Trust Deed Format In Hindi In Broward

Description

Form popularity

FAQ

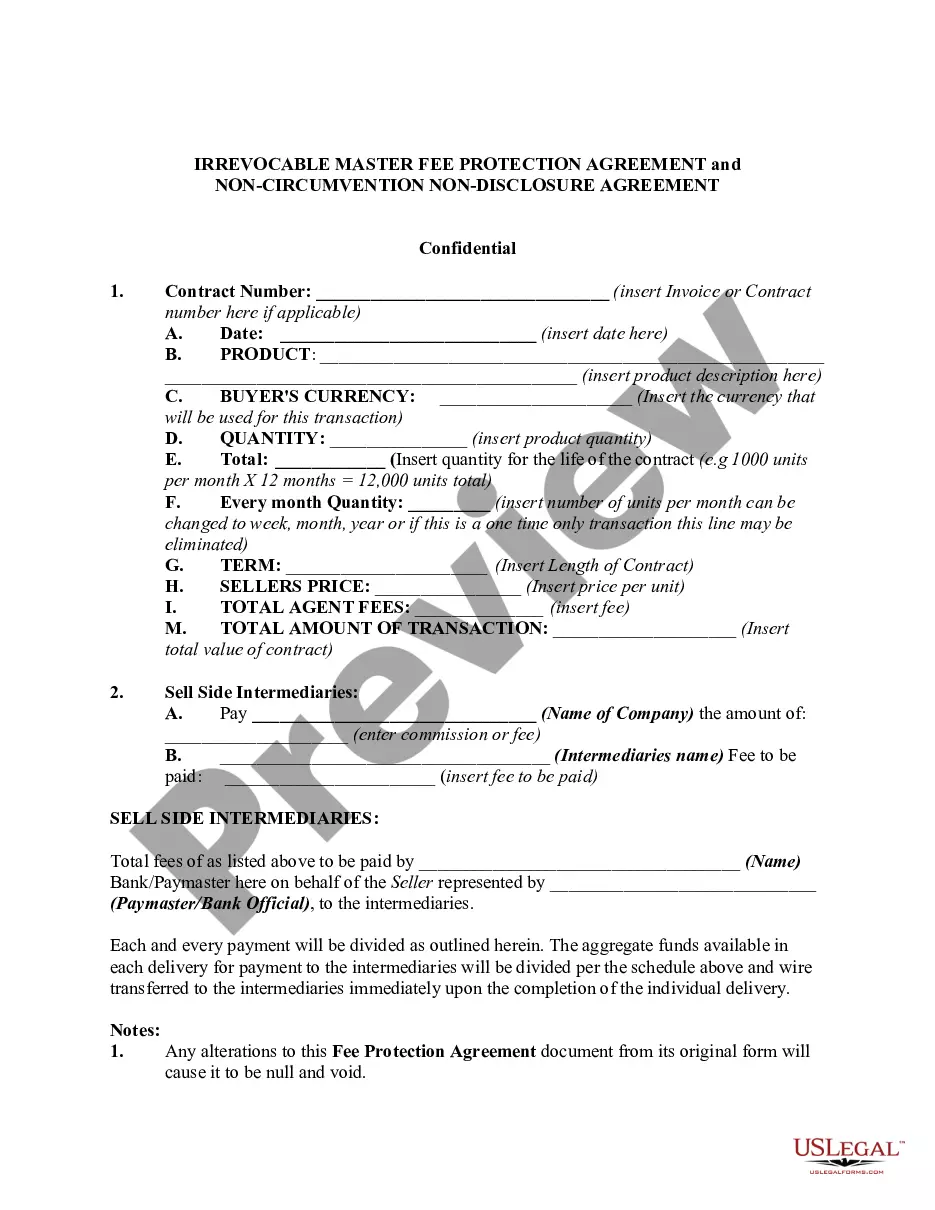

This Deed of Trust (the “Trust Deed”) sets out the terms and conditions upon which: Settlor Name (the “Settlor”), of Settlor Address, settles that property set out in Schedule A (the “Property”) upon Trustee Name (the “Trustee”), being a Company duly registered under the laws of state with registered number ...

How To Create a Trust in Florida Decide on an Individual or Shared Trust. Choose the Property To Include. Designate a Successor Trustee. Choose the Beneficiaries. Draft the Trust Document. Sign the Document in the Presence of a Notary. Change Property Titles ingly.

Yes, you can create your own living trust in Florida by using a pre-made form or online service. Some online services like also offer guidance from an estate planning attorney, which may be best if your estate is complex.

Here's what to do: Create a Valid Trust. Work with an experienced estate planning attorney to establish a trust that's tailored to your needs before transferring the property. Choose The Type of Deed. Prepare & Sign The Deed. Notify Your Mortgage Lender. Record The Deed. Update Trust Records. Inform The Trustee.

How To Create a Trust in Florida Decide on an Individual or Shared Trust. Choose the Property To Include. Designate a Successor Trustee. Choose the Beneficiaries. Draft the Trust Document. Sign the Document in the Presence of a Notary. Change Property Titles ingly.

No. Unlike a Will that does need to be filed with the Clerk of Court within 10 days of death, a trust can allow you to keep personal financial information out of probate. Probate is the legal and very public process many families must go through upon death of a family member.

The Long Form, which could be 20-30 pages long, is the one used by institutional lenders.

How do I fill this out? Gather information about trustees, settlors, and trust creation date. Identify the powers of the trustees and whether the trust is revocable or irrevocable. Fill out each section ingly, following the prompts. Ensure all acting trustees sign the document. Notarize the document if required.

In the U.S., each state has its laws regarding trust certificates. For instance, some states require a notary public to witness the certificate signing. Others may need more specific information in the document. California: Requires a notary public.