Deed Of Trust Records With Assignment Of Rents In Collin

Description

Form popularity

FAQ

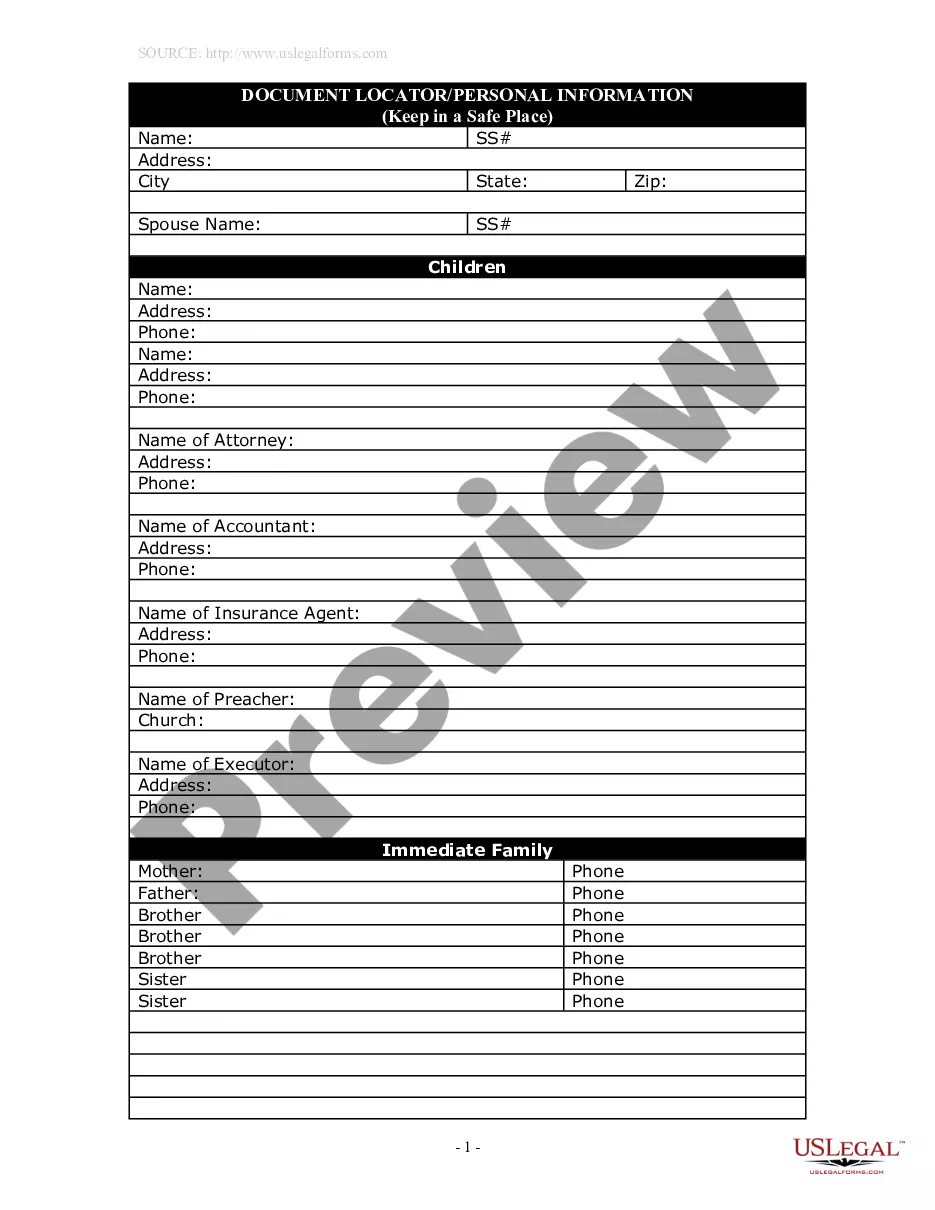

Land Records and more: Contact the County Clerk for deeds, foreclosures, liens, public notices, marriage licenses, birth certificates and other vital records, beer & wine applications, cattle brands, and business registrations (DBA's/Assumed Names).

Property ownership information can be requested from the County Registrar-Recorder/County Clerk.

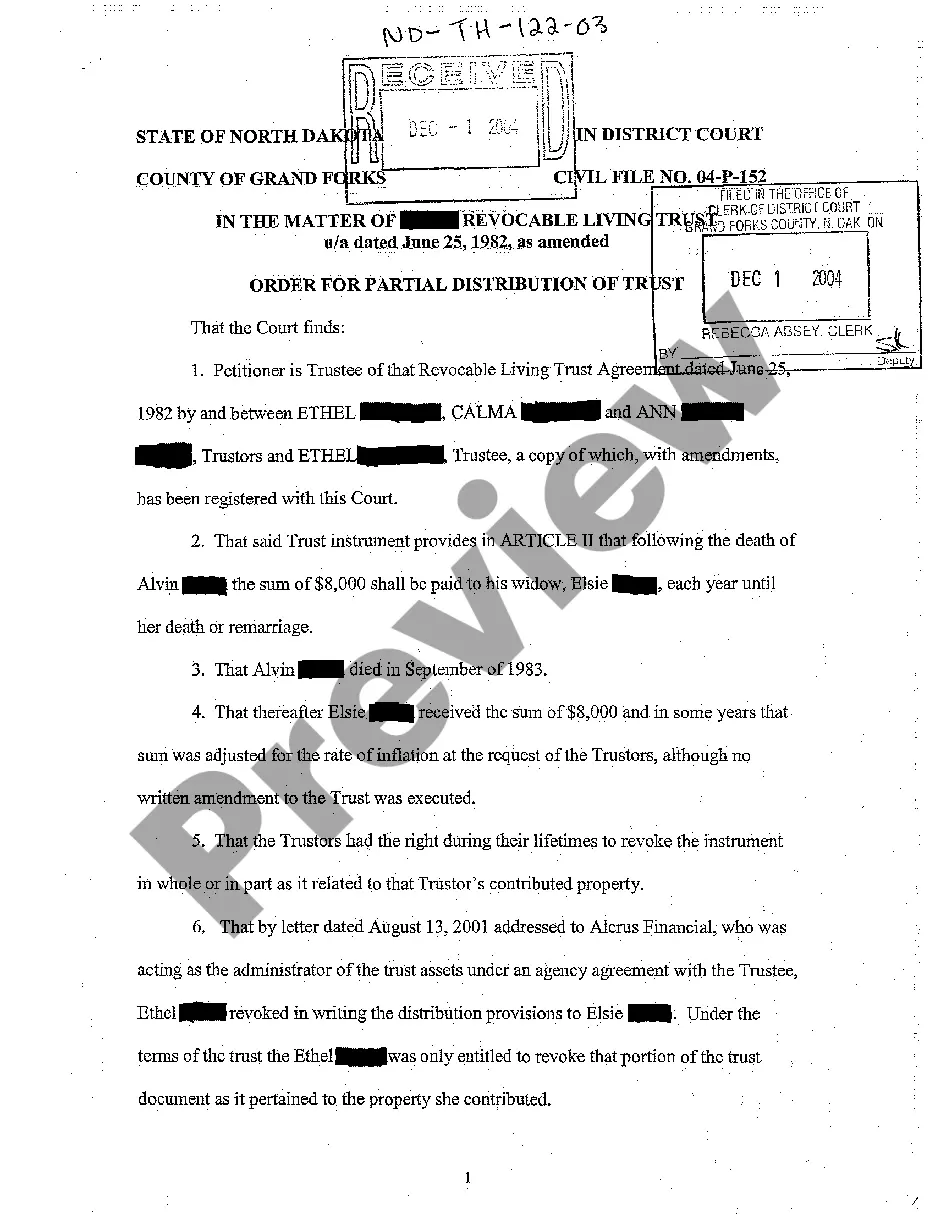

ASSIGNMENT OF RENTS - Trustor hereby assigns and transfers to Beneficiary all right, title and interest in rents generated by the property, including rents now due, past due, or to become due under any use of the property, to be applied to the obligations secured by this Deed of Trust.

TEX. CIVIL PRACTICE & REMEDIES CODE §16.035: Deed of Trust lien becomes barred 4 years after the original or extended maturity date of the secured obligation.

(b) A sale of real property under a power of sale in a mortgage or deed of trust that creates a real property lien must be made not later than four years after the day the cause of action accrues.

Effectively, that meant that any Trust created in Texas could not be valid for more than about 100 years. However, with the passage of a new law in 2021, Trusts can now last up to 300 years after the last beneficiary dies.

Under the Marketable Title Act, “the duration of a debt secured by a deed of trust is limited to 10 years after the final maturity date of the debt, if that date can be ascertained from the recorded evidence of indebtedness (i.e., the mortgage or deed of trust), or, if no maturity date is evident, to 60 years after the ...

Erecording, or electronic document recording, is the process of transmitting real property documents electronically to the local government entity charged with recording and maintaining public records.

The beneficiary is the lender. Therefore, the only answer selection that applies is the bank. A clause in a trust deed calling for an assignment of rents most benefits the: beneficiary.