This form is a deed of trust modification. It is to be entered into by a borrower, co-grantor, and the lender. The agreement modifies the mortgage or deed of trust to secure a debt described within the agreement. Other provisions include: renewal and extension of the lien, co-grantor liability, and note payment terms.

Deed Of Trust Records For A Domain In Houston

Description

Form popularity

FAQ

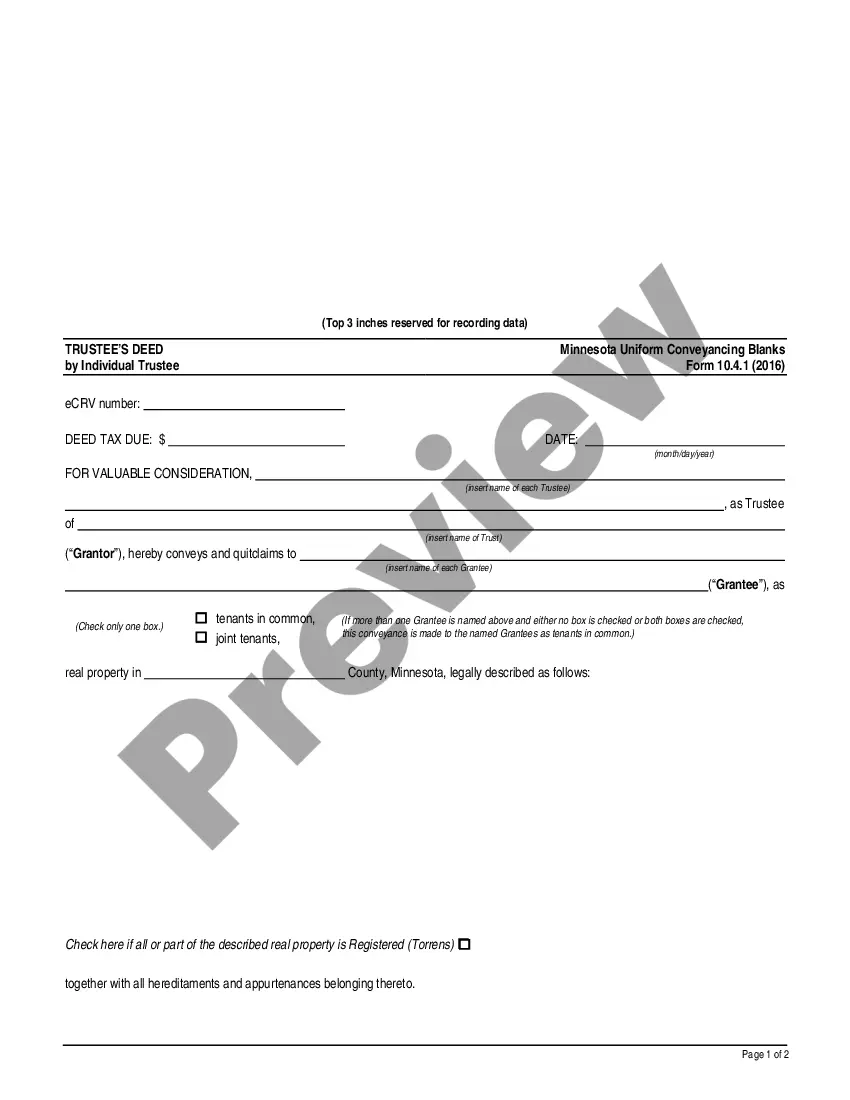

A deed of trust will include the same type of information stated in a mortgage document, such as: The identities of the borrower, lender, and trustee. A full description of the property to be placed in trust. Any restrictions or requirements on the use of the property while it is in trust.

This Deed of Trust (the “Trust Deed”) sets out the terms and conditions upon which: Settlor Name (the “Settlor”), of Settlor Address, settles that property set out in Schedule A (the “Property”) upon Trustee Name (the “Trustee”), being a Company duly registered under the laws of state with registered number ...

(b) An instrument conveying real property may not be recorded unless it is signed and acknowledged or sworn to by the grantor in the presence of two or more credible subscribing witnesses or acknowledged or sworn to before and certified by an officer authorized to take acknowledgements or oaths, as applicable.

Deeds of trust transfer the legal title of a property to a third party—such as a bank, escrow company, or title company—to hold until the borrower repays their debt to the lender.

This Deed of Trust (the “Trust Deed”) sets out the terms and conditions upon which: Settlor Name (the “Settlor”), of Settlor Address, settles that property set out in Schedule A (the “Property”) upon Trustee Name (the “Trustee”), being a Company duly registered under the laws of state with registered number ...

Once a deed has been recorded by the County Clerk's Office, copies of the deed may be requested if the original deed has been misplaced. Plain copies can be found by using the Official Public Records Search and selecting "Land Records". A certified copy may be purchased through request either in person or by mail.

Let's get started how to get a copy of a deed. In Texas in Texas property Deeds are public records.MoreLet's get started how to get a copy of a deed. In Texas in Texas property Deeds are public records. This means anyone can access them the process to obtain a copy is straightforward.

Harris County Clerk Real Property Department Harris County Civil Courthouse. 201 Caroline, Suite 320. Houston, TX 77002. (713) 274-8680.

How do I get a copy of my deed? We have 11 locations within Harris County, or you may submit a request in writing by fax, mail or email. We need to know the owner name and legal description of the property. Please note that the legal description can be obtained from your tax statement.

The County Clerk as Recorder of Deeds/Official Public Records: Texas Government Code, Local Government Code, Property Code, Uniform Commercial Code, Civil Practice and Remedies Code, Business and Commercial Code.