Sample Money Order Form For Rent In Clark

Description

Form popularity

FAQ

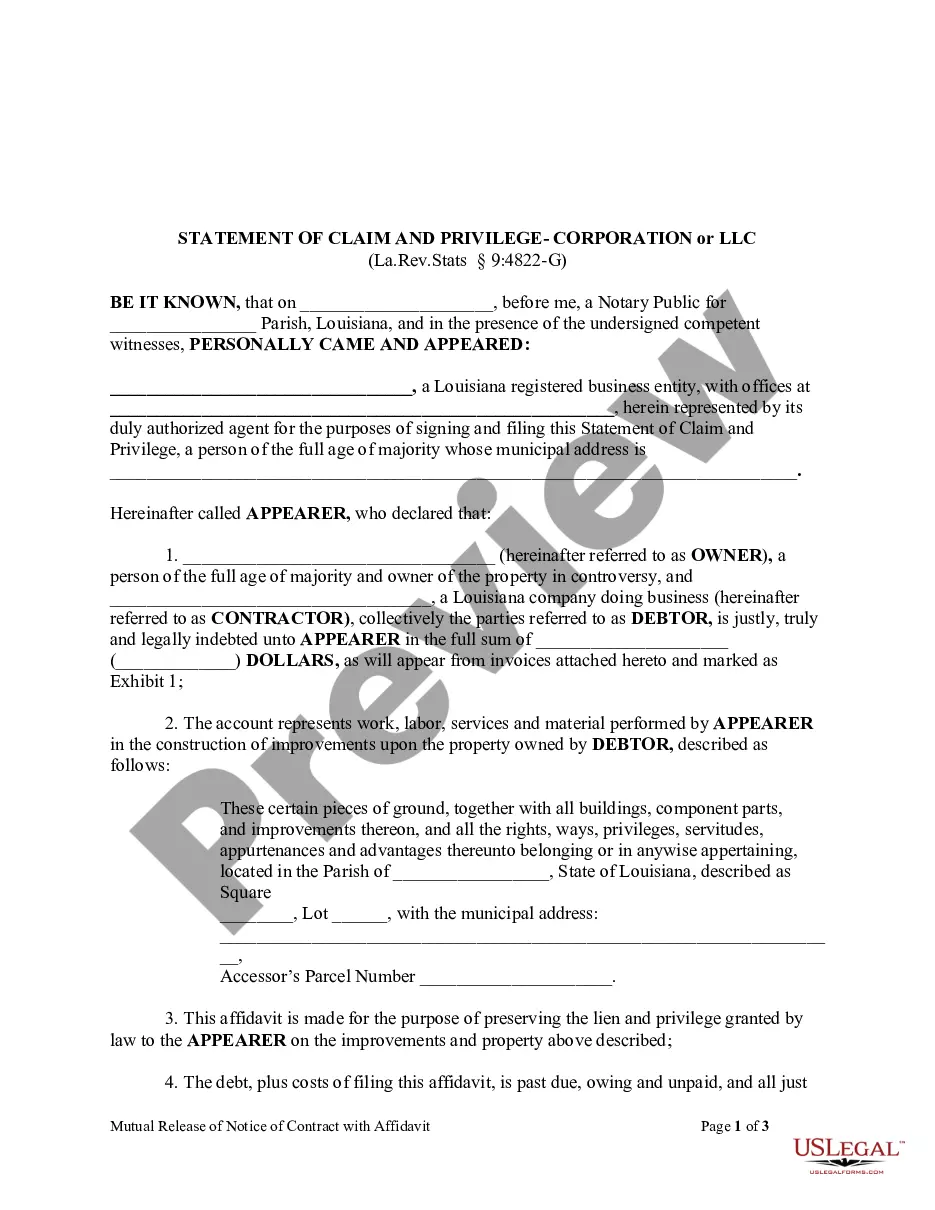

Deed Recording Requirements Pursuant to Nevada Revised Statutes (NRS) Document formatting ing to Section 2 of NRS 247.305. Assessor's parcel number(s) must be listed at the top of the first page of the document. Grantee's mailing address must be listed on the document. Mail tax statements to.

Real Property Transfer Tax RPTT is calculated as $1.95 for each $500.00 of value or fraction thereof. When dealing with the fraction thereof you would round up to the nearest $500.00. Note: Taxable value is market value not the assessed value. If the taxable value is $0.00 to $100.00, there is no RPTT due.

So I'll just write that out. Including. You know the decimals for cents. And then this dollars lineMoreSo I'll just write that out. Including. You know the decimals for cents. And then this dollars line is where you're going to actually write out the amount you're paying. So I will put 500.

A landlord must use the 14-day/30-day notice for any breach except nonpayment of rent. Common causes for 14-day/30-day notices are keeping pets when the lease says “no pets”, loud parties that cause neighbors to report noise complaints, and illegal activity (such as illegal drugs) in the unit, among others.

New York Tenant Eviction Process Timeline Providing a Notice14-90 calendar days Serving the Complaint 10-17 business days Tenant Response 10 or fewer business days Court Process 10-20 business days Final Move-out Period 14 business days or fewer