Trust Deed Format For Gratuity In Kings

Description

Form popularity

FAQ

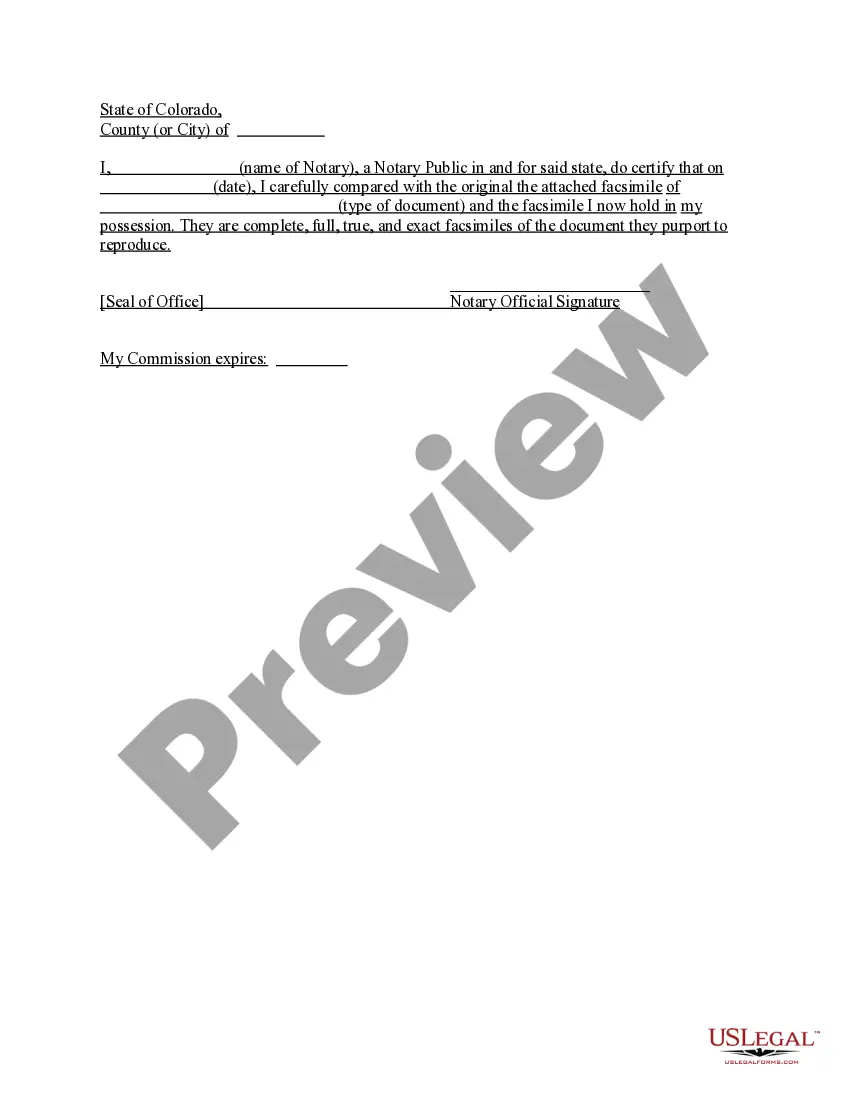

How do I fill this out? Gather information about trustees, settlors, and trust creation date. Identify the powers of the trustees and whether the trust is revocable or irrevocable. Fill out each section ingly, following the prompts. Ensure all acting trustees sign the document. Notarize the document if required.

This Deed of Trust (the “Trust Deed”) sets out the terms and conditions upon which: Settlor Name (the “Settlor”), of Settlor Address, settles that property set out in Schedule A (the “Property”) upon Trustee Name (the “Trustee”), being a Company duly registered under the laws of state with registered number ...

In India, the standard formula to calculate gratuity is: Monthly Salary × Number of years of employment (rounded to nearest year) × 15/26 Generally, Monthly Basic + D.A. salary is considered for gratuity valuation.

Process of setting up Trust Step 1: Drafting and execution of the trust in deed and appointment of trustees. Step 2: Application for PAN card of trust. Step 3: Opening of bank account of trust. Step 4: Application with commissioner of income tax for the approval of the trust.

This Deed of Trust (the “Trust Deed”) sets out the terms and conditions upon which: Settlor Name (the “Settlor”), of Settlor Address, settles that property set out in Schedule A (the “Property”) upon Trustee Name (the “Trustee”), being a Company duly registered under the laws of state with registered number ...

As an Approved Gratuity Trust is a separate entity, so every year auditing of that trust is must.

Trust Declaration: the trust deed must identify the trust, the trustee, and the beneficiary, and confirm the assets being held in the trust. Trustee Powers: The administrative powers of the trustee, such as the power to manage or invest the trust assets must be detailed in the document.

Rich people frequently place their homes and other financial assets in trusts to reduce taxes and give their wealth to their beneficiaries. They may also do this to protect their property from divorce proceedings and frivolous lawsuits.

What Are the Disadvantages of Putting Your House in a Trust in California? Putting a home, or any real estate, into a trust can be costly. The process can also take time, even with the help of an experienced attorney. If the home is in a trust, it can also make refinancing and changing your mortgage much harder.