Bill Personal Property Form For Will In Utah

Description

Form popularity

FAQ

Utah Intestate Succession Laws Descendants are the decedent's children, grandchildren, and great-grandchildren. The order of succession is as follows: Presence of a spouse and no descendants – The spouse inherits all of the intestate estates.

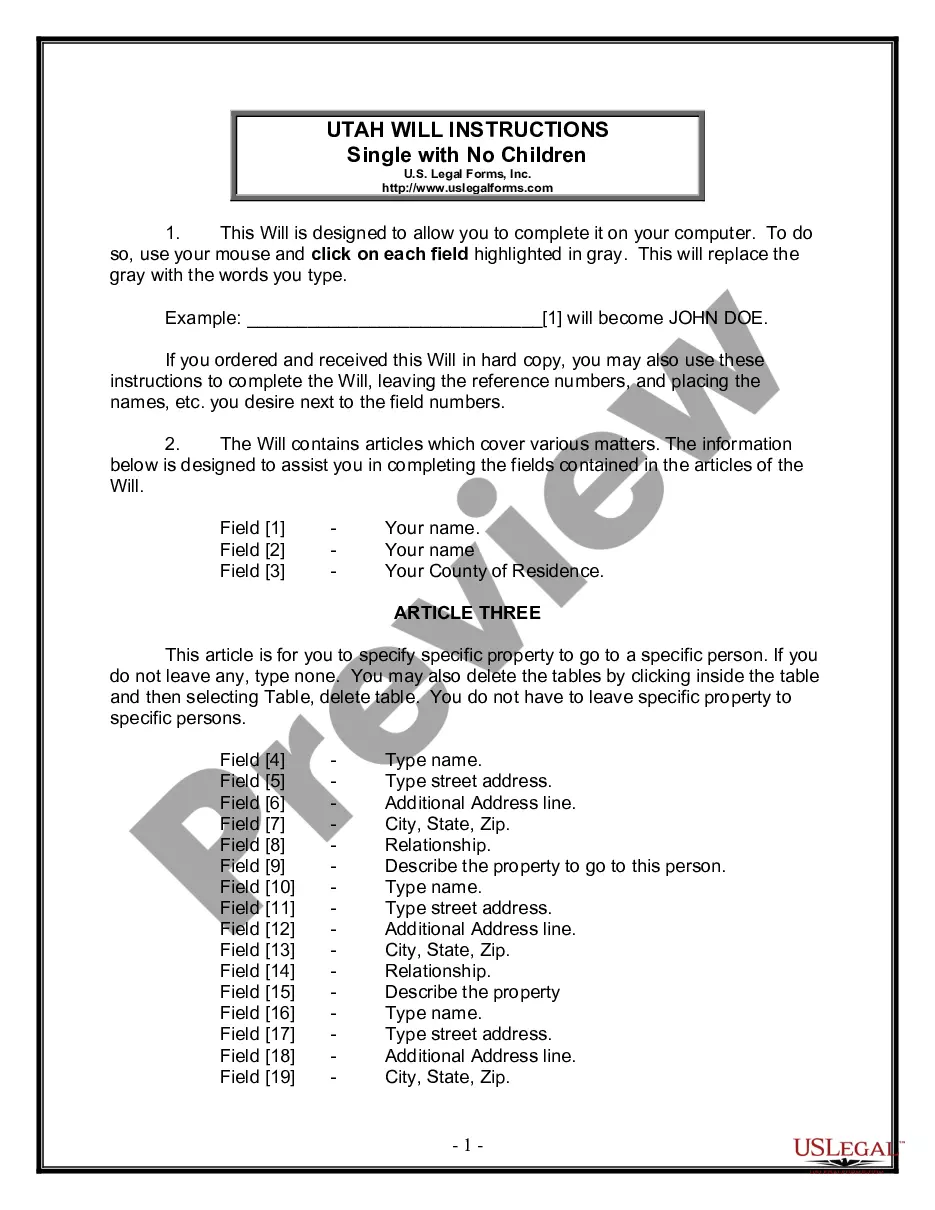

The general requirements for a valid Will are usually as follows: (a) the document must be written (meaning typed or printed), (b) signed by the person making the Will (usually called the “testator” or “testatrix”, and (c) signed by two witnesses who were present to witness the execution of the document by the maker ...

The Utah State Tax Commission defines tangible personal property as material items such as watercraft, aircraft, motor vehicles, furniture and fixtures, machinery and equipment, tools, dies, patterns, outdoor advertising structures, and manufactured homes.

Utah recognizes two types of written Wills. An attested Will is the most common type of Last Will and Testament. To be valid, it must be in writing, signed by you, or another person at your direction and in your presence, and attested in your presence by at least two credible witnesses over the age of 14.

A small estate affidavit may be used if: the entire value of the estate is under $100,000, there is no real property, at least 30 days have passed since the death, and. no application for appointment of personal representative has been filed.

The list is usually incorporated by reference into a Will or a Trust, such as: I may leave a list that is attached to this Will, and if I do so, I direct that such list be treated as a part of this Will and that that the tangible personal property identified on that list be distributed to the designated individuals.

Handwritten Will: A holographic will is a will written entirely by the testator and signed without any witnesses. Utah permits holographic wills only if the testator's signature and material portions of the document are in the testator's handwriting.

The basic requirements for a Utah last will and testament include the following: Age: The testator must be at least 18 years old. Capacity: The testator must be of sound mind. Signature: The will must be signed by the testator or by someone else in the testator's name in his conscious presence, by his direction.

While there is no state in the U.S. that doesn't have property taxes on real estate, some have much lower property tax rates than others. Here's how property taxes are calculated. The effective property tax rate is used to determine the places with the lowest and highest property taxes in the nation.