Deed Of Trust Records With Lien In Houston

Description

Form popularity

FAQ

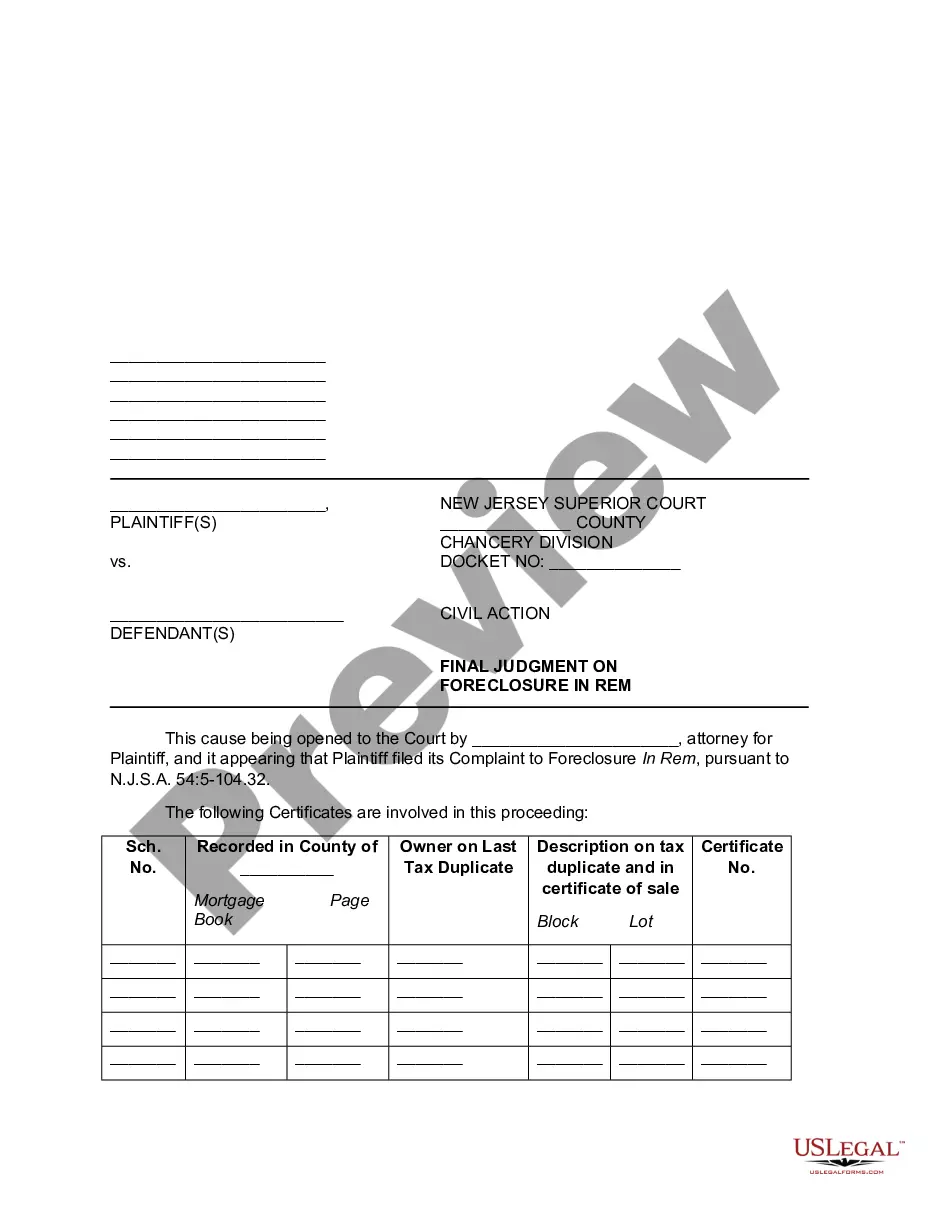

The deed of trust must then be recorded with the county where the property is located, and each of the parties (the trustor, trustee, and lender) should keep a copy of the recorded document.

A deed of trust creates a lien on the purchased property when it is executed and delivered by the trustor/borrower to the beneficiary (usually the lender). Once executed and delivered, the deed of trust takes priority as a security against the property in relation to any other liens previously recorded.

Once a deed has been recorded by the County Clerk's Office, copies of the deed may be requested if the original deed has been misplaced. Plain copies can be found by using the Official Public Records Search and selecting "Land Records". A certified copy may be purchased through request either in person or by mail.

So, put simply, if your deed was not recorded or you have discovered unrecorded deeds in your chain of title, there is no need to worry. The deeds themselves will still be valid and you can file correction instruments to correct any mistakes.

You do not have to record the deed to make the transfer valid between the parties. However, as described above, the grantee will want to record the deed as soon as possible after receiving delivery.

Texas doesn't require you to record your trust. As long as it's signed, notarized, and properly funded, it's valid.

A Deed of Trust in Texas transfers title of real property in trust. It is the equivalent to a mortgage used in other states and provides a secured interest for a lender against real estate.

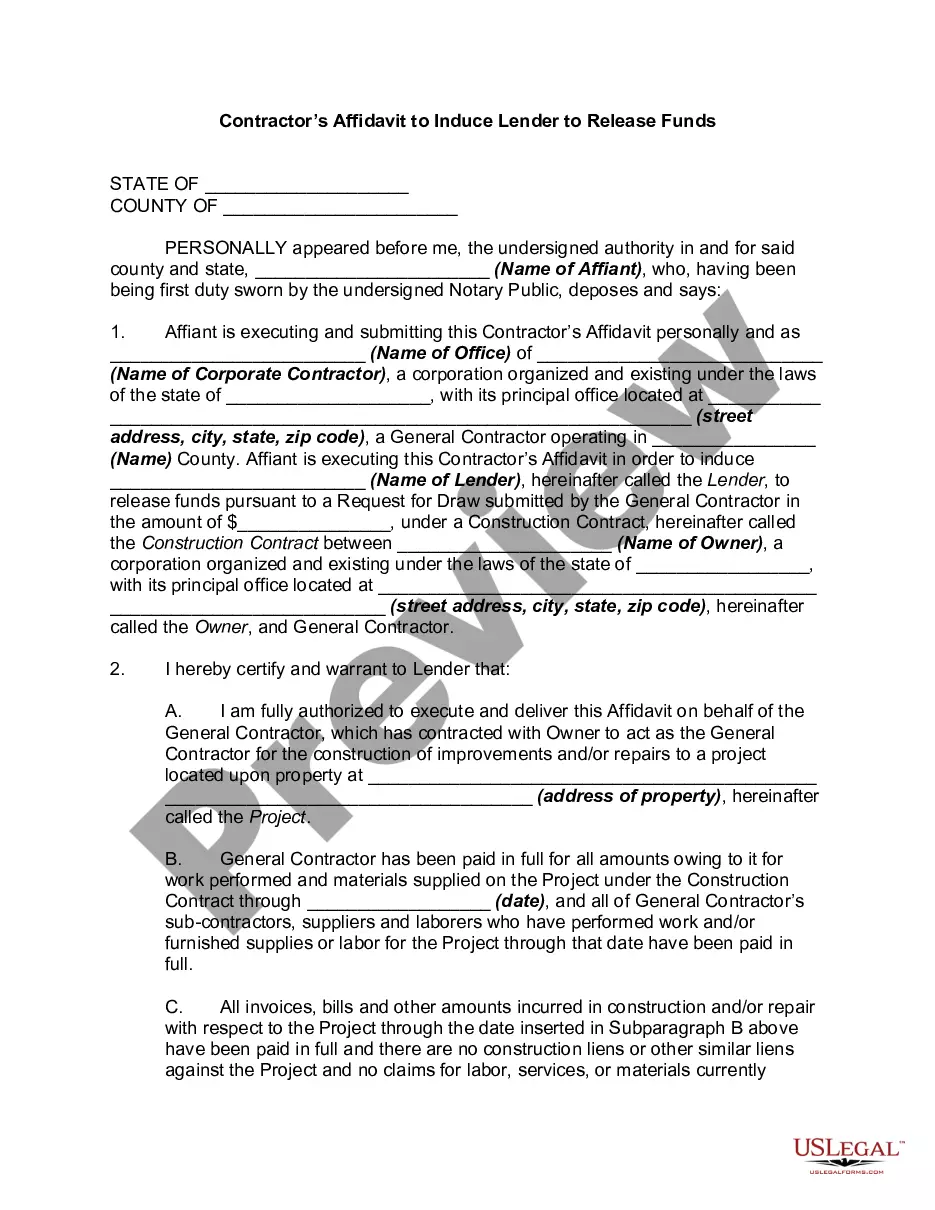

A deed of trust will include the same type of information stated in a mortgage document, such as: The identities of the borrower, lender, and trustee. A full description of the property to be placed in trust. Any restrictions or requirements on the use of the property while it is in trust.

Yes, you can sell a home with a Deed of Trust. However, just like a mortgage, if you're selling the home for less than you owe on it, you'll need approval from the lender.