Personal Property Business Form Forsyth County In San Jose

Description

Form popularity

FAQ

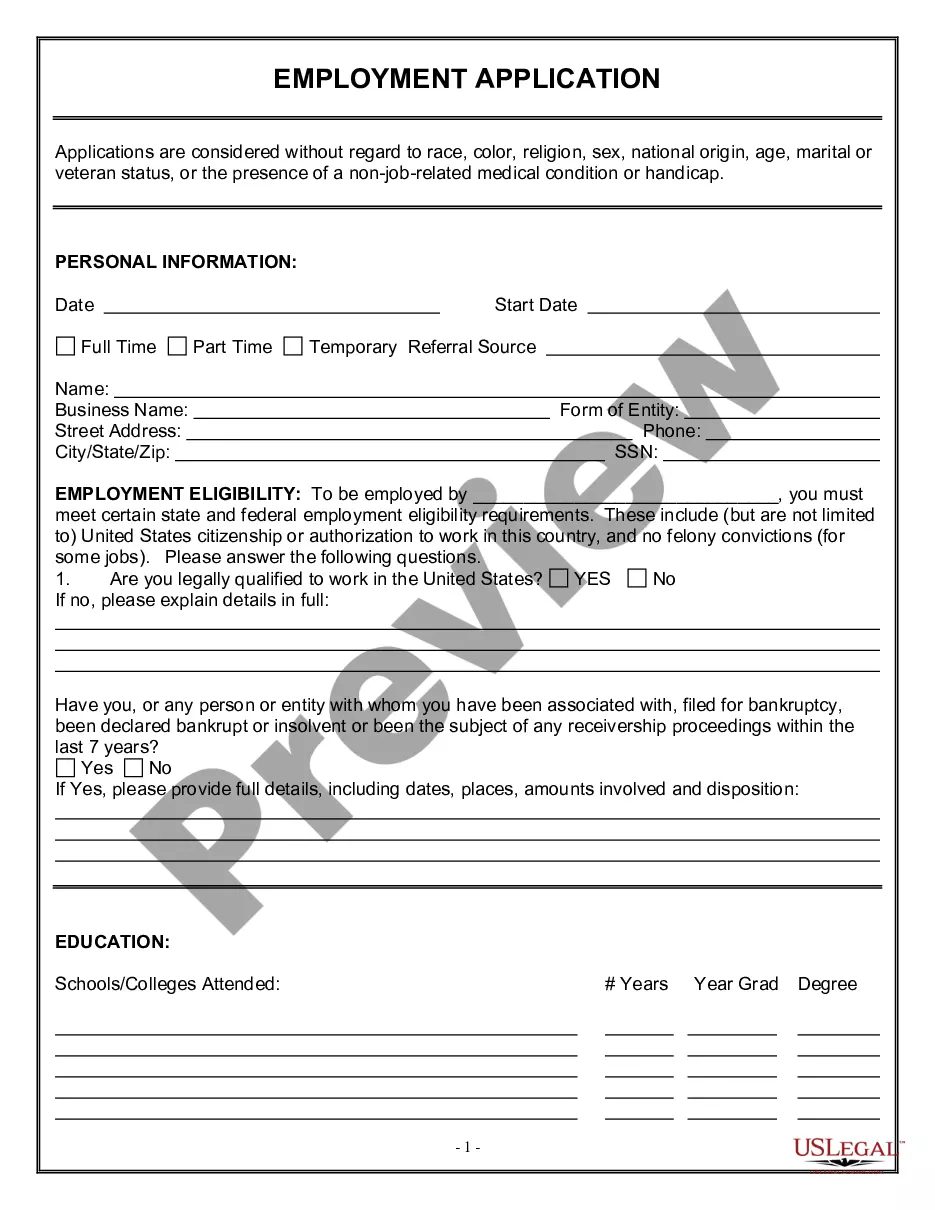

Business Personal Property Tax is a tax assessed on tangible personal property businesses own. This type of property includes equipment, furniture, computers, machinery, and inventory, among other items not permanently attached to a building or land.

Business Personal Property includes all supplies, equipment and any fixtures used in the operation of a business. Exempt from reporting are business inventory, application software and licensed vehicles (except Special Equipment (SE) tagged and off-road vehicles).

How you file your business taxes with the IRS depends on your business's structure. Some structures, like corporations, must file their business taxes separately from their personal taxes. Other structures, like sole proprietorships, must report their business income on their personal taxes.

The state of Georgia provides the following exemptions: All personal clothing and effects, household furniture, furnishings, equipment, appliances, and other personal property used within the home, if not held for sale, rental or other commercial use, shall be exempt from all ad valorem taxation.

An annual filing of a Business Property Statement is a requirement of section 441(d) of the California Revenue and Taxation Code.

Taxes, like real estate taxes, can represent a great LLC tax loophole. You can write off property taxes up to a maximum of $10,000. If you're writing off your property taxes, you should know that you may even be able to write off your homeowners' association fees!

Personal property can be classified as either business property or personal-use property. Business property includes items used for commercial purposes, while personal-use property includes items acquired and used for personal enjoyment. Therefore, the statement is correct.

California Property Tax Rates Property taxes in California are applied to assessed values. Each county collects a general property tax equal to 1% of assessed value.

In general, business personal property is all property owned, possessed, controlled, or leased by a business except real property and inventory items. Business personal property includes, but is not limited to: Machinery. Computers. Equipment (e.g. FAX machines, photocopiers)