Secure Debt Shall Withdraw In Los Angeles

Description

Form popularity

FAQ

In many cases, a bankruptcy discharge can eliminate your personal responsibility for secured debt, so the lender can't sue you for unpaid amounts. However, the lien on the property doesn't automatically go away. The lender can still take back the collateral if you stop making payments.

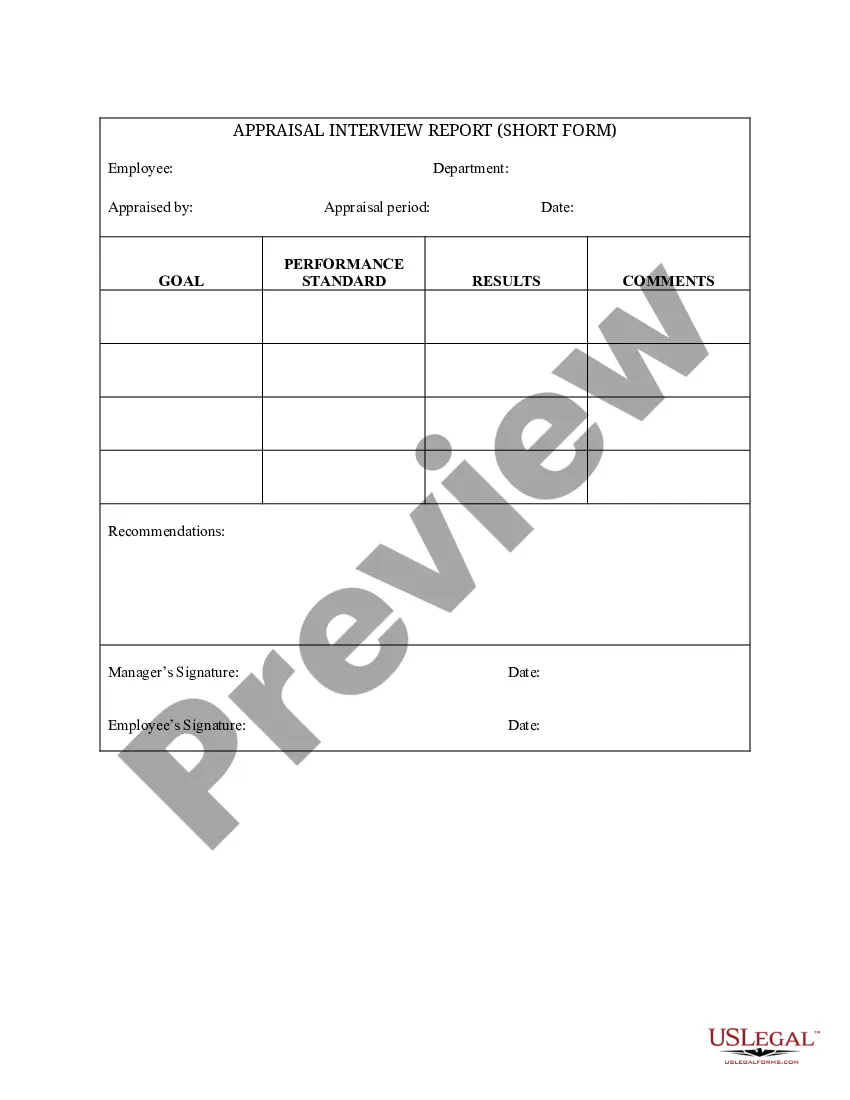

Here are strategies and tips for getting out of debt faster. Add Up All Your Debt. Adjust Your Budget. Use a Debt Repayment Strategy. Look for Additional Income. Consider Credit Counseling. Consider Consolidating Your Debt. Don't Forget About Debt in Collections. Stay Accountable.

More on our best debt relief companies AvailabilityLower monthly payments by Americor 49 states 40% or more National Debt Relief 47 states Up to 50% less than your monthly credit card payments. Freedom Debt Relief 42 states Up to 30% New Era Debt Solutions 47 states 50% or more3 more rows

When it comes to credit card debt relief, it's important to dispel a common misconception: There are no government-sponsored programs specifically designed to eliminate credit card debt. So, you should be wary of any offers claiming to represent such government initiatives, as they may be misleading or fraudulent.

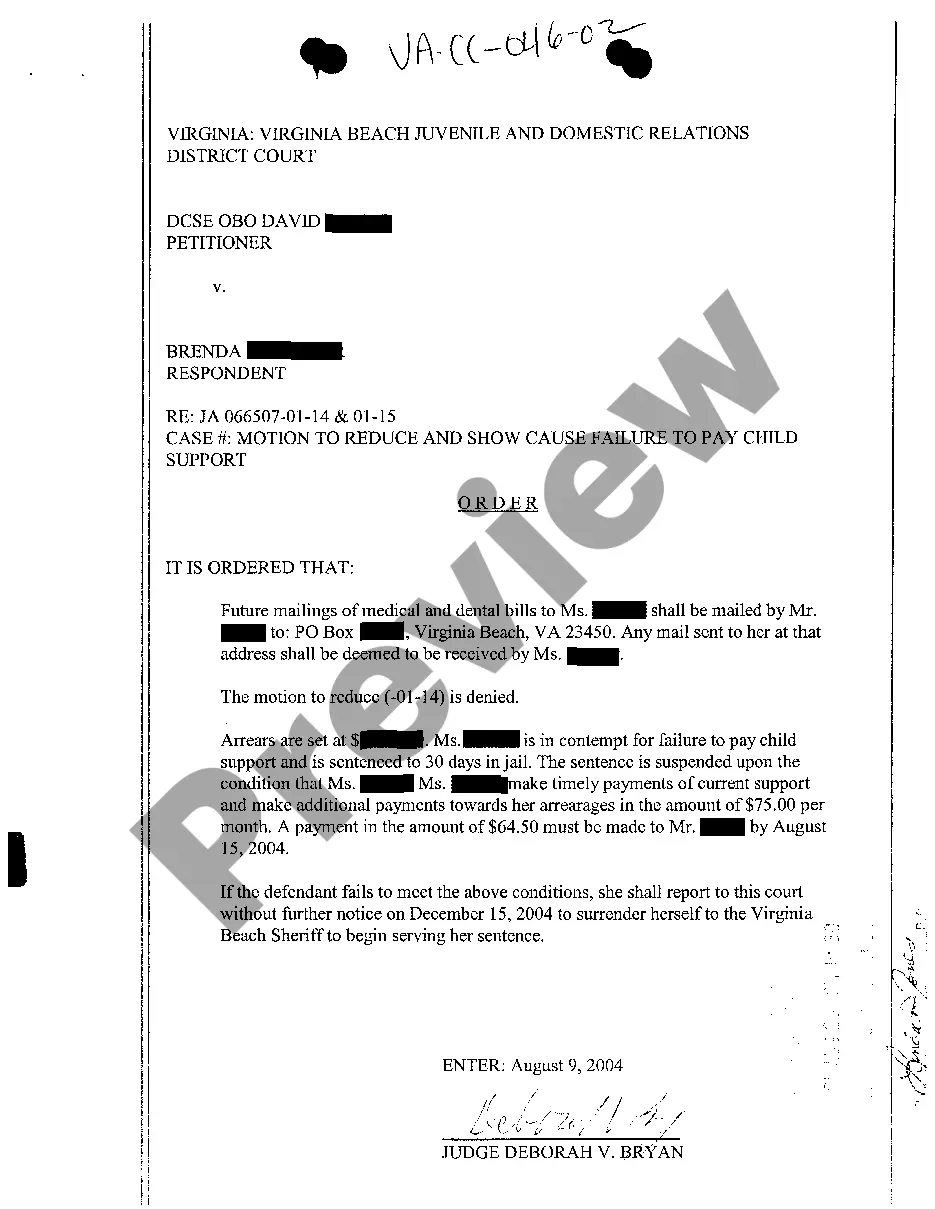

The bank provide you with a Notice of Levy (EJ-150) to let you know. The bank or sheriff will hold the seized funds for up to 20 days, allowing you the opportunity to seek to stop or reduce the levy by filing a Claim of Exemption (EJ-160).

Start a case Form NameForm NumberGuide Plaintiff's Claim and Order to Go to Small Claims Court SC-100 Fill out forms to start a small claims case Other Plaintiffs or Defendants (Attachment to Plaintiff's Claim and ORDER to Go to Small Claims Court) SC-100A Fictitious Business Name (Small Claims) SC-103 3 more rows

How long do bank levies last? Usually, bank levies last as long as it takes for the debt to be satisfied. However, your state may place a statute of limitations on how long a creditor can attempt to collect a debt.

There are no federal limits to the amount that can be taken in account garnishment. Your state may have laws that are more protective. Some sources of income are considered protected in account garnishment, including: Social Security, and other government benefits or payments.

Ask the judge to set aside (cancel) the judgment It means you could file an answer and present a defense to your case. Setting aside the default requires filing a motion. This is complicated and most people need assistance from a legal expert to do it correctly.

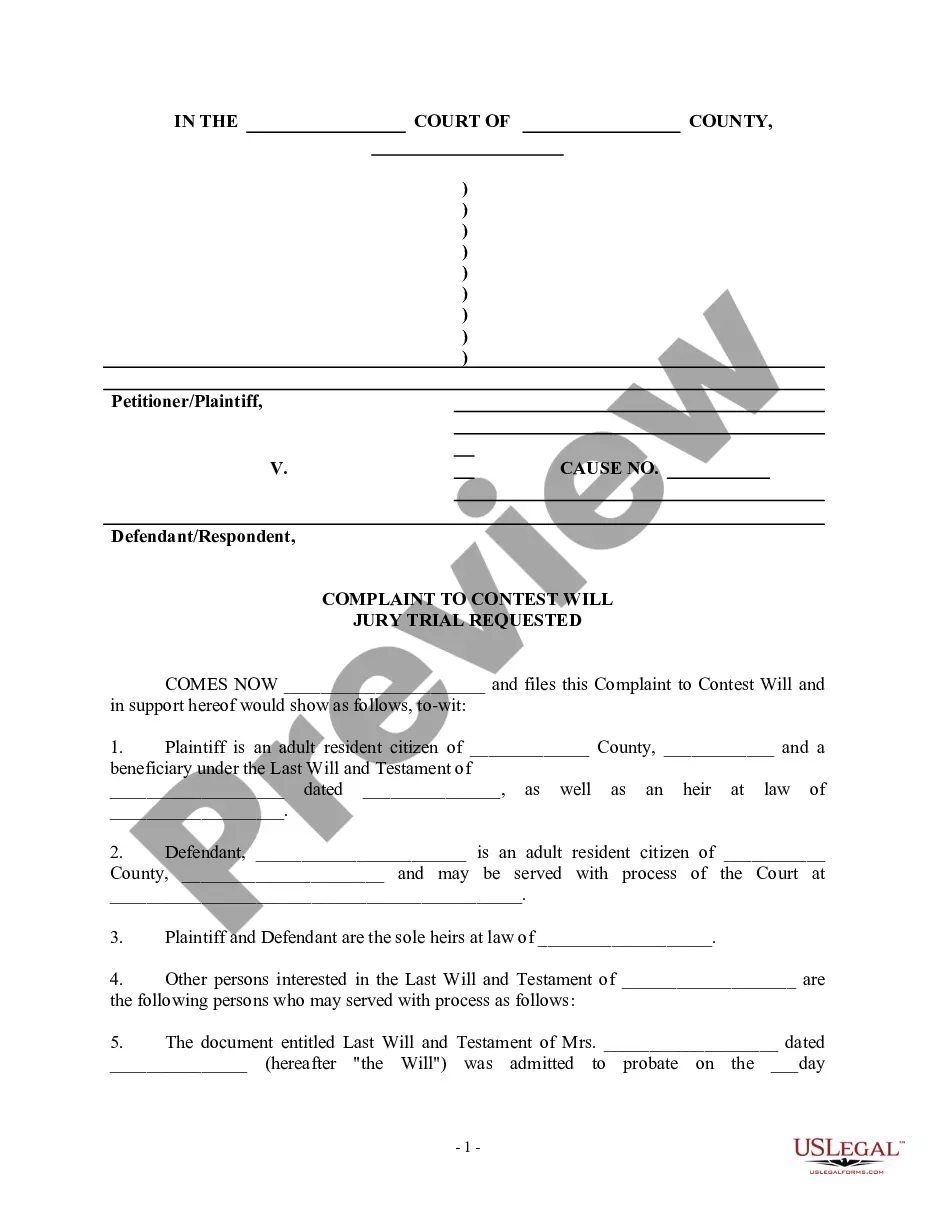

The creditor or its attorney will serve you with a court summons and a copy of the Petition after filing the Petition with the court. The summons lets you know that the creditor has initiated the legal process. Often, the summons will come from a third-party debt collector instead of the original creditor.