Trust Deed Format In Hindi In Alameda

Description

Form popularity

FAQ

You may not need to involve an attorney to create a particular deed if you already have all the information. This is especially true if you are transferring property between family members or into or out of a trust. We provide several real estate forms that can help you transfer property validly in your state.

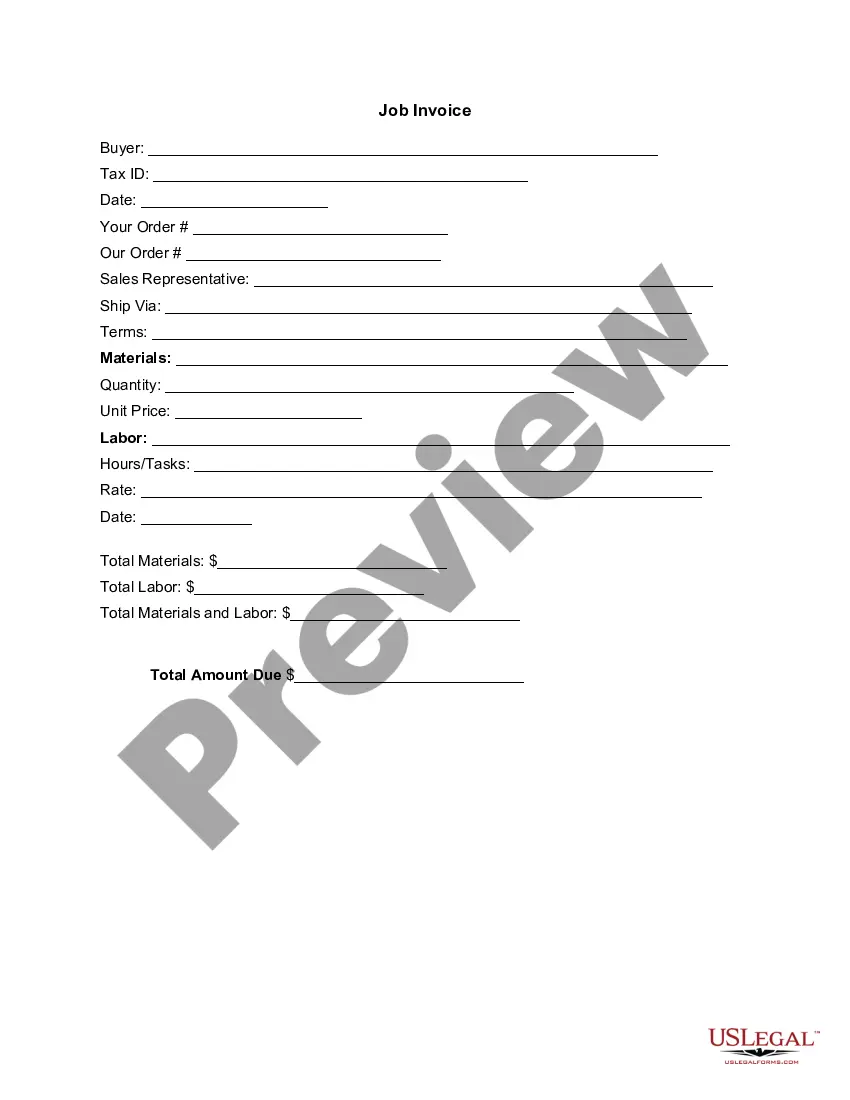

The grantor must sign the deed form and that signature must be properly acknowledged by a notary public. All signatures must be original; we cannot accept photocopies. A complete description of the property including the village, town, county and state where the property is located must also be included on the form.

In California, a deed of trust must come with security, typically a promissory note. To be valid, a deed of trust must be (1) in writing, (2) with a description of the property, and (3) signed by the trustor of the deed of trust.

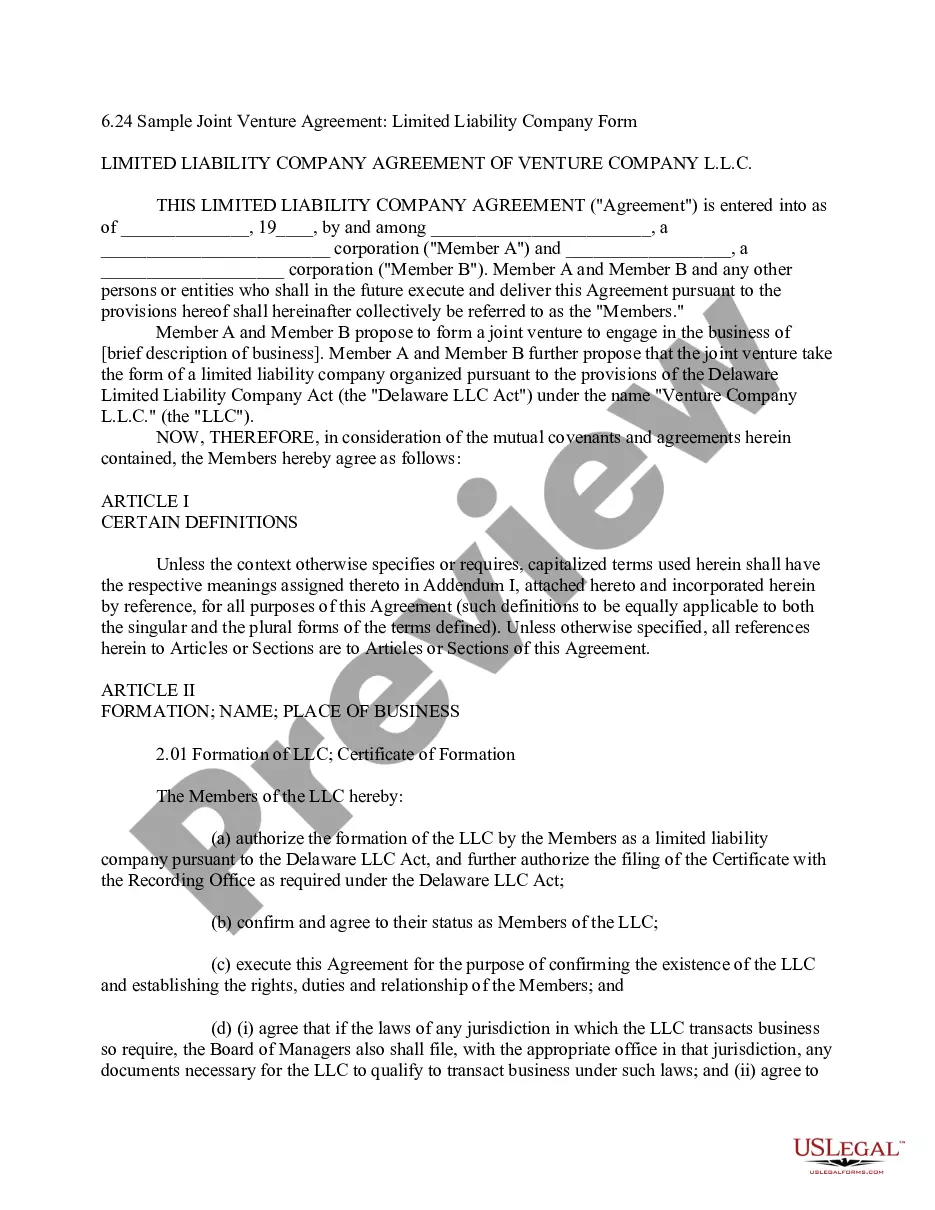

This Deed of Trust (the “Trust Deed”) sets out the terms and conditions upon which: Settlor Name (the “Settlor”), of Settlor Address, settles that property set out in Schedule A (the “Property”) upon Trustee Name (the “Trustee”), being a Company duly registered under the laws of state with registered number ...

For a deed to be legal, it must state the name of the buyer and the seller, describe the property being transferred, and include the signature of the party transferring the property. In addition to being either official or private, deeds are classified as general warranty, special warranty, or quitclaim.

What is an example of deed? A warranty deed is the most common example of a deed. A warranty deed is a deed that indicates that the property has been fully researched, and the grantor guarantees (warrants) that the grantor has full legal rights to sell the property with no liens or other encumbrances.

For a deed to be legal, it must state the name of the buyer and the seller, describe the property being transferred, and include the signature of the party transferring the property. In addition to being either official or private, deeds are classified as general warranty, special warranty, or quitclaim.

Here is the rough outline: Select the trust that is best suited to your needs, such as a revocable living trust. Draft a trust deed and have it notarized so that it is legally binding. Record the deed at the county recorder's office. Notify the relevant parties, such as your mortgage lender and insurance provider.

Disadvantages of a Trust Deed For borrowers, if financial circumstances change, default on repayment can result in property foreclosure.

The deed of trust must then be recorded with the county where the property is located, and each of the parties (the trustor, trustee, and lender) should keep a copy of the recorded document.