Deed Of Trust Records With Lien In Suffolk

Description

Form popularity

FAQ

The grantor must sign the deed form and that signature must be properly acknowledged by a notary public. All signatures must be original; we cannot accept photocopies. A complete description of the property including the village, town, county and state where the property is located must also be included on the form.

How do I obtain a copy of my property deed? Property deeds are recorded in the Suffolk County Clerk's Office in Riverhead, NY. The direct phone number is (631) 852-2000.

How do I obtain a copy of my property deed? Property deeds are recorded in the Suffolk County Clerk's Office in Riverhead, NY. The direct phone number is (631) 852-2000.

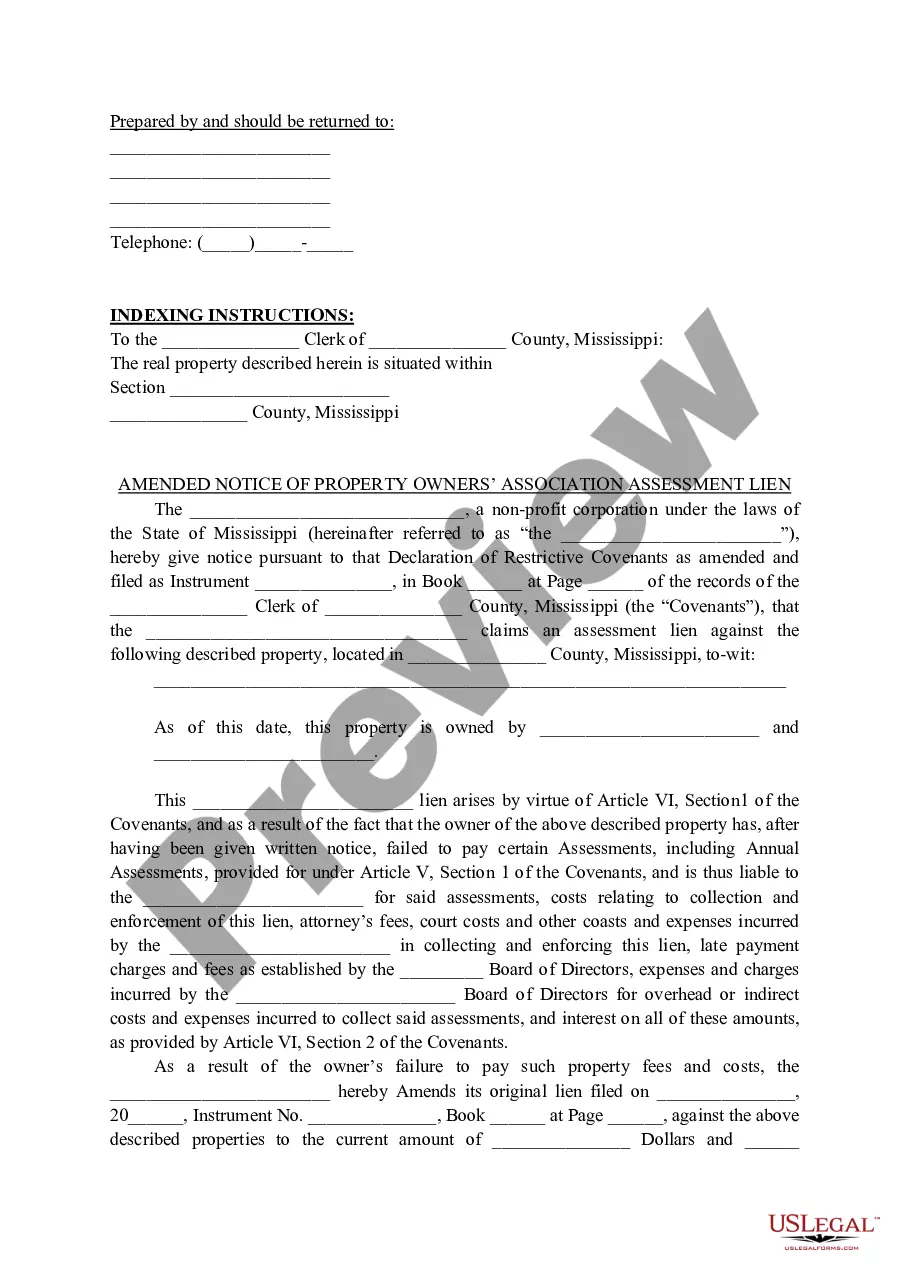

Property liens A lien will show up in a property title search. If you are trying to sell your home, you'll need to settle the dispute with the lienholder—in this case, the mortgage lender—to clear the title and proceed with the sale.

Recording Fees Document TypeFee Declaration of Trust $255 Deed, Unit Deed, or Easement $155 Mortgage $205 Mortgage Foreclosure Deed & Affidavit $1559 more rows

Yes you can complete and record your own deed. It must b properly signed, witnessed, and notarized.

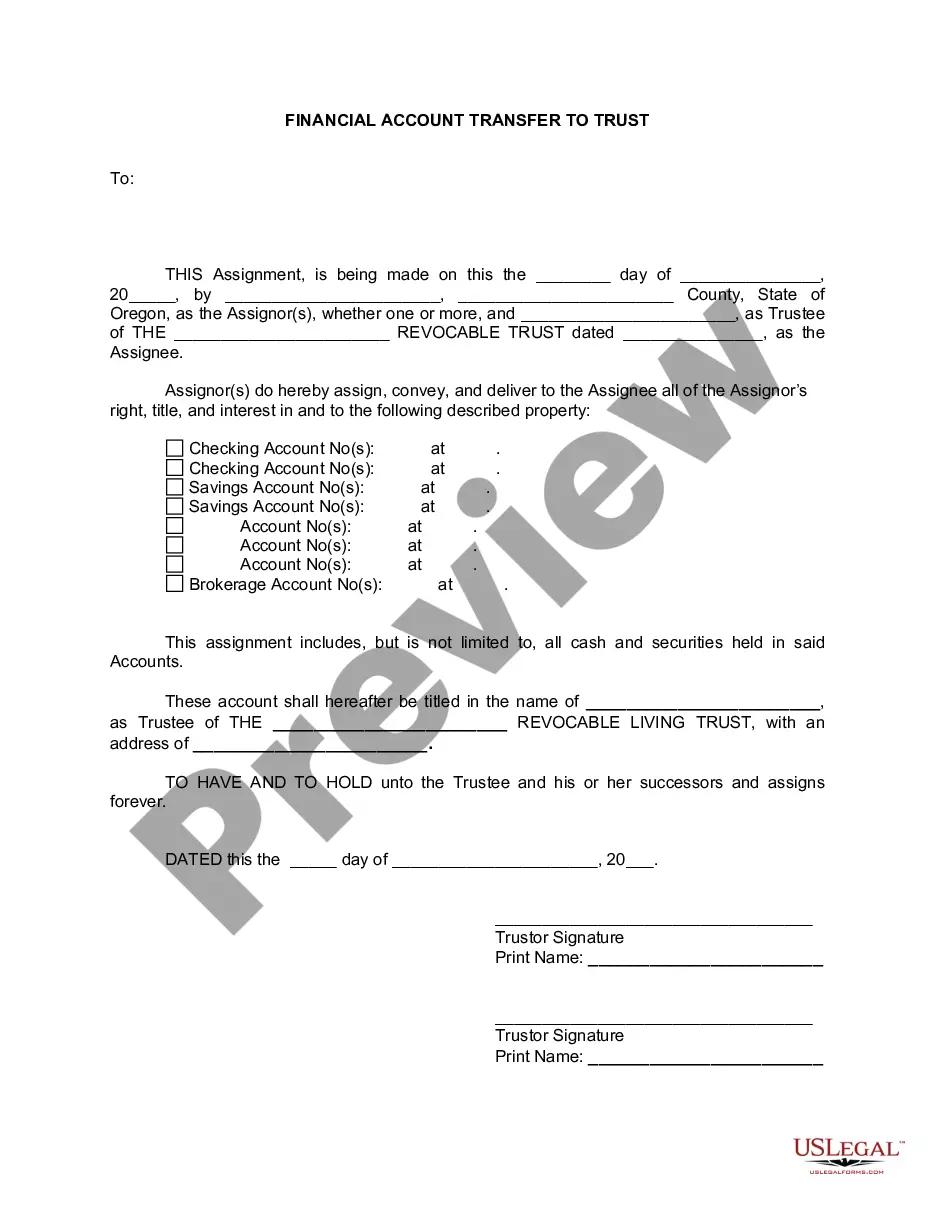

A deed of trust creates a lien on the purchased property when it is executed and delivered by the trustor/borrower to the beneficiary (usually the lender). Once executed and delivered, the deed of trust takes priority as a security against the property in relation to any other liens previously recorded.

Individuals and organizations seeking public records may submit a request using the Public Records Request Form available here. Requests may be directed to the DA's Records Access Officer (RAO) at SCDAOPRR@state.ma. The RAO can be reached by phone at 617-619-4176 or 617-619-4192.

The seller's attorney will give the original deed to the buyer's attorney at closing. That original then gets recorded at the clerk's office of the local municipality. The clerk's office scans and records the document into the land records and then sends it to the buyer or their attorney.

How do I obtain a copy of my property deed? Property deeds are recorded in the Suffolk County Clerk's Office in Riverhead, NY. The direct phone number is (631) 852-2000.