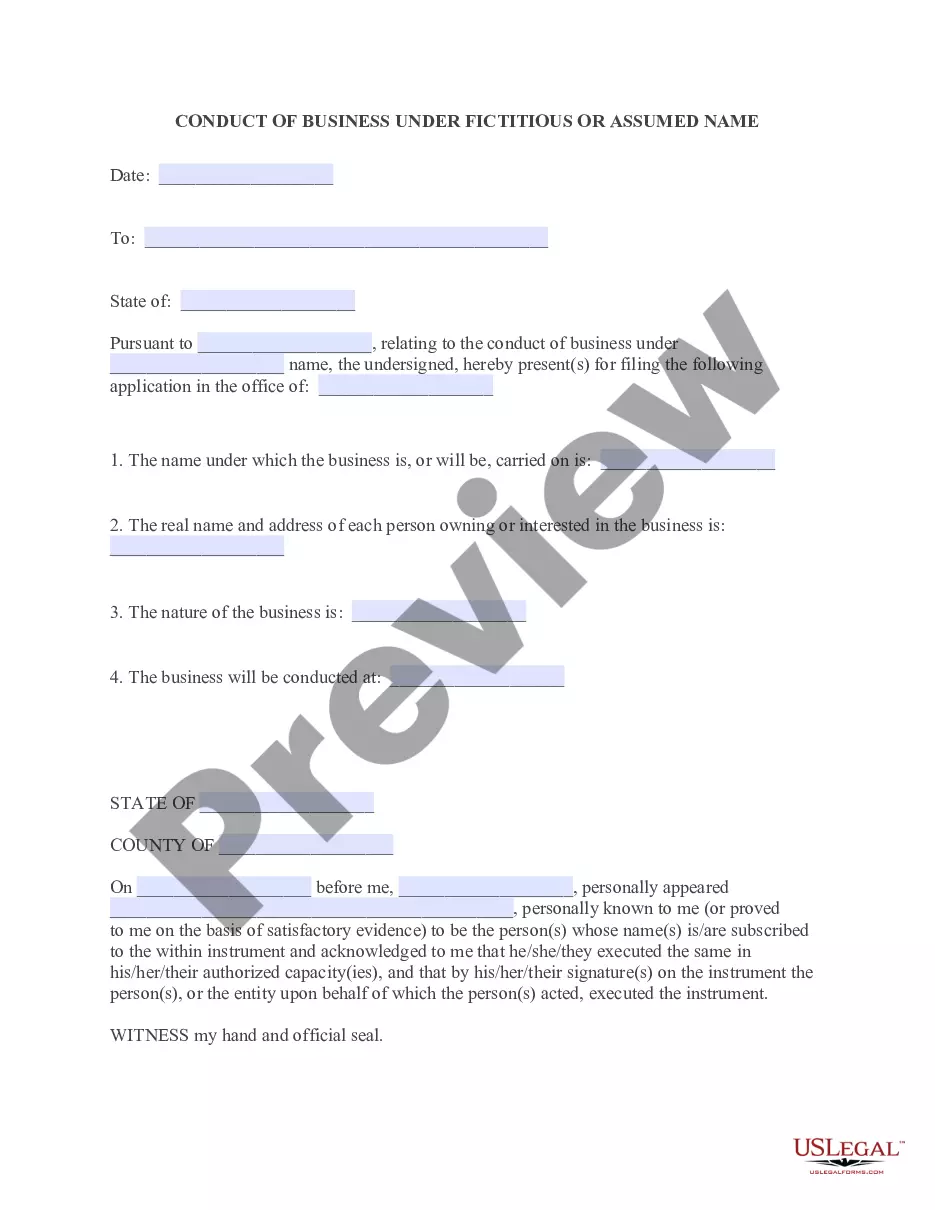

This form is a deed of trust modification. It is to be entered into by a borrower, co-grantor, and the lender. The agreement modifies the mortgage or deed of trust to secure a debt described within the agreement. Other provisions include: renewal and extension of the lien, co-grantor liability, and note payment terms.

Deed Of Trust Vs Deed Of Gift In Collin

Description

Form popularity

FAQ

Placing your house into a trust has many potential benefits. If you are thinking of planning for long term care or simply want to avoid the process of probate, you should consider a trust to hold title to your property.

Parents and other family members who want to pass on assets during their lifetimes may be tempted to gift the assets. Although setting up an irrevocable trust lacks the simplicity of giving a gift, it may be a better way to preserve assets for the future.

The probate process in California is time-consuming and expensive. Probate is required even if there is a Will. Unlike a Will, a Revocable Trust avoids probate. Lifetime gifts do as well.

Generally trusts are used as they allow the settlor a degree of control over how the property is to be used whereas gifts are used when no control over the asset is required. There is also different tax treatment of each type of deed.

Disadvantages of Putting Your House in a Trust Loss of Direct Ownership. Potential Complexity and Administrative Burden. Potential for Increased Costs. No Asset Protection Benefits. Limited Tax Advantages. No Protection Against Creditors.

Disadvantages of a Trust Deed For borrowers, if financial circumstances change, default on repayment can result in property foreclosure.

To prepare a gift deed, you need to include the legal description of the property, the names of the donor and recipient, a clear statement indicating the gift's nature and have it notarized before filing it with the county clerk's office.

Trusts provide much more flexibility, control, and protection for both you and your beneficiaries. They allow you to avoid probate, protect your assets and better ensure your wishes are carried out exactly as you intend.