Bill Personal Property Form For Tax Purposes In Wayne

Description

Form popularity

FAQ

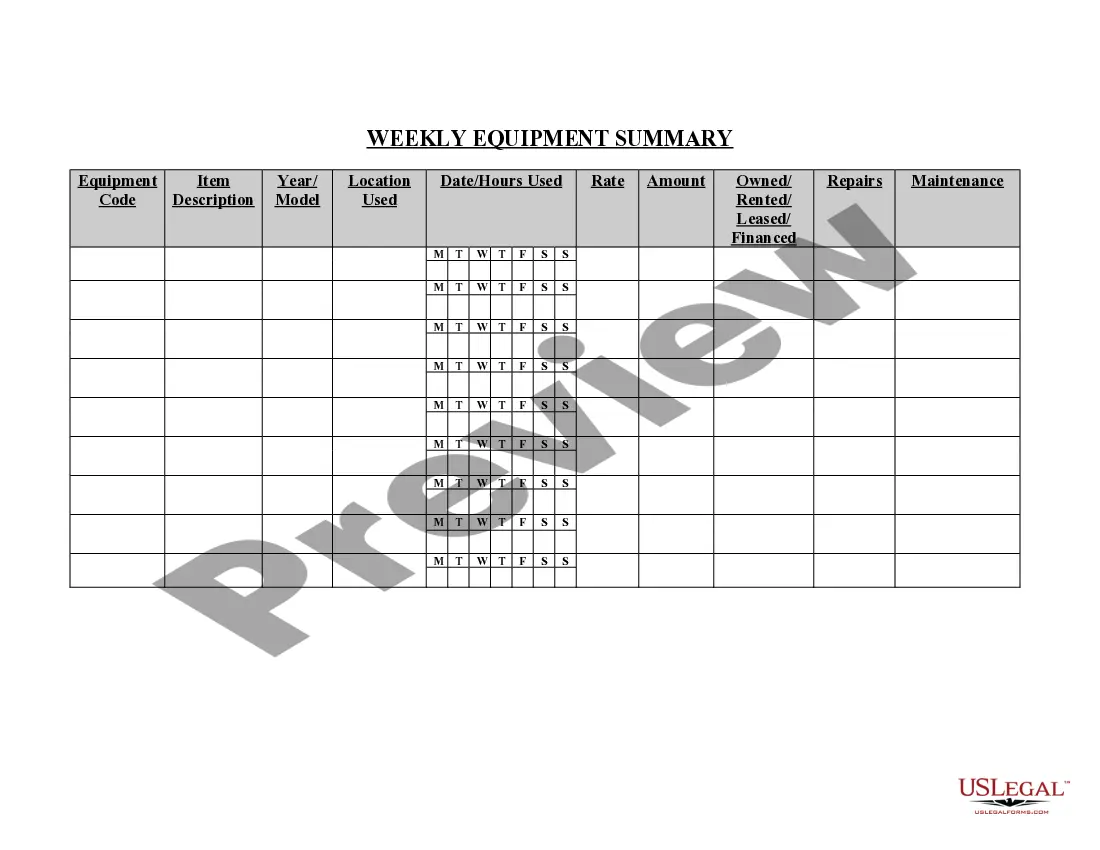

In addition to real estate, Indiana taxes all personal property. The taxpayer is responsible for reporting all tangible personal property that is used in their trade or business, used for the production of income, or held as an investment that should be or is subject to depreciation for federal income tax purposes.

Deductible personal property taxes are those based only on the value of personal property such as a boat or car. The tax must be charged to you on a yearly basis, even if it's collected more than once a year or less than once a year.

A personal property tax is imposed by state or local governments on certain assets that can be touched and moved such as cars, livestock, or equipment. Personal property includes assets other than land or permanent structures such as buildings. These are considered to be real property.

Deductible personal property taxes are those based only on the value of personal property such as a boat or car. The tax must be charged to you on a yearly basis, even if it's collected more than once a year or less than once a year.

Examples of tangible personal property include vehicles, furniture, boats, and collectibles. Digital assets, patents, and intellectual property are intangible personal property. Just as some loans—mortgages, for example—are secured by real property like a house, some loans are secured by personal property.

Personal property includes: Machinery and equipment. Furniture. Stocks and Bonds: If personal property is sold by a bona fide resident of a relevant possession such as Puerto Rico, the gain (or loss) from the sale is treated as sourced with that possession.

What Is Personal Property? Personal property is a class of property that can include any asset other than real estate. The distinguishing factor between personal property and real estate, or real property, is that personal property is movable, meaning it isn't fixed permanently to one particular location.

Where to Report Personal Property on Your Taxes. Claim the itemized deduction on Schedule A – State and local personal property taxes (Line 5c). Taxes you deduct elsewhere on your return — like for a home office or rental — don't qualify for this deduction.