Secure Debt Shall Forget The Day In Fairfax

State:

Multi-State

County:

Fairfax

Control #:

US-00181

Format:

Word;

Rich Text

Instant download

Description

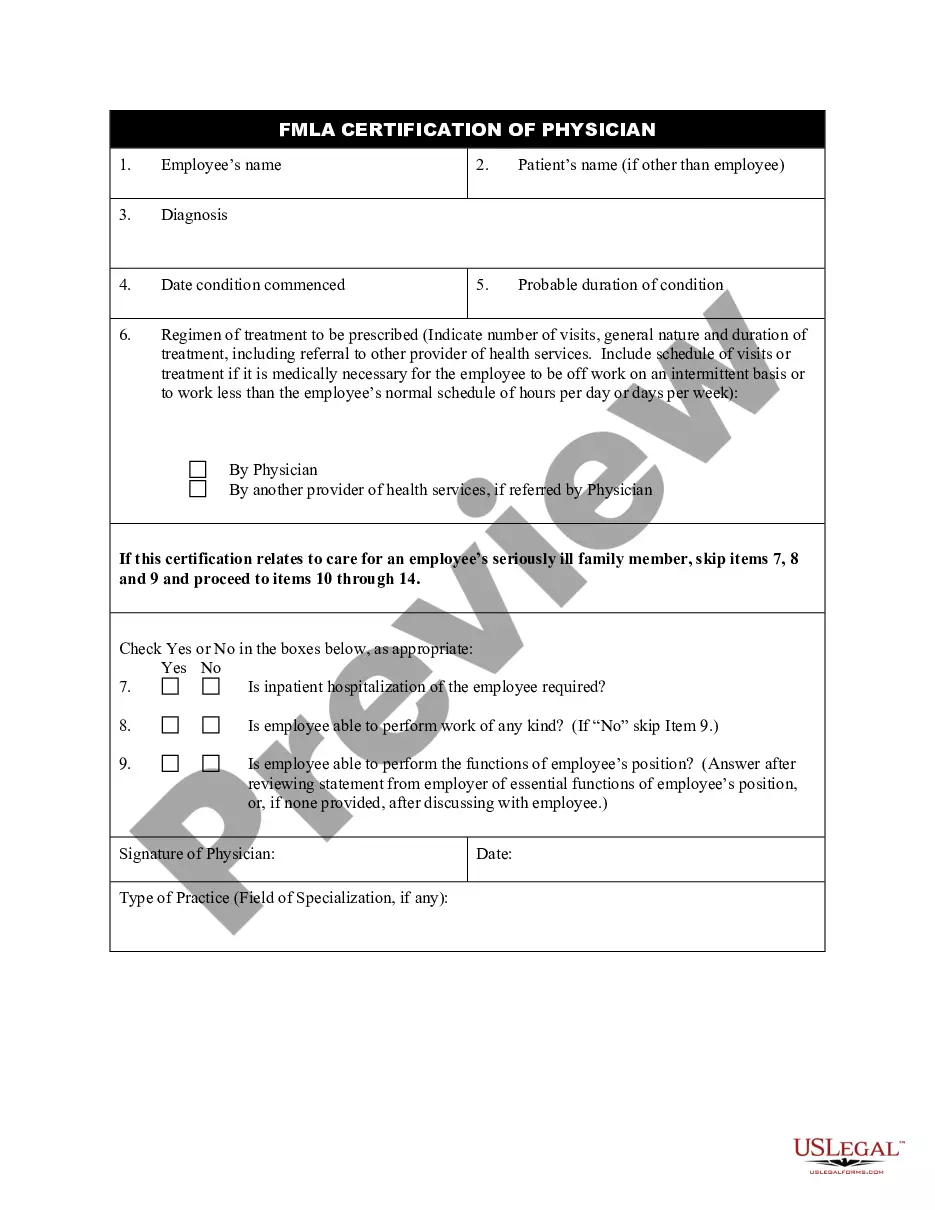

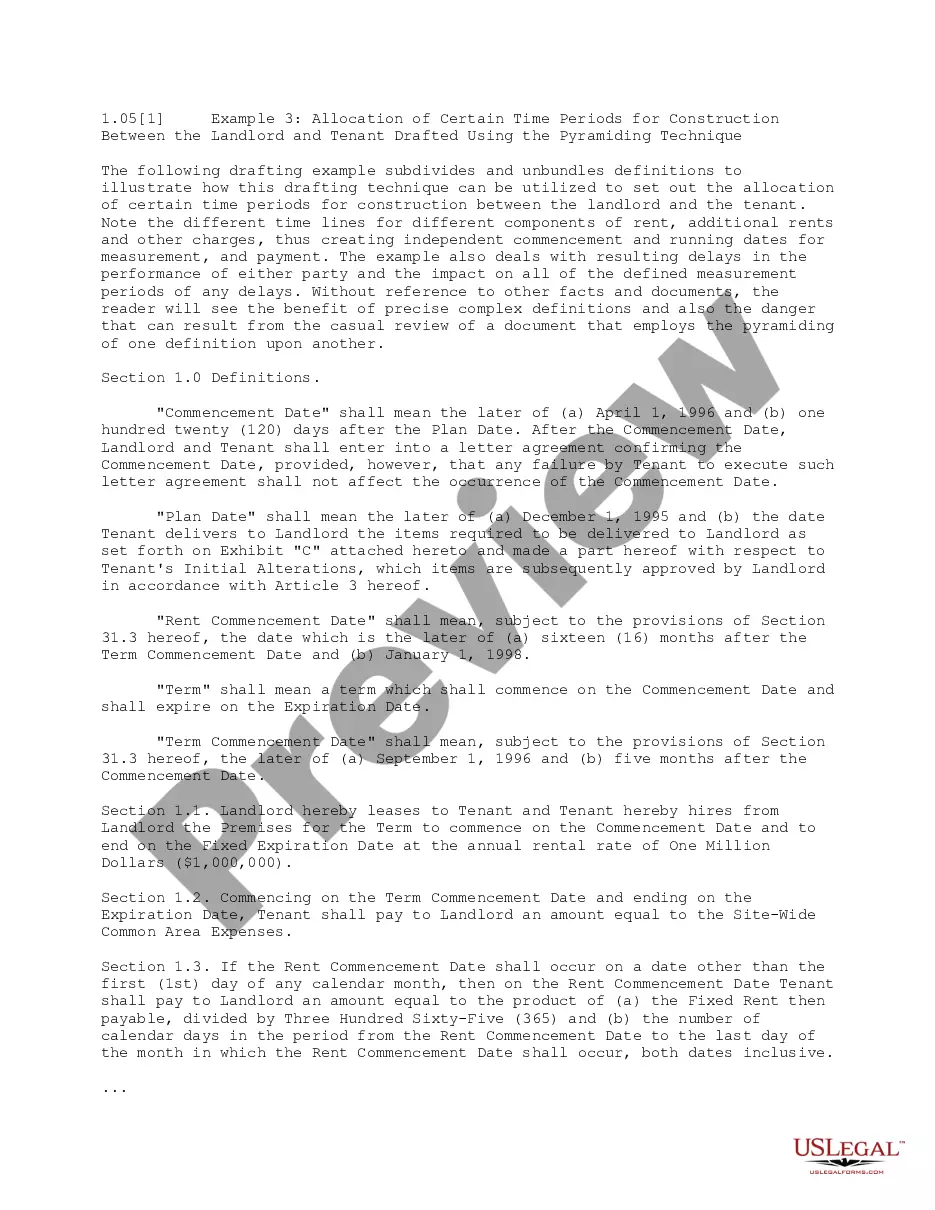

The Secure Debt Shall Forget the Day in Fairfax form serves as a legal instrument for establishing a deed of trust between a debtor and a secured party. It outlines the terms under which the debtor conveys property to a trustee as collateral for a loan, ensuring the secured party's rights are protected in case of default. Key features include provisions for the debtor's obligations regarding insurance, taxes, and maintenance of the property, as well as the rights of the secured party to recover debts through property sale if necessary. Filling instructions necessitate careful completion of debtor, trustee, and beneficiary details, as well as specifying the amount and terms of the indebtedness. This form is ideal for attorneys, owners, and paralegals involved in real estate transactions, as it provides a clear structure for securing loans through property. Legal assistants will find this form useful for assisting clients in understanding their obligations and rights in collateral agreements. The unambiguous language and step-by-step obligations clarify the parties' expectations and streamline the loan process.

Free preview

Form popularity

FAQ

There is a penalty for late filing of vehicle and business tangible property tax returns. This penalty is 10% or $10, whichever is greater and not to exceed the amount of tax due, and will be applied automatically.

You would owe a penalty for late filing if your return shows a balance due and the return was filed after the extension period ends; you must compute a late filing penalty of 30% of the tax due with your return.

Vehicles and Business Tangible Property Taxes There is a penalty for late filing of vehicle and business tangible property tax returns. This penalty is 10% or $10, whichever is greater and not to exceed the amount of tax due, and will be applied automatically.