Trust Deed And Rules In Georgia

Description

Form popularity

FAQ

Mortgages are used, but they are rare. A security deed (deed to secure debt) is the customary security instrument in Georgia. Georgia does not use a Deed of Trust.

What Are the Disadvantages of Putting Your House in a Trust in California? Putting a home, or any real estate, into a trust can be costly. The process can also take time, even with the help of an experienced attorney. If the home is in a trust, it can also make refinancing and changing your mortgage much harder.

A deed used to convey Georgia real property to a revocable trust. This Standard Document contains integrated notes with important explanations and drafting tips.

To make a living trust in Georgia, you: Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries—that is, who will get the trust property. Create the trust document.

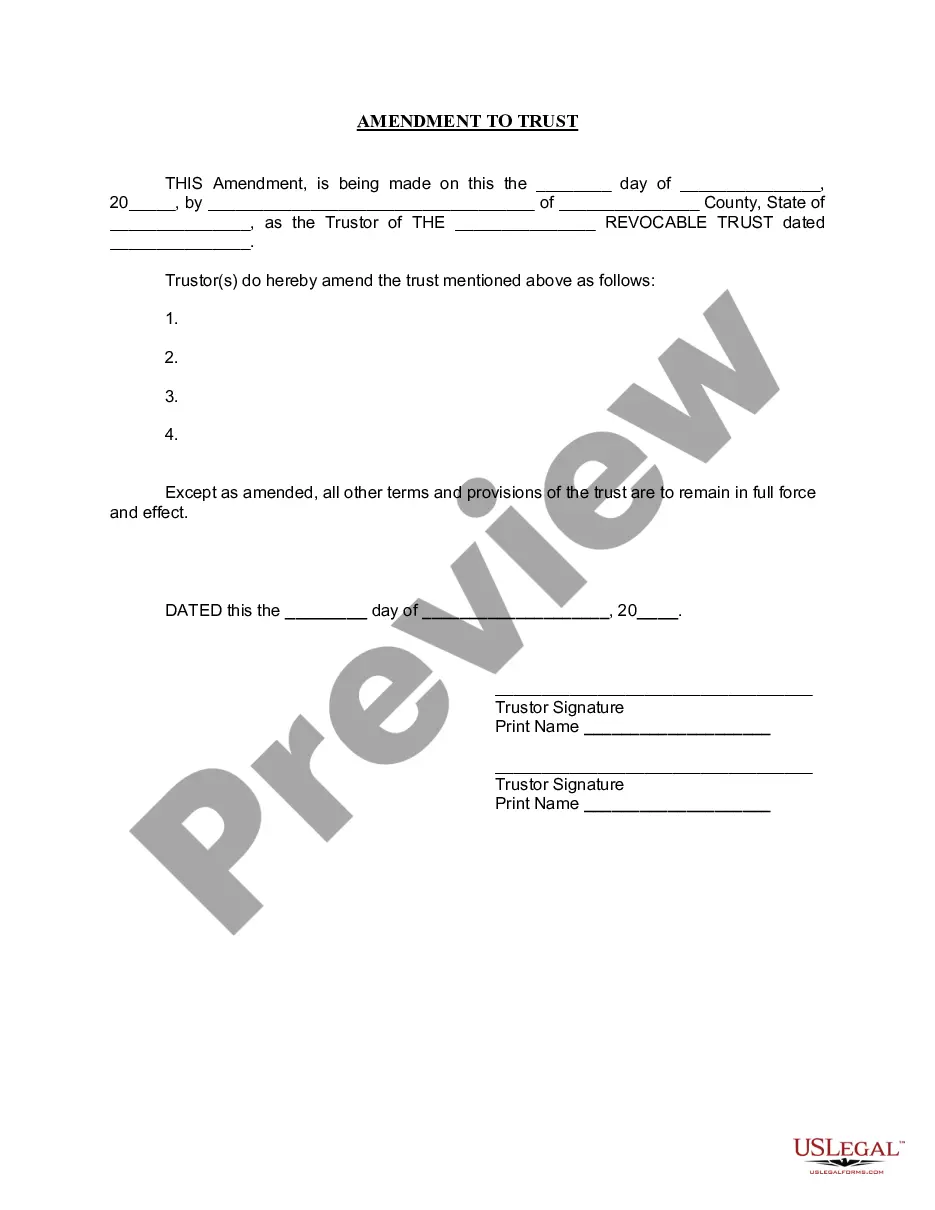

To form a Trust, a Trust Deed is prepared and signed. The Trust Deed specifies who the Settlor, Trustees and Discretionary Beneficiaries are. The Trust Deed also provides the Trustees with a full range of administrative powers. This allows the Trustees to undertake virtually any action an individual could do.

How do I transfer my property into a trust in Georgia? Step 1: Create a Trust Document. The first step in transferring your property into a trust is to create a trust document. Step 2: Transfer the Assets. Step 3: Notify Creditors and Beneficiaries. Step 4: File the Trust with the Court.

Selecting an individual trustee Choosing a friend or family member to administer your trust has one definite benefit: That person is likely to have immediate appreciation of your financial philosophies and wishes. They'll know you and your beneficiaries.

Yes, you are legally allowed to set up your own living trust in Georgia. For this reason, it is a good idea to hire an attorney or use an online legal service, such as , that comes with attorney assistance.

Mortgages are used, but they are rare. A security deed (deed to secure debt) is the customary security instrument in Georgia. Georgia does not use a Deed of Trust.