This form is a simple model for a bill of sale for personal property used in connection with a business enterprise. Adapt to fit your circumstances.

Personal Property Business Form For The Following Except In Suffolk

Description

Form popularity

FAQ

You might also be wondering, “How long can you operate a business without a license?” Judging by real-world examples, you could be shut down in as little as 60 days.

If you're conducting business within a city's limits, check with your city government to determine its licensing requirements. If you're in an unincorporated area, check with the county government. If you have an office in more than one city or county, you might need to get a license for each one.

The license approves your engagement in a specific business in a certain jurisdiction; an LLC provides an official, legally-recognized business entity. Forming an LLC effectively makes your business a company rather than a sole proprietorship.

BPP insurance covers the contents of your business's building, including moveable property the business owner owns. It also covers property that is in the open, or contained inside of a vehicle, within 100 feet of the building or 100 feet of the premises (whichever is greater).

Personal property can be characterized as either tangible or intangible. Examples of tangible personal property include vehicles, furniture, boats, and collectibles. Digital assets, patents, and intellectual property are intangible personal property.

A BOP also includes general liability coverage. Business personal property insurance just covers the contents of your business space — equipment, inventory, furniture and upgrades you made to the space.

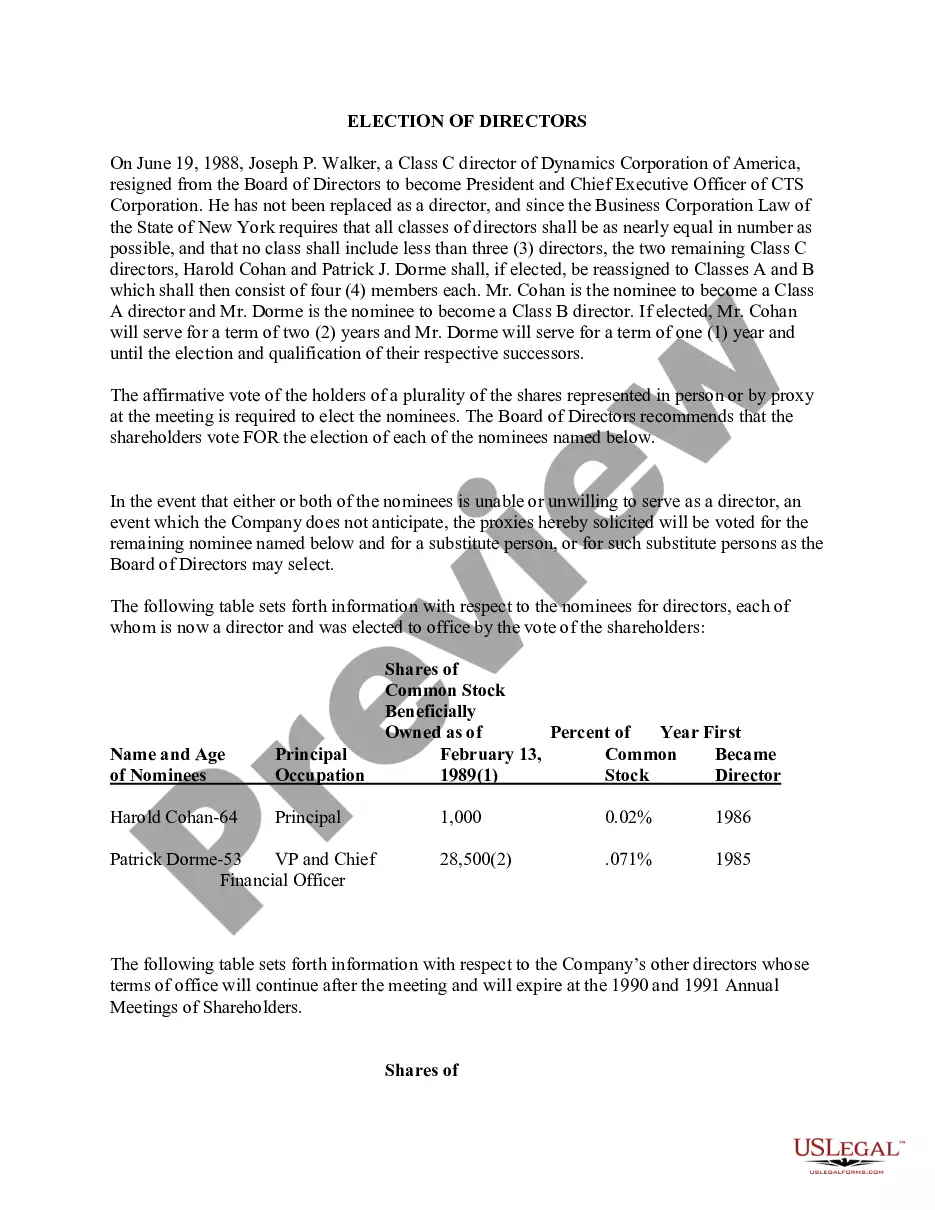

Compare business structures Business structureOwnership Sole proprietorship One person Partnerships Two or more people Limited liability company (LLC) One or more people Corporation - C corp One or more people3 more rows •

Business personal property (BPP) insurance covers the equipment, furniture, fixtures and inventory that you own, use or rent inside your workspace. Basically, it covers almost everything except the building itself.

Business personal property is all property owned or leased by a business except real property.

To qualify for the real property tax credit, you must meet all of these conditions for tax year 2024: Your household gross income was $18,000 or less. You occupied the same New York residence for six months or more. You were a New York State resident for all of 2024.