Deed Of Trust Modification With Wells Fargo In San Diego

Description

Form popularity

FAQ

Because of a glitch in Wells Fargo's software program, hundreds of people were unable to modify their home loans, leaving many stuck in the financial situation that caused them to apply for the modification in the first place.

Having served generations of families, we have the knowledge, resources and experience to administer trusts and estates with sensitivity and professionalism. is ranked #1 as the largest provider of personal trust services with $130.4B under management.

Trust Services are available through Wells Fargo Bank, N.A. Member FDIC and Wells Fargo Delaware Trust Company, N.A. Any estate plan should be reviewed by an attorney who specializes in estate planning and is licensed to practice in your state.

To make sure your trust reflects your values and lessens the burden on your loved ones, Wells Fargo Bank can serve as the corporate trustee of your personal trust.

A modification is a change or alteration, usually to make something work better. If you want to change something — in other words, modify it — you need to make a modification. Lots of things require modification, because they get older or just because they can be improved.

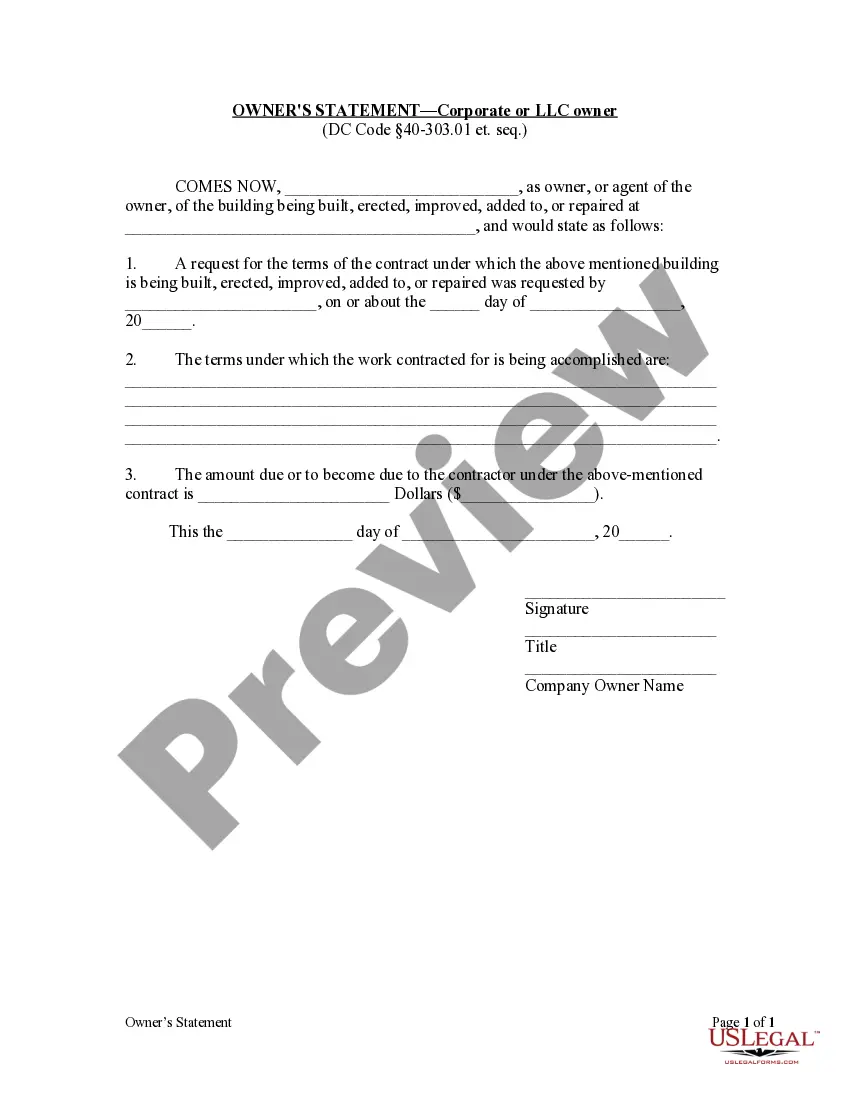

Deed of Trust Modification means, with respect to any Deed of Trust, a modification agreement entered into between the Borrower or the Project Owner, as applicable, and the Lender, modifying the terms and conditions of the Deed of Trust in order to (i) add to the lien of the Deed of Trust Additional Lots, or (ii) make ...

In terms of semantics, however, the big difference is that the mortgage is a two-party transaction whereas the deed of trust involves three. In addition, there is also a difference with how title actually passes with deeds of trust.

Again, the deed and a mortgage are both important documents that are a part of the homebuying process. However, the key difference between a deed vs. mortgage is that the deed is the only document that legally proves who owns the home. In this sense, it may be considered the more important of the two.