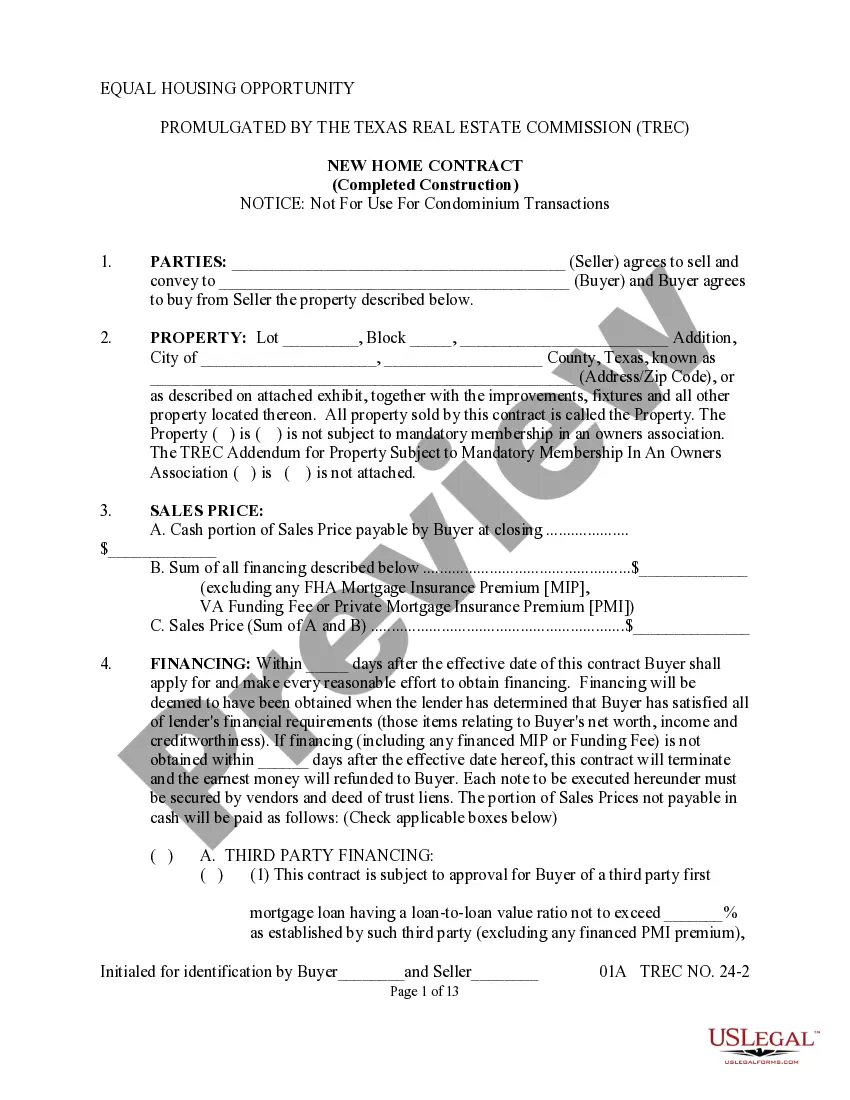

Debtor is obligated to pay the secured party attorneys fees. In consideration of the indebtedness, debtor conveys and warrants to trustee certain property described in the land deed of trust.

Secured Debt Shall For Bad Credit In San Diego

Description

Form popularity

FAQ

Highlights: Most negative information generally stays on credit reports for 7 years.

Secured debts are written off very differently than unsecured debts. The reason for this is because they have collateral against them. If you stop paying them, as per the original terms the creditor will have the right to seize the asset.

The Limitation Act says that the limitation period for mortgage shortfalls is twelve years for capital owed, and six years for the interest part of the shortfall. The cause of action (when the limitation period starts running) for mortgage shortfalls, is usually when the lender is entitled to be repaid in full.

What Are the Current Chapter 13 Debt Limits? The debt limitations set for cases filed between April 1, 2022, and March 31, 2025, are $1,395,875 of secured debt, and $465,275 of unsecured debt.

You cannot legally go to jail over debt. This is referred to as a ``debtor's prison'' and is not a legally acceptable practice.

If you file for a Chapter 7 bankruptcy, your secured debt may be discharged, but the lender is also able to repossess the property that secured the debt. In other words, if you have a mortgage on your home and file a Chapter 7 bankruptcy, the mortgage debt may be discharged but the lender can take back your home.

For example, in December 2021, Congress raised the debt ceiling from $28.9 trillion to $31.4 trillion, allowing borrowing to proceed until the total government borrowing reached this new limit (which finally happened on January 19, 2023).

Chapter 13 Eligibility Any individual, even if self-employed or operating an unincorporated business, is eligible for chapter 13 relief as long as the individual's combined total secured and unsecured debts are less than $2,750,000 as of the date of filing for bankruptcy relief. 11 U.S.C. § 109(e).