Change Deed Trust With Irs In Cuyahoga

Description

Form popularity

FAQ

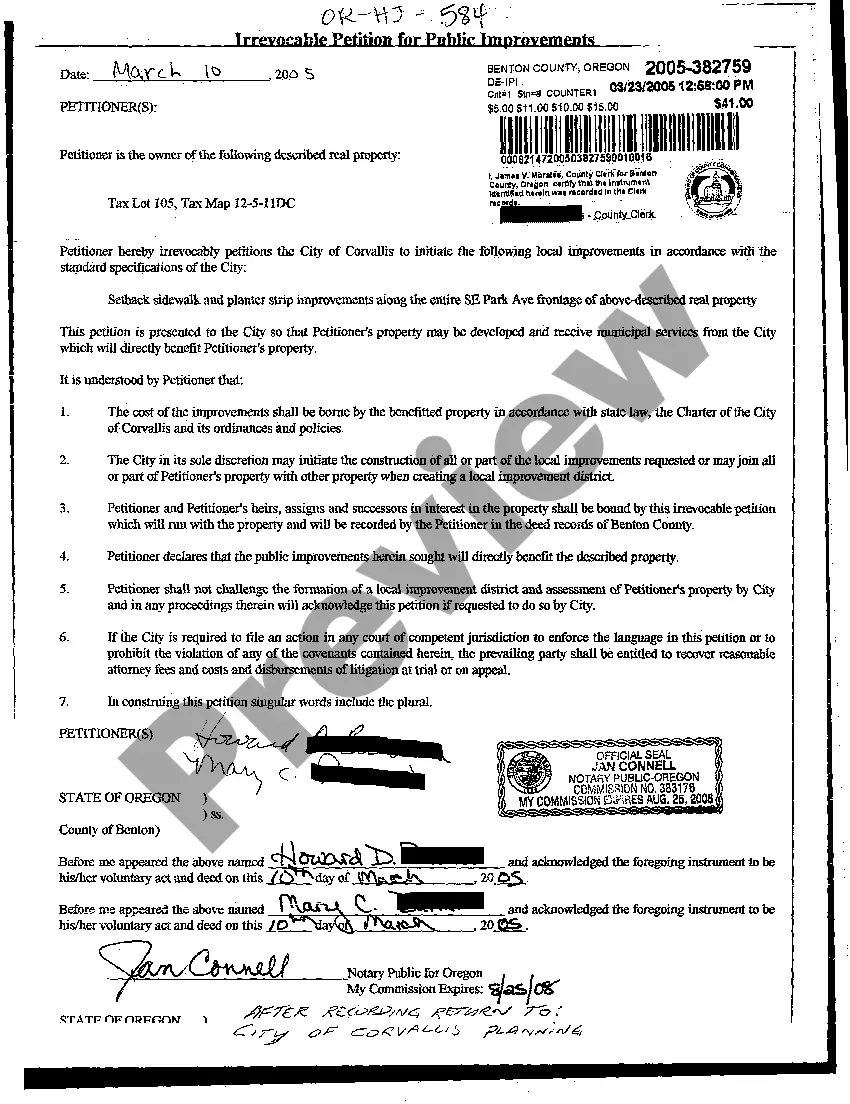

To change a name on a Deed: Execute a new deed. Present it to the Auditor's Deed Transfer Department for either a "Transfer" or "No Transfer" stamp. Present the deed to the Recorder's Office for recordation.

When the transferee presents the deed or instrument of conveyance to the county recorder of the county in which the property is situated, the recorder shall file the deed or instrument of conveyance, and, if the recorder finds that the transferor is entitled to make the transfer under this chapter and Chapter 5310.

It usually takes four to six weeks to complete the legal processes involved in the transfer of title.

Deeds and additional ownership documentation (circa 1810 to present) is available online or in person at the Recorder's Office, located on the 4th floor of the Cuyahoga County Administration Building.

You may use Form 56 to: Provide notification to the IRS of the creation or termination of a fiduciary relationship under section 6903.

All beneficiaries must sign a written consent form to transfer assets from a trust that does not allow modifications. You will need to create the new trust first, then request the court to allow the asset transfer and the termination of the old trust.

Who Must File. A fiduciary (see Definitions below) who seeks to act on behalf of a taxpayer before the IRS, or to inform the IRS that the fiduciary capacity has terminated, must file Form 56 to notify the IRS of the creation or termination of a fiduciary relationship under section 6903.