Blank Deed Of Trust Withdrawal In Phoenix

Description

Form popularity

FAQ

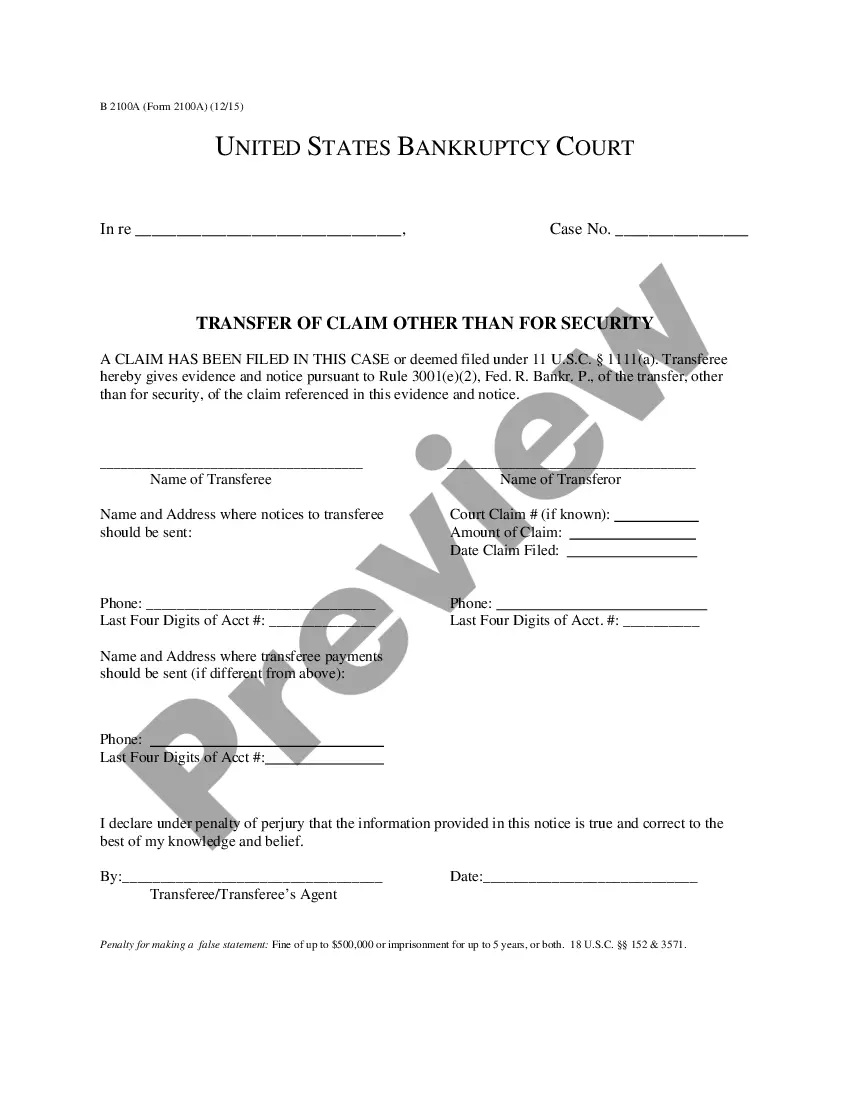

Requirements for Release of Deed of Trust Accurate Information: The release must include precise details of the original deed of trust, including recording information and property description. Authorized Signatures: The lender or an authorized representative must sign the release, and it often requires notarization.

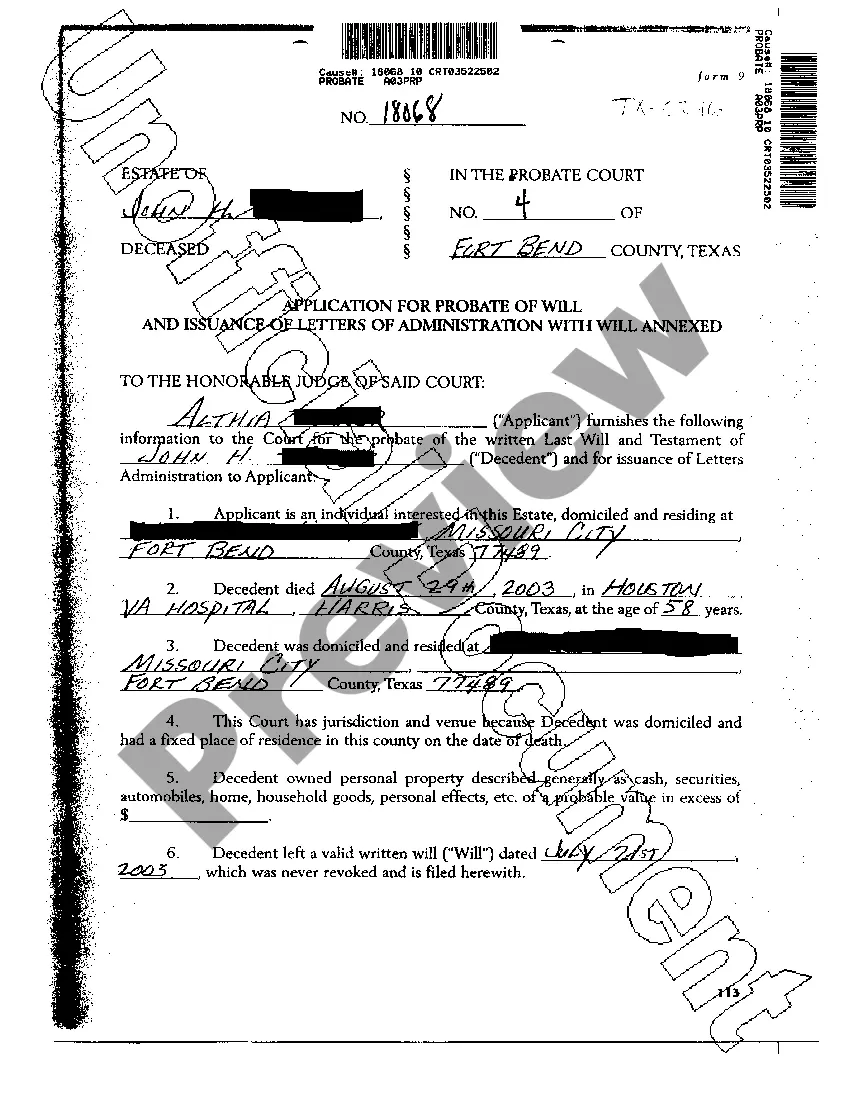

The quitclaim deed must identify both the grantor and the grantee or the person or entity receiving the interest in the real estate by name. Finally, one of the parties must record the quitclaim deed at the local county recorder's office so that it becomes an official document.

One of the main drawbacks of using a quitclaim deed is that you have little to no legal recourse if the grantor didn't actually have a legal interest in the property to give away. This is the risk you take with a quitclaim deed that doesn't offer any warranties.

Maricopa County Recorder's Office has two full service offices to record your quitclaim deed. The main office is located in downtown Phoenix. The Southeast office is in Mesa, Arizona. Maricopa County Recorder's Offices are responsible for recording and maintaining permanent public records.

This instrument can only be used in the state of Arizona. While most quitclaim deeds are the same, each state and their counties have their own laws and procedures. After executing the quitclaim deed, you should record the document in the county where the property is located.

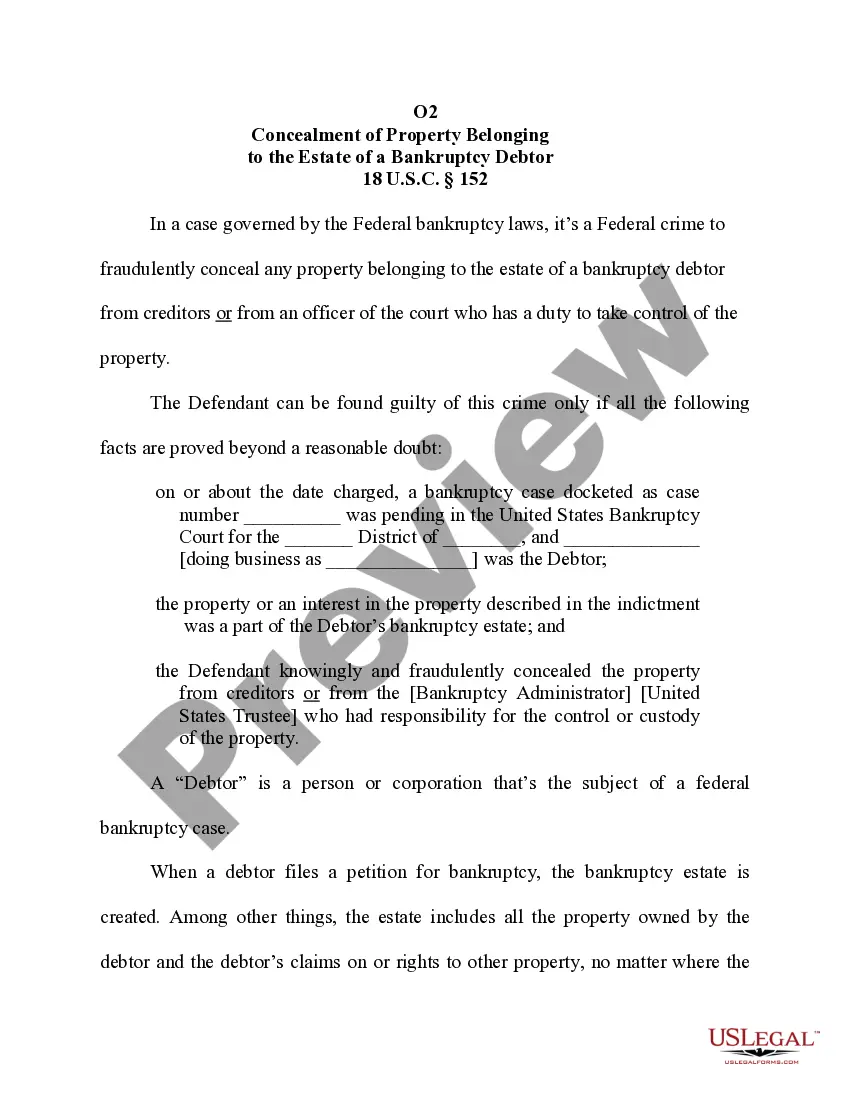

Requirements for Release of Deed of Trust Accurate Information: The release must include precise details of the original deed of trust, including recording information and property description. Authorized Signatures: The lender or an authorized representative must sign the release, and it often requires notarization.

You can fill that out, have your signature notarized, and take it to the Register of Deeds in the county where the property is located to have it recorded. But a much safer alternative would be to consult with an attorney to properly draft the quit claim deed.

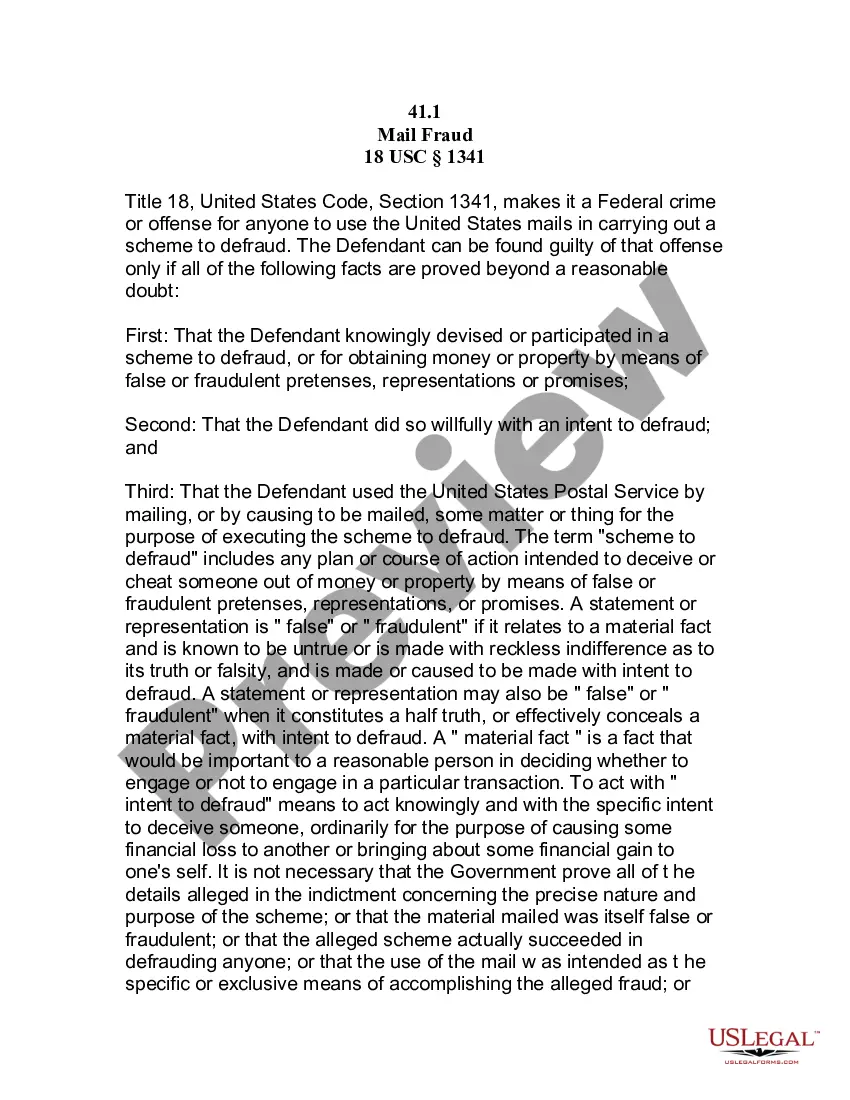

Through a deed of release of mortgage, also called a release of deed of trust, the lender agrees to remove the deed of trust, which is the document containing all of the mortgage's terms and conditions that is filed at the beginning of the mortgage process.

Once you've decided that you want to revoke a trust, you must take the following steps to dissolve it: Review the Trust Agreement. You will want to make sure that you are aware of any specific requirements contained in the trust. Consult an Estate Planning Attorney. Defund the Trust. Complete a Written Revocation.