Deed Of Trust With Assignment Of Rents Form California In Utah

Description

Form popularity

FAQ

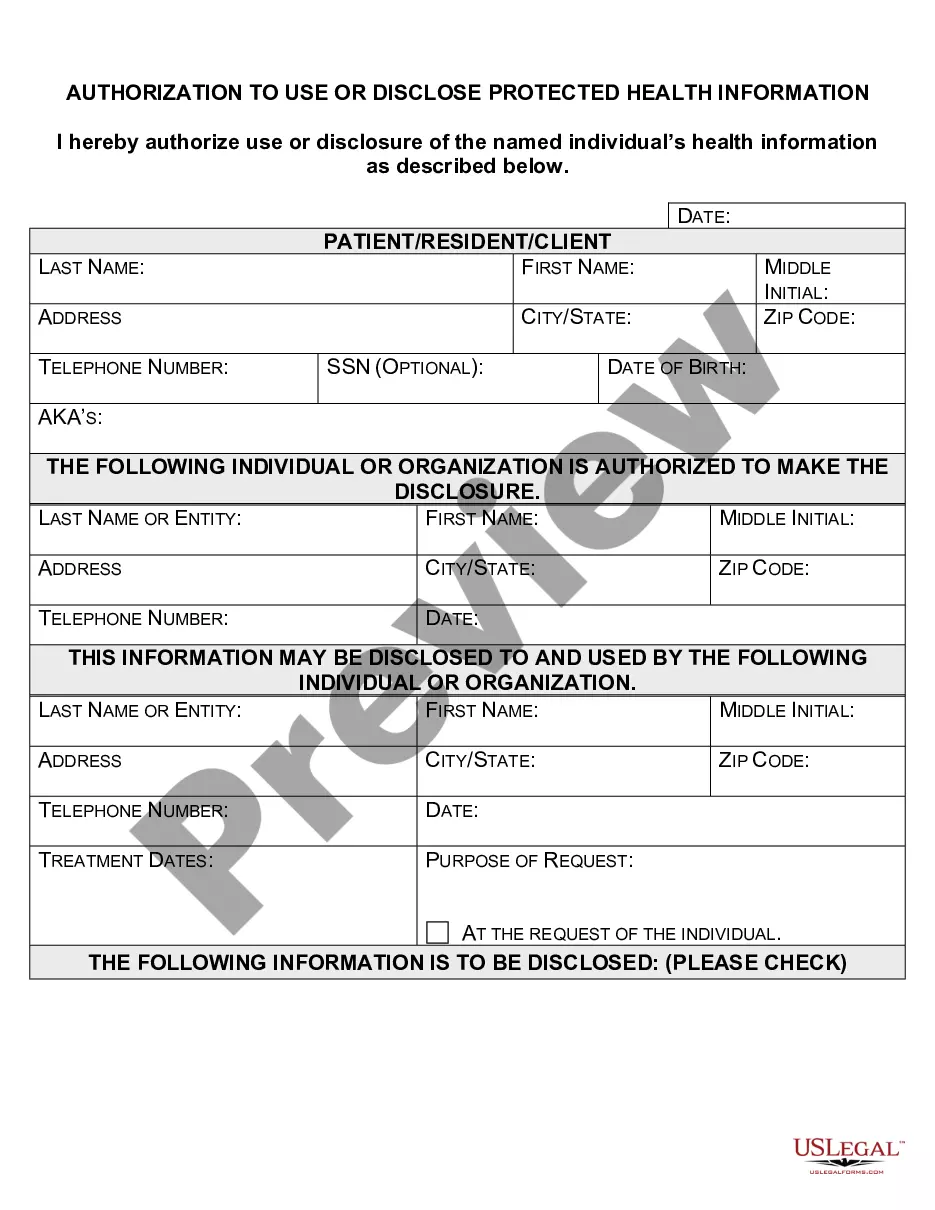

The short answer is that a living trust is a private document and does not need to be recorded in California. The only time a trust is in a public record is when it contains real estate.

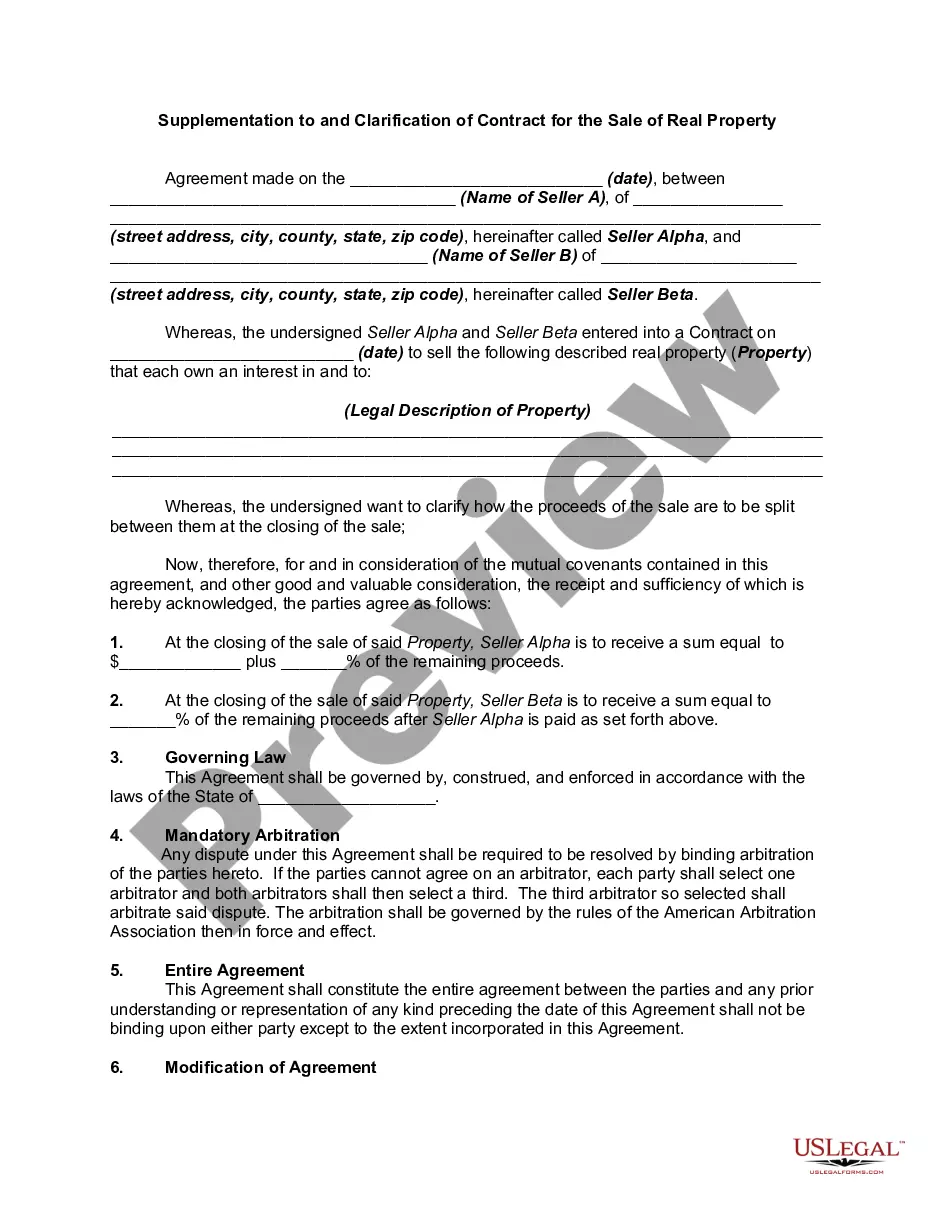

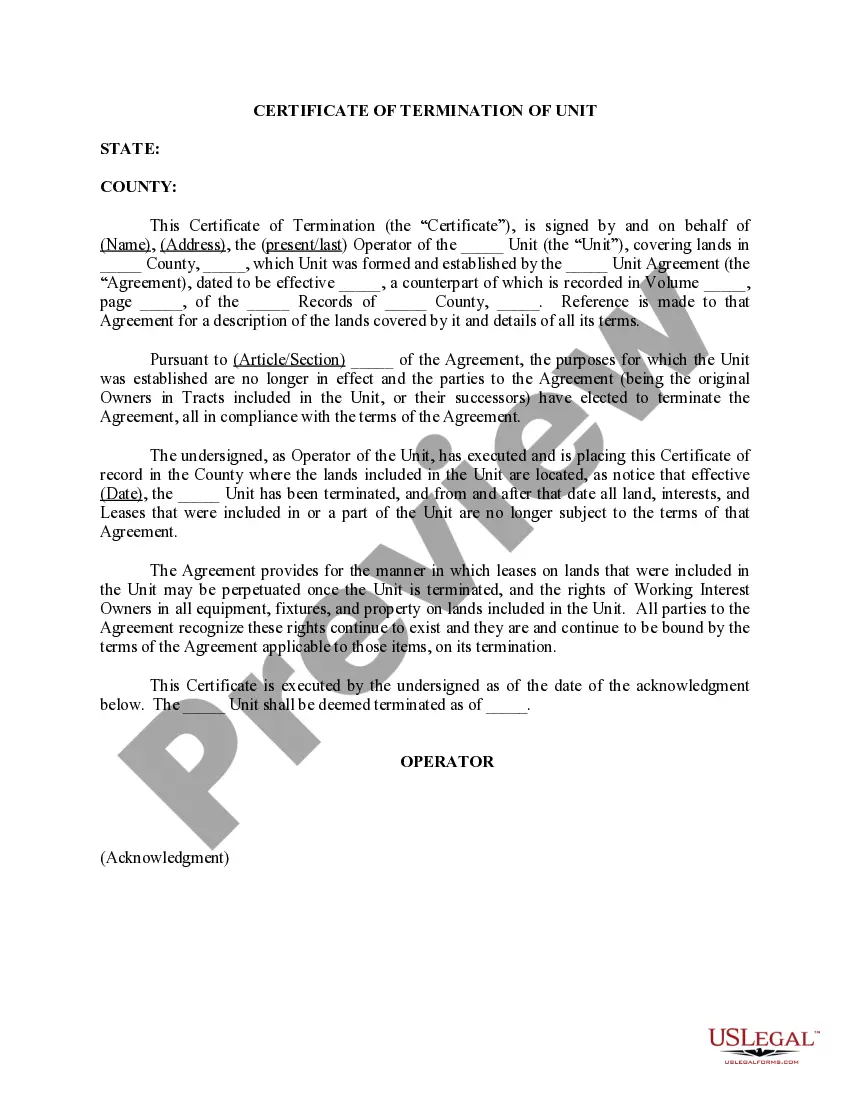

The "Assignment of Rents" clause is a contractual provision frequently found in mortgages or deeds of trust, allowing the lender to take possession of rental income generated by the mortgaged property in the event of borrower default.

The "Assignment of Rents" clause is a contractual provision frequently found in mortgages or deeds of trust, allowing the lender to take possession of rental income generated by the mortgaged property in the event of borrower default.

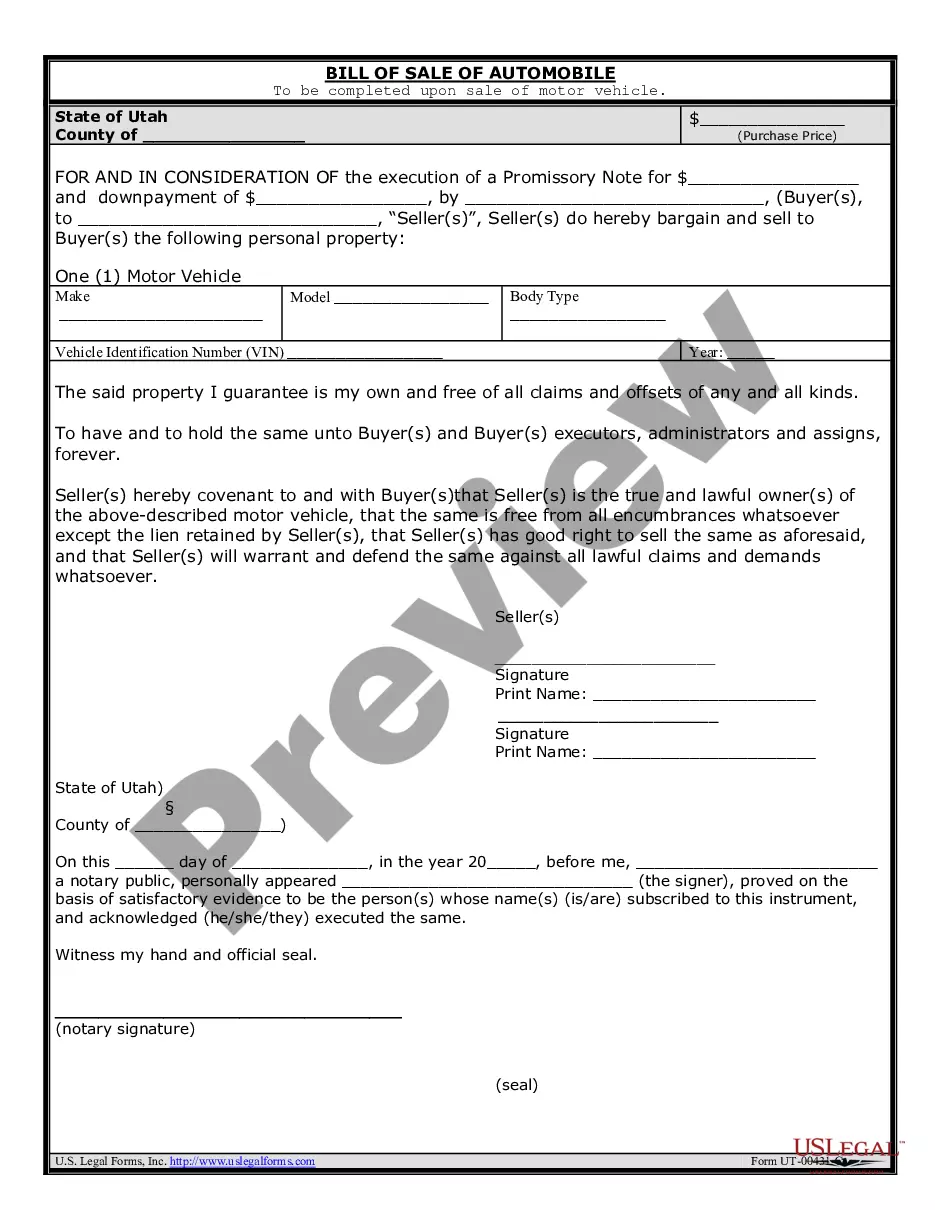

If the title stays with the borrower this is the definition of Lien Theory and results in a non-judicial foreclosure with the Power of Sale being entrusted to a Trustee and not the lender. In a Judicial/Mortgage foreclosure, the Title is held by the lender. Utah is known as a Trust Deed and Promissory Note state.

In California, there are three steps to getting a copy of a trust document: Make a written demand for a copy of the Trust and its amendments, if any; Wait 60 days; and. If you do not receive a copy of the Trust within 60 days of making your written demand, file a petition with the probate court.

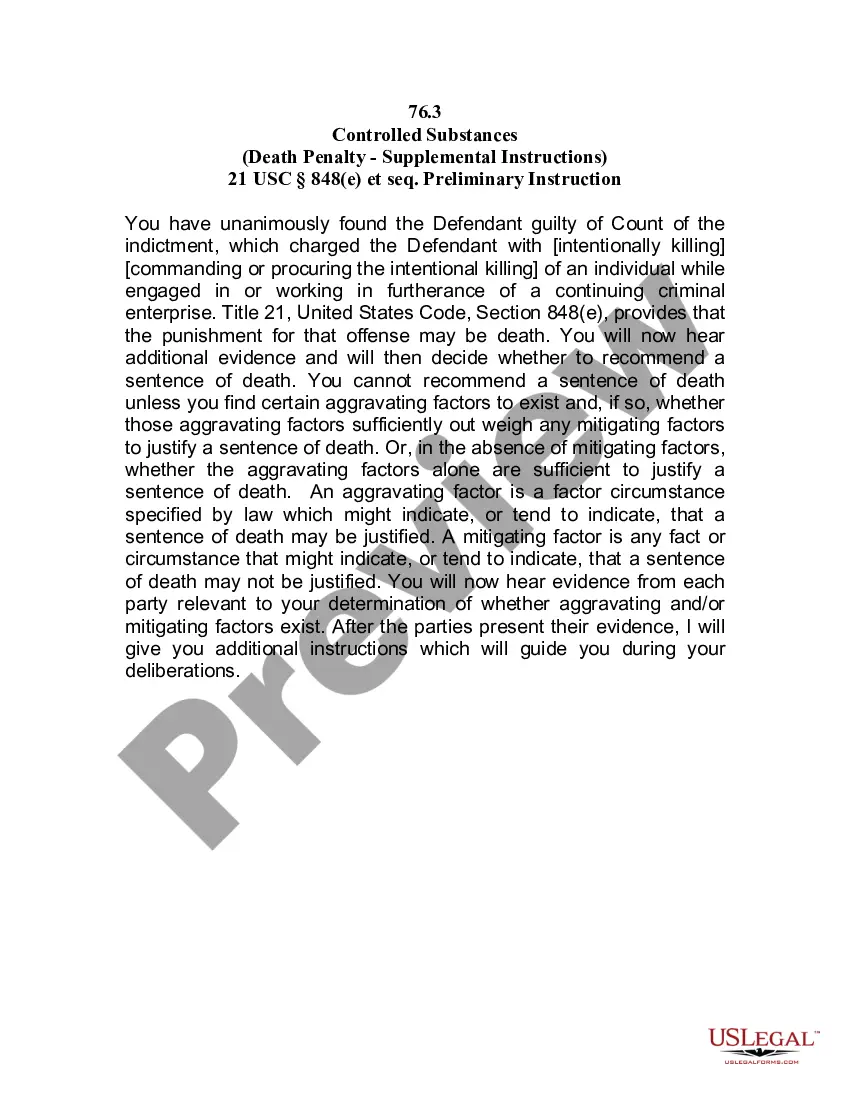

Some of the most common reasons trusts are invalid include: Legal formalities were not followed when executing the trust instrument. The trust was created or modified through forgery or another type of fraud. The trust maker was not mentally competent when they created or modified the trust.

Draft a trust deed and have it notarized so that it is legally binding. Record the deed at the county recorder's office. Notify the relevant parties, such as your mortgage lender and insurance provider. Update the property records to show that the trust is now the legal owner.

The short answer is that a living trust is a private document and does not need to be recorded in California. The only time a trust is in a public record is when it contains real estate.