Trust Of Deeds For Property In Harris

Description

Form popularity

FAQ

You will usually be discharged after four years, but some trust deeds can last for longer. This information will be included in the terms of the trust deed.

(b) A sale of real property under a power of sale in a mortgage or deed of trust that creates a real property lien must be made not later than four years after the day the cause of action accrues.

Ideally, an SMSF trust deed should be written in a way that doesn't require regular updating. However, the deed should be reviewed at least annually to ensure it's up to date.

Question #3: How do I get a copy of my deed restrictions? Answer #3: For most people living in the City of Houston, their property is located in Harris County. Please contact the Harris County Clerk's Office at 713.755. 6405 to request a copy.

TEX. CIVIL PRACTICE & REMEDIES CODE §16.035: Deed of Trust lien becomes barred 4 years after the original or extended maturity date of the secured obligation.

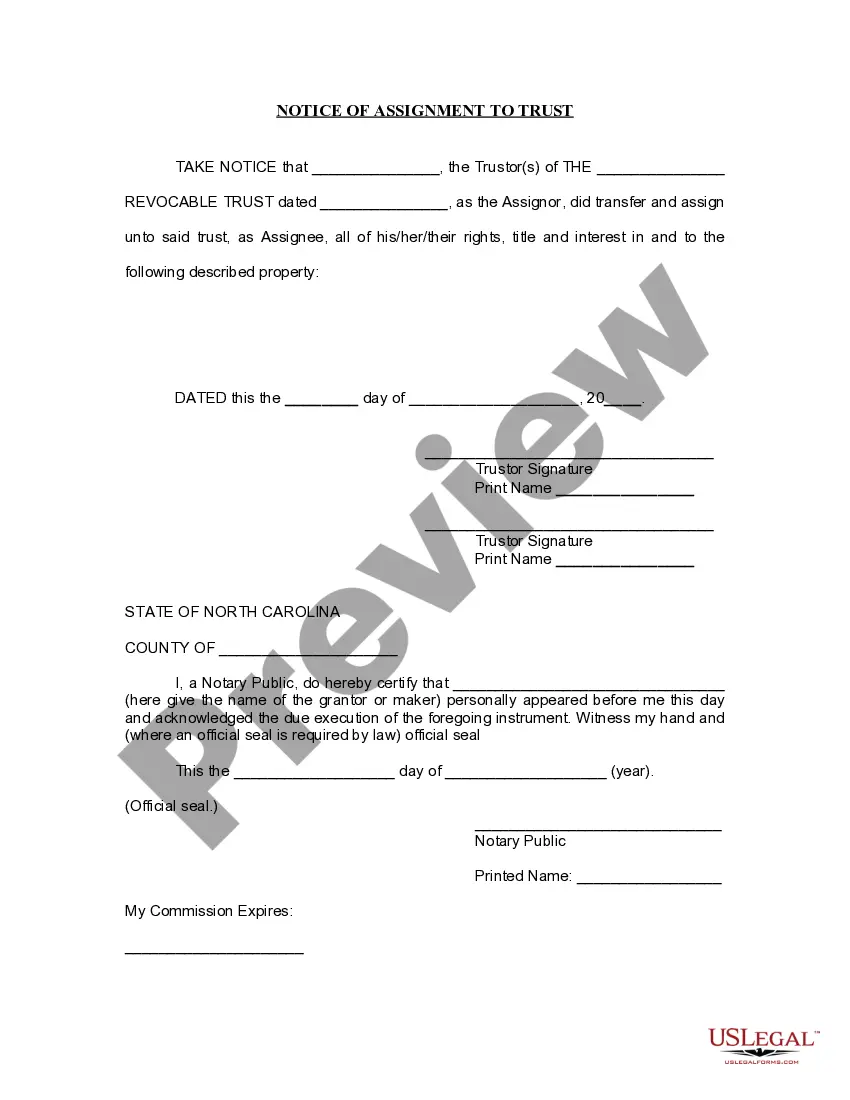

Transferring real estate to a living trust in Texas involves signing a deed that transfers the interest in the property to the trust and then recording this deed with the county to formalize the transfer. A wide range of financial accounts, including bank accounts, can also be transferred to a living trust.

If you wish, a copy may be obtained in person at the Harris County Clerk's Office located downtown in the Harris County Civil Courthouse, 201 Caroline, 3rd Floor, Monday through Friday from a.m. to p.m. If your property is not located in Harris County and you would like to obtain a copy of the recorded deed ...

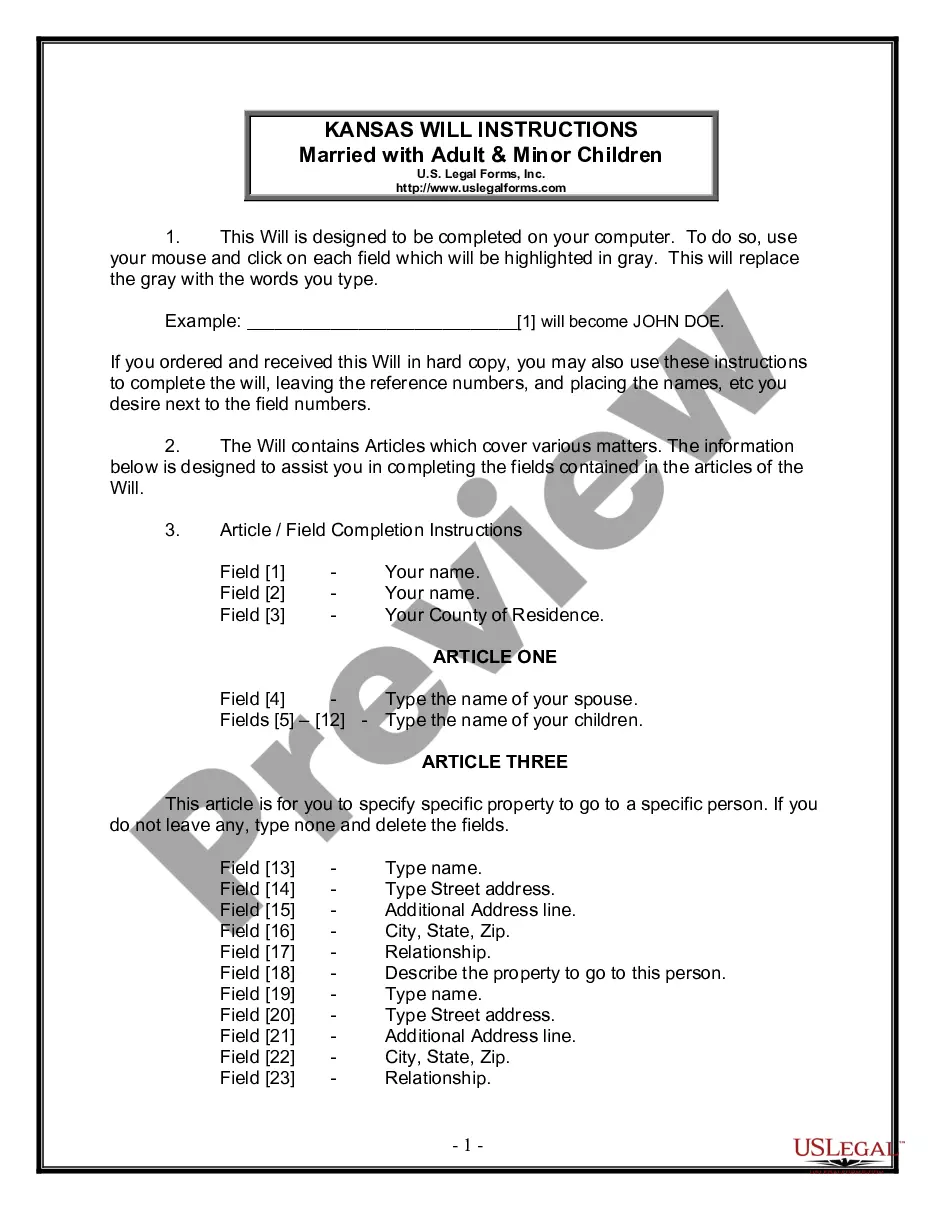

Where to Get a Deed of Trust? To get a Deed of Trust, you must file the proper paperwork with the proper court as generally outlined above. These documents must be filed with the county clerk or recorder, and the lender typically sends them to the recording office after the property closing.

Question #3: How do I get a copy of my deed restrictions? Answer #3: For most people living in the City of Houston, their property is located in Harris County. Please contact the Harris County Clerk's Office at 713.755. 6405 to request a copy.