Trust Deed Format For Temple In North Carolina

Description

Form popularity

FAQ

Deeds of trust are the most common instrument used in the financing of real estate purchases in Alaska, Arizona, California, Colorado, the District of Columbia, Idaho, Maryland, Mississippi, Missouri, Montana, Nebraska, Nevada, North Carolina, Oregon, Tennessee, Texas, Utah, Virginia, Washington, and West Virginia, ...

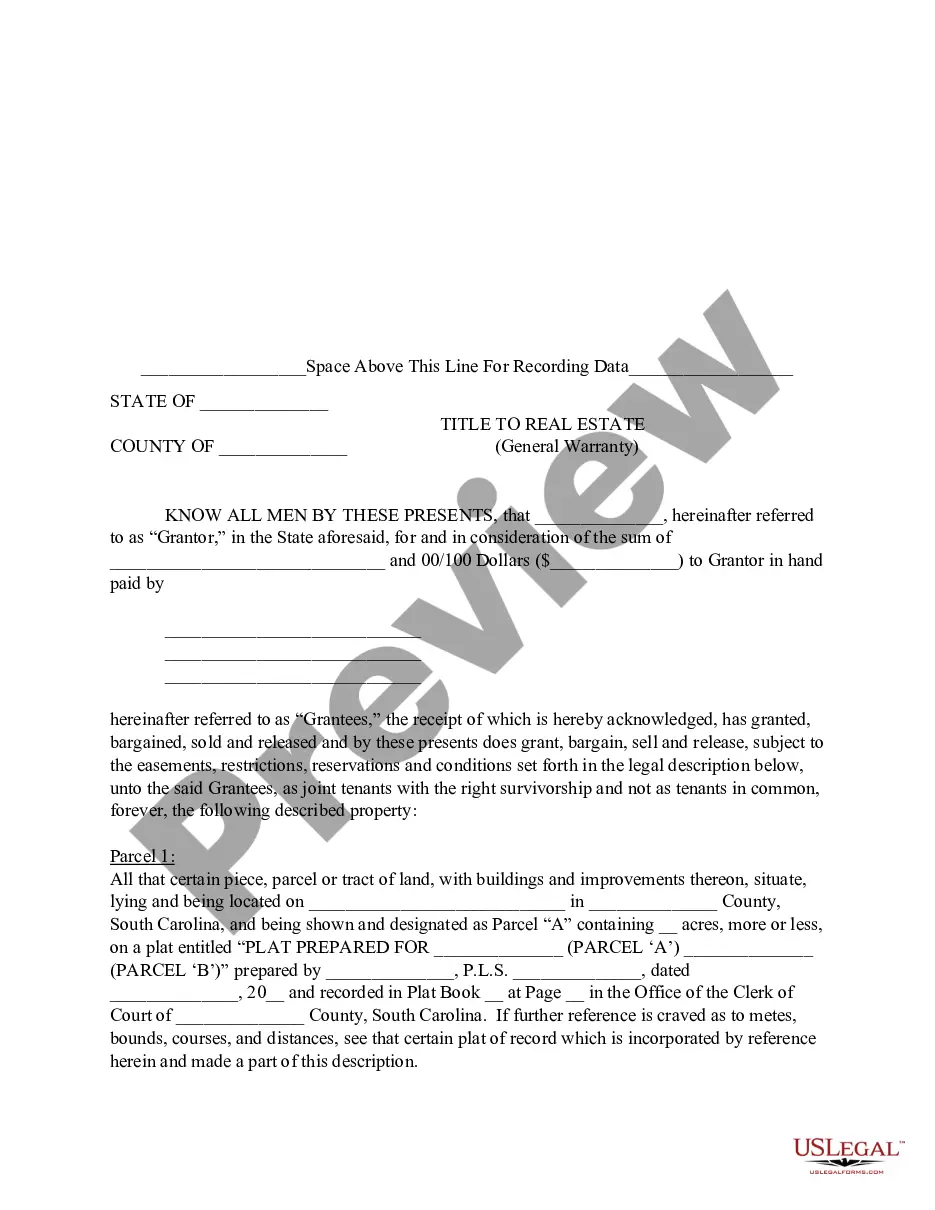

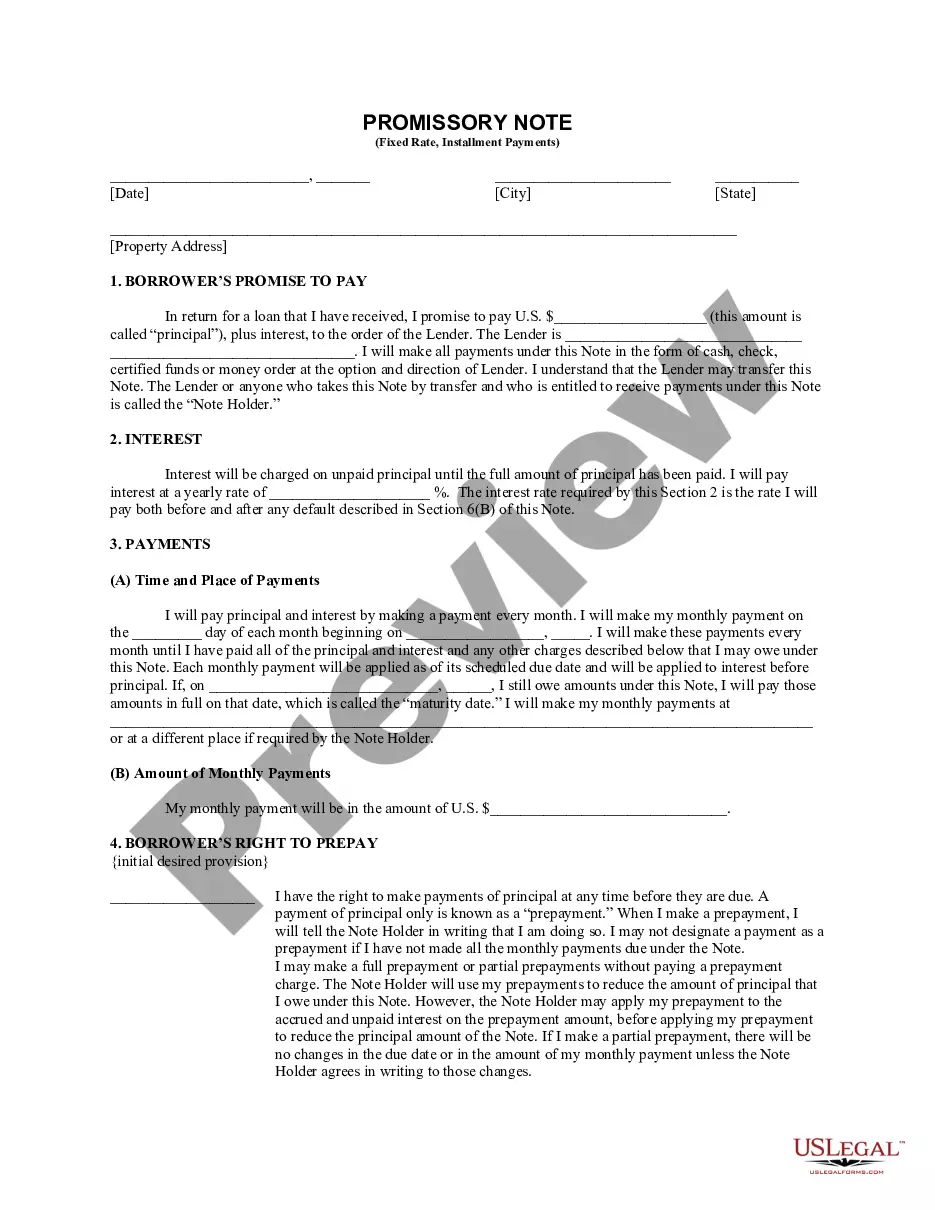

A deed of trust (also known as a trust deed) is a document sometimes used in financed real estate transactions, generally instead of a mortgage.

A deed of trust creates a lien on the purchased property when it is executed and delivered by the trustor/borrower to the beneficiary (usually the lender). Once executed and delivered, the deed of trust takes priority as a security against the property in relation to any other liens previously recorded.

Whenever the trustor (borrower) executes a deed of trust he/ she conveys “bare legal” title to the property described therein to a party called the trustee.

This Deed of Trust (the “Trust Deed”) sets out the terms and conditions upon which: Settlor Name (the “Settlor”), of Settlor Address, settles that property set out in Schedule A (the “Property”) upon Trustee Name (the “Trustee”), being a Company duly registered under the laws of state with registered number ...

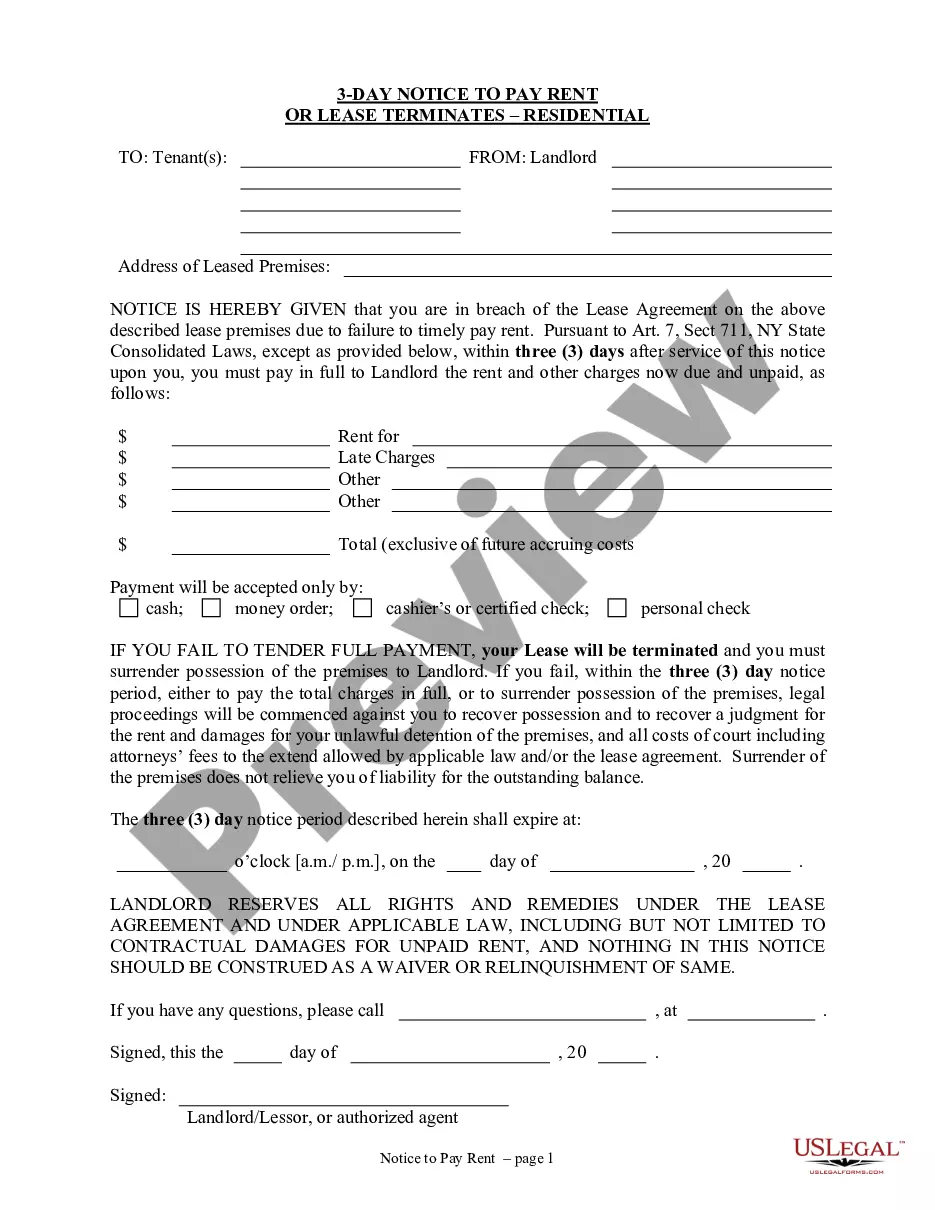

What Are the Disadvantages of Putting Your House in a Trust in California? Putting a home, or any real estate, into a trust can be costly. The process can also take time, even with the help of an experienced attorney. If the home is in a trust, it can also make refinancing and changing your mortgage much harder.

Rich people frequently place their homes and other financial assets in trusts to reduce taxes and give their wealth to their beneficiaries. They may also do this to protect their property from divorce proceedings and frivolous lawsuits.

How to Create a Trust in North Carolina Step 1: Determine Trust Assets. Step 2: Name a Trustee and Beneficiaries. Step 3: Draft and Sign the Trust Documents. Step 4: Transfer Ownership (Title) to the Trust.

In North Carolina, a deed of trust or mortgage acts as a conveyance of the real estate. Upon repayment of the debt or performance of the obligation, the conveyance becomes void.