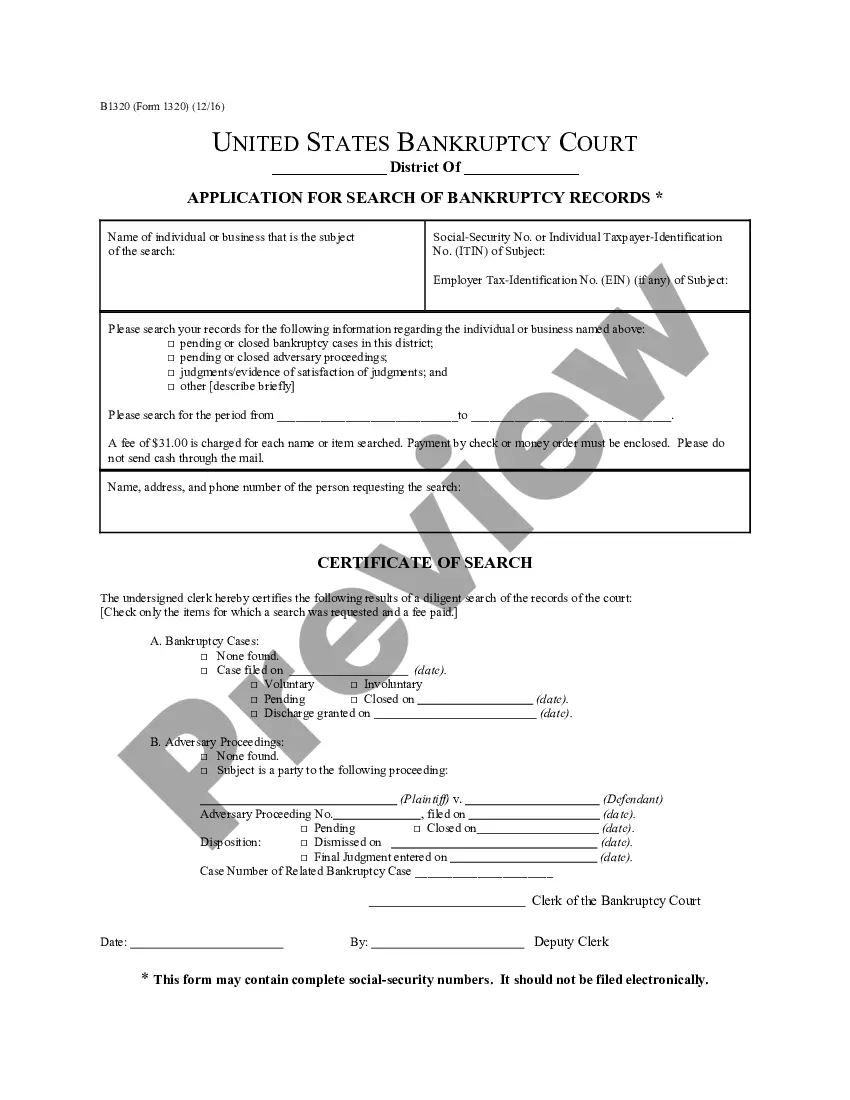

The docket index, estate index, or general index is the first place to search for evidence of probate proceedings.

How long probate takes in Pennsylvania varies depending on several factors, but the average process can take anywhere from nine months to over a year. Simple estates with few assets and no disputes may be completed in as little as six months, while more complex estates can take much longer.

Can an estate be settled without probate in Pennsylvania? In certain cases, it is possible to bypass the probate process altogether. This includes situations where the deceased had a living trust or assets held in joint tenancy with rights of survivorship.

The average time to settle an estate in Pennsylvania can vary depending on the complexity of the estate and any potential challenges or disputes. On average, it can take anywhere from 6 months to over a year to complete the probate process and distribute assets to beneficiaries.

The rates for Pennsylvania inheritance tax are as follows: 0 percent on transfers to a surviving spouse or to a parent from a child aged 21 or younger; 4.5 percent on transfers to direct descendants and lineal heirs; 12 percent on transfers to siblings; and.

The process of settling an estate in Pennsylvania involves naming a personal representative, collecting estate assets, filing appropriate forms with the Register of Wills, notifying heirs, providing public notice, paying all debts and taxes, and distributing the remaining assets to heirs named in the will or under the ...