Trust Deed Format For Temple In Maricopa

Description

Form popularity

FAQ

Are you familiar with the deed of trust? In Arizona, this is the primary financial security document that's used when purchasing a home. While the deed of trust is similar to the mortgage, there are some notable differences to be aware of. If you're not sure how to differentiate the two, don't worry.

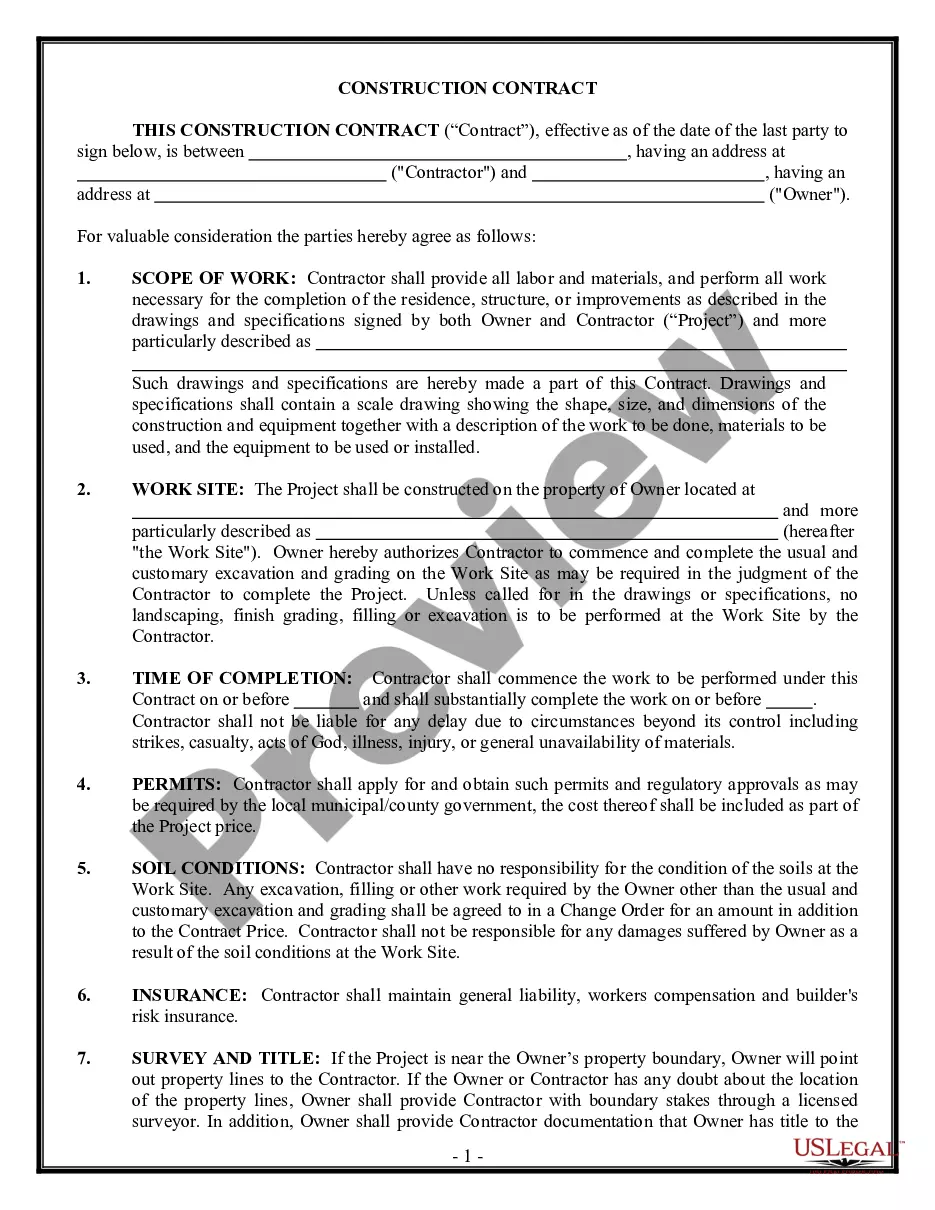

This Deed of Trust (the “Trust Deed”) sets out the terms and conditions upon which: Settlor Name (the “Settlor”), of Settlor Address, settles that property set out in Schedule A (the “Property”) upon Trustee Name (the “Trustee”), being a Company duly registered under the laws of state with registered number ...

Where to Get a Deed of Trust? To get a Deed of Trust, you must file the proper paperwork with the proper court as generally outlined above. These documents must be filed with the county clerk or recorder, and the lender typically sends them to the recording office after the property closing.

This Deed of Trust (the “Trust Deed”) sets out the terms and conditions upon which: Settlor Name (the “Settlor”), of Settlor Address, settles that property set out in Schedule A (the “Property”) upon Trustee Name (the “Trustee”), being a Company duly registered under the laws of state with registered number ...

While it is not legally mandatory that an attorney file your quit claim deed, an attorney can help with ensuring that the quitclaim deed is properly drafted and filed, and that you take advantage of any tax exemptions or benefits that may be available to you.

All deeds must be filed with the County Recorder's Office. Affidavit of Property Value – Required for every deed or transfer of ownership (except for property that is transferred through quitclaim for no monetary exchange or for a nominal amount.

The deed of trust must then be recorded with the county where the property is located, and each of the parties (the trustor, trustee, and lender) should keep a copy of the recorded document.

You can record a document in-person, by mail, or electronically. Your document must be an ORIGINAL or government-issued CERTIFIED copy to be accepted for recording.

A deed is signed only by the grantor(s), not the grantee. A deed does not have to be recorded to be valid, but recording is very common. Bailey Law Firm advises clients on what deed is appropriate for their circumstance.