Sample Money Order Form With Payment In Oakland

Category:

State:

Multi-State

County:

Oakland

Control #:

US-0016LTR

Format:

Word;

Rich Text

Instant download

Description

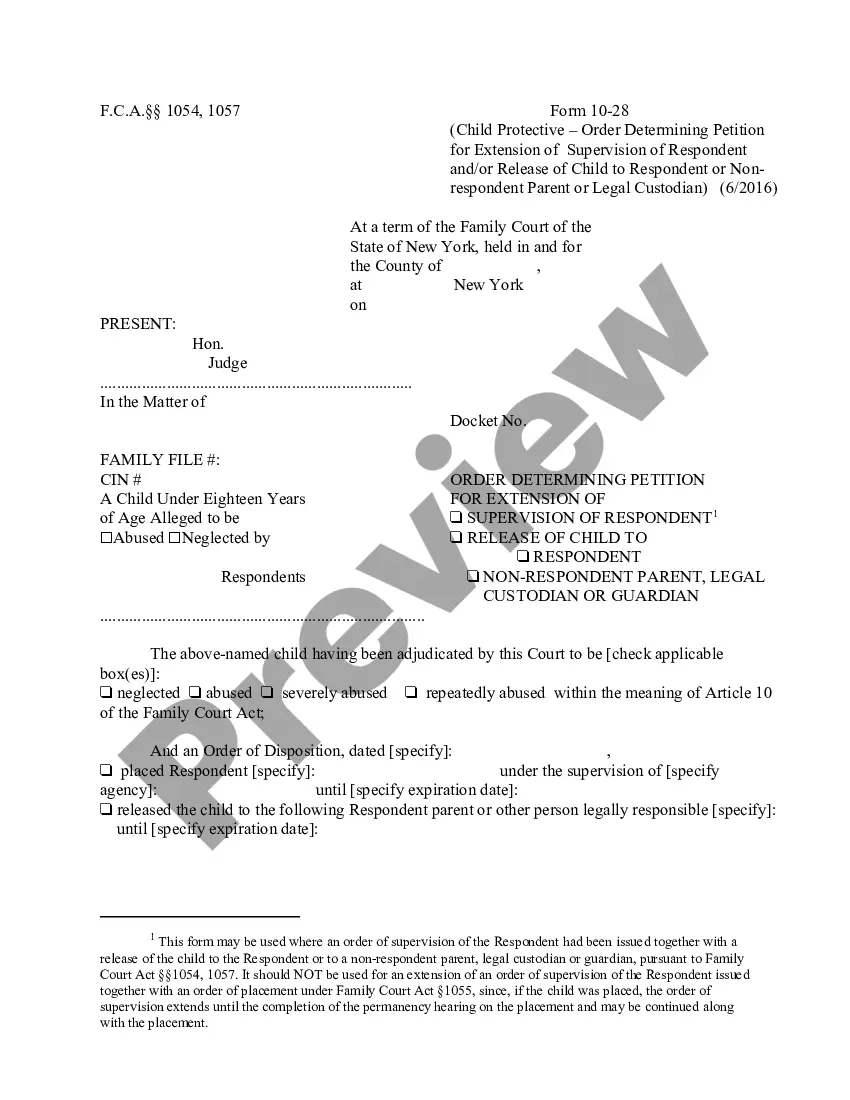

The Sample Money Order Form with payment in Oakland is a standard template designed to facilitate financial transactions via money orders. This form typically includes sections for the payee's name, account number, and the signature of the sender, making it easy to complete necessary payments securely and efficiently. Key features include clearly defined fields for all critical information, ensuring users understand what is required to complete the transaction. For editing and filling out the form, individuals should provide accurate details regarding the payment recipient and maintain clarity in their correspondence. This form is particularly useful for attorneys, partners, owners, associates, paralegals, and legal assistants who require a reliable method for transferring funds in a formal legal context. Common use cases include payment for legal services, filing fees, or other expenses where a money order is preferred over other payment methods. Overall, it serves as an essential tool that enhances professionalism and accountability in legal financial transactions.

Form popularity

FAQ

Application Process You will receive an emailed containing your certificate from the Business Tax Office within 5 days.

There is no state-level general business license in California. But many businesses must register with the California Secretary of State's office. If you sell goods that are typically subject to sales tax, you'll also need a California seller's permit.