Deed Of Trust Modification With Partial Claim In Allegheny

Description

Form popularity

FAQ

A quitclaim deed denotes a legal instrument that eliminates the grantor's (seller's) interest in a piece of property, transferring it to the grantee (receiver or buyer). It allows the grantor to “quit” any claim to the property, effectively passing over their rights and interest to the grantee.

Deed of Trust Modification means, with respect to any Deed of Trust, a modification agreement entered into between the Borrower or the Project Owner, as applicable, and the Lender, modifying the terms and conditions of the Deed of Trust in order to (i) add to the lien of the Deed of Trust Additional Lots, or (ii) make ...

Partial denial of coverage occurs when an insurance company agrees to cover a portion of a claim but denies coverage for another part. This can happen for various reasons, such as certain aspects of the claim not meeting policy terms or specific exclusions being applied.

During the trial period your credit score may be negatively impacted, particularly if your payments are not current. However, “Paying under a Partial or Modified Agreement” may be less negative than an ongoing series of late payments or foreclosure.

The problem with HUD partial claims is that they almost always end up being far larger than expected by the homeowner, and usually this additional debt lands the homeowner in a position where they owe more than their home is worth.

A partial claim mortgage might sound like a complicated term, but it could be a lifeline for many homeowners struggling with monthly mortgage payments. This type of mortgage modification allows homeowners affected by financial hardships—such as those caused by COVID-19—to get back on track without losing their homes.

There are several scenarios where a quitclaim deed can be a convenient option: Marriage: allows you to easily add your spouse to your title. Divorce: if you get divorced and need the title transferred to you or your ex-spouse. Wills: If someone passes and they've granted the title to a friend or relative.

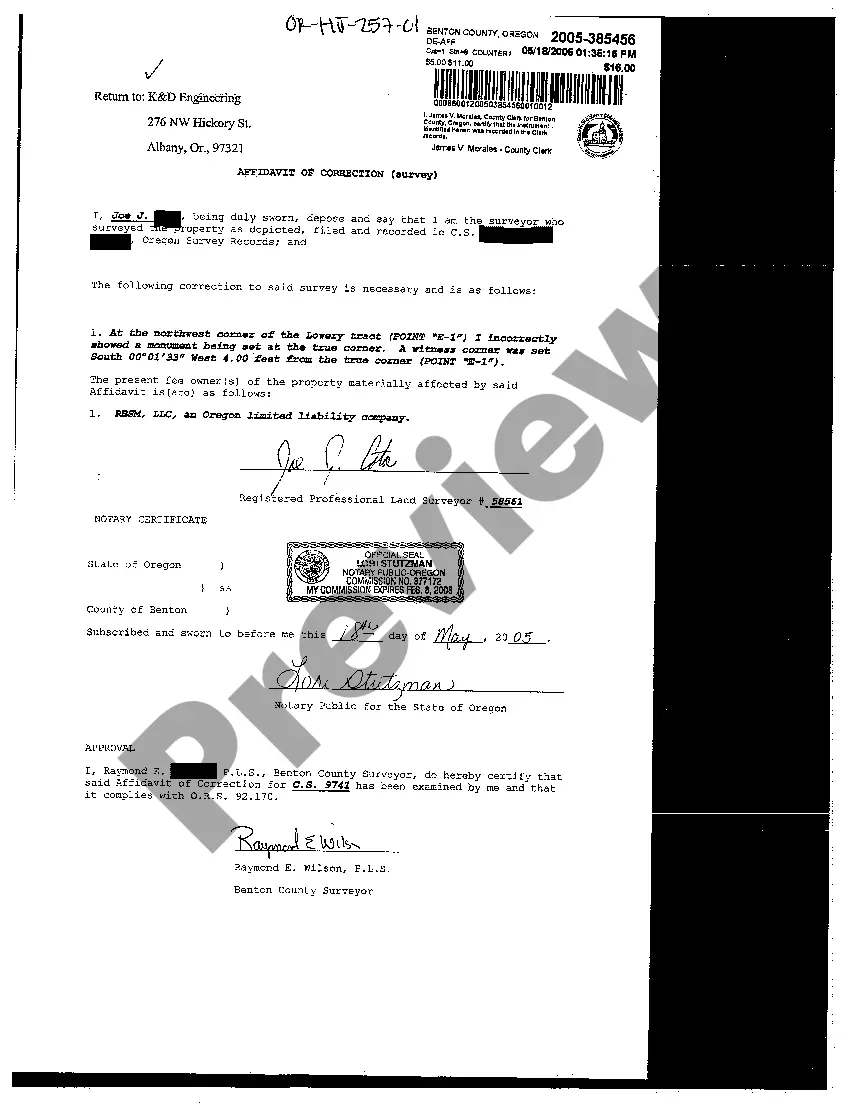

A deed made without consideration for the sole purpose of correcting an error in the description of the parties or of the premises conveyed is not taxable.

While irrevocable trusts focus on asset protection and control, quit claim deeds primarily deal with quick ownership transfers.