Deed Of Trust Modification With Future Advance Clause In Nevada

Description

Form popularity

FAQ

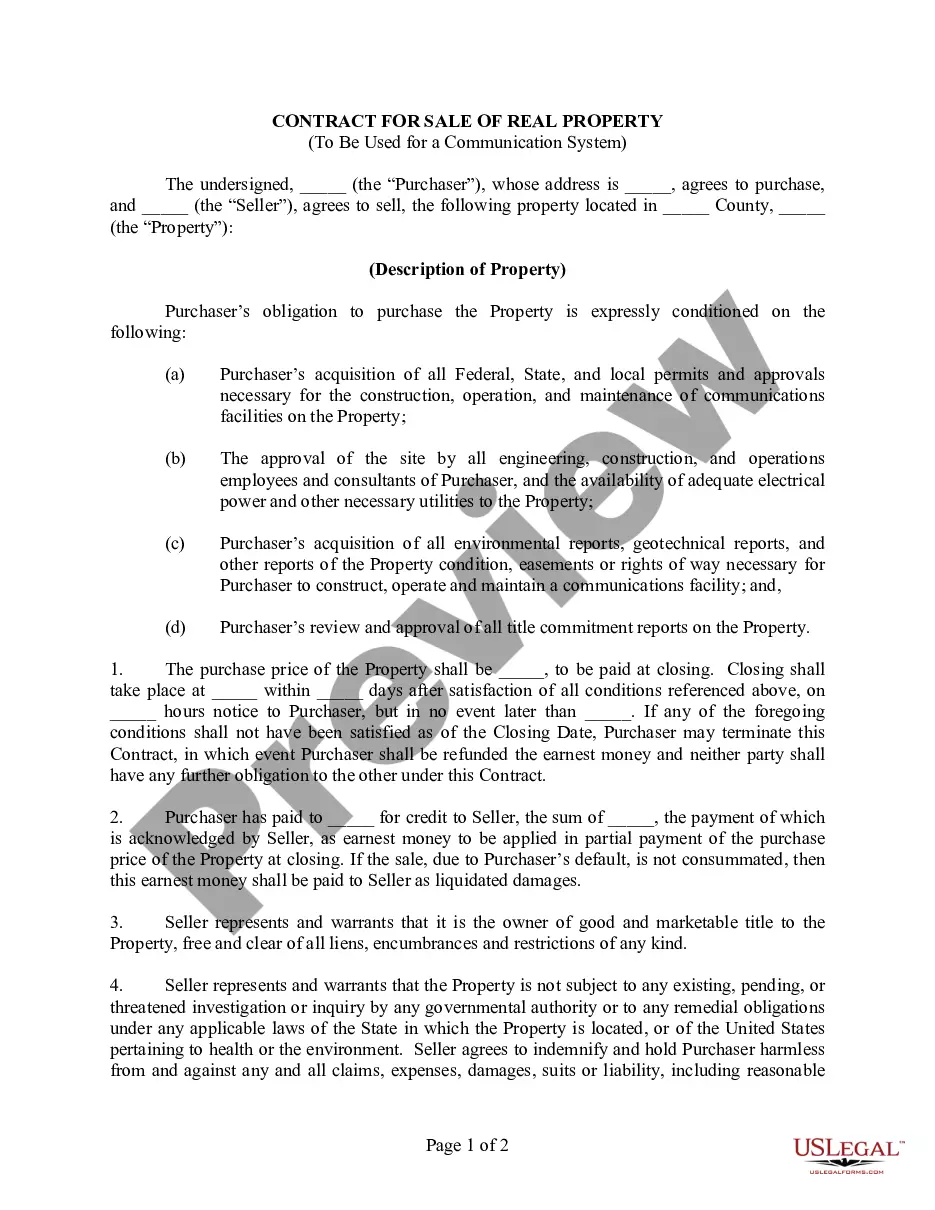

Deeds of trust almost always include a power-of-sale clause , which allows the trustee to conduct a non-judicial foreclosure - that is, sell the property without first getting a court order.

The granting clause grants the property with its related rights and appurtenances, beginning with “grants, sells, and conveys.” The habendum clause defines the extent of property ownership conveyed to the grantee, beginning with “to have and to hold.” The warranty clause describes the warranties of title made by the ...

In real estate, a grantee is the recipient of the property, and the grantor is a person who transfers ownership rights of a property to another person. However, the specifics of their transaction may vary depending on the situation.

Also, the statute of limitations on a contract is 6 years on a “contract, obligation or liability founded upon an instrument in writing: NRS 11.190(1)(b). However, the statute of limitations on a mortgage or deed of trust is 10 years.

Granting Clause: The clause in the deed that lists the grantor and the grantee and states that the property is being transferred between the parties.

Through a deed-in-lieu of foreclosure, you sign your home over to your lender, and in exchange your lender foregoes foreclosure and releases you from your mortgage. The deficiency amount under a deed-in-lieu of foreclosure is the difference between the fair market value of the property and the total debt.

You will usually be discharged after four years, but some trust deeds can last for longer. This information will be included in the terms of the trust deed. If the trust deed does not become protected, your discharge will only be binding on those creditors who agreed to the arrangement.

To change the trust deed itself, you must execute a deed of variation. This is a document that updates the relevant section of the original trust deed. The deed of variation forms part of the documentation of your discretionary trust and details how the trust deed has been changed over time.

Put simply, if the trust deed empowers the trustees to unanimously amend the trust deed, they may legally undertake such amendment regardless of whether beneficiaries have accepted benefits previously.