Property Sell Out With Me In Nassau

Description

Form popularity

FAQ

Annual IncomePercentage of Assessed Valuation Exempt From Taxation (M+ $2,000) or more but less than (M + $3,000) 35% (M+ $3,000) or more but less than (M + $3,900) 30% (M+ $3,900) or more but less than (M + $4,800) 25% (M+ $4,800) or more but less than (M + $5,700) 20%5 more rows

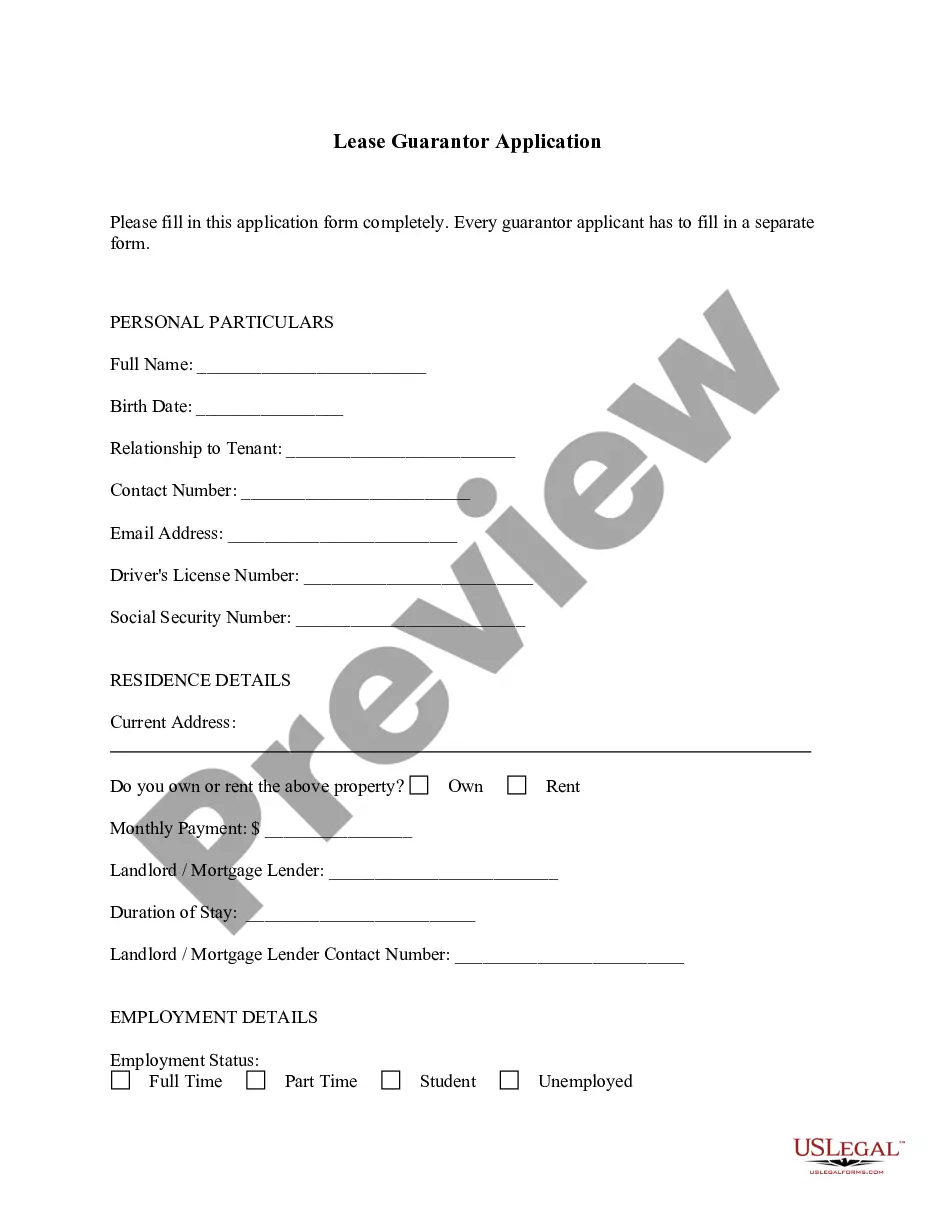

To reduce your property taxes, you have to file a Property Tax Grievance. You can do this yourself (if you love doing paperwork and dealing with Town Hall) or you can hire a firm on your behalf. All Island Tax Grievance specializes in representing homeowners in Suffolk County.

If you believe that the assessment of your property is excessive, you have the right to file a “grievance” or complaint. Your grievance will be reviewed by an impartial party and, if he or she agrees, your taxes will be reduced. If they disagree, your grievance will be denied.

In Suffolk County, a property tax grievance can be filed every year, unless you received a reduction through an appeal in the prior year.

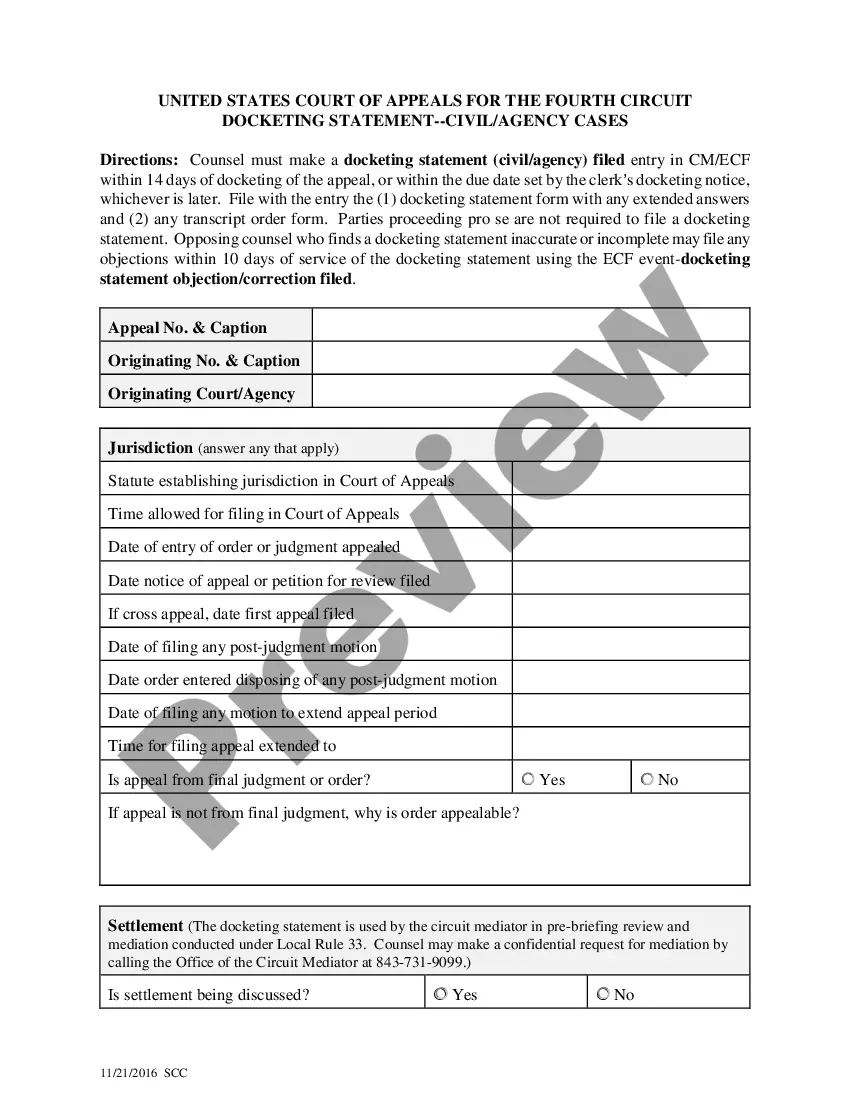

Tax certiorari is the term for legal proceedings by which a real property's tax assessment is reviewed by an administrative agency such as the Nassau County Assessment Review Commission (“ARC”) and ultimately by the courts.

Use Form RP-524, Complaint on Real Property Assessment to grieve your assessment. The form can be completed by yourself or your representative or attorney. File the grievance form with the assessor or the board of assessment review (BAR) in your city or town.

File appeals online at nassaucountyny/arc/arow or in person at 240 Old Country Road, Mineola, NY 11501. For additional information call the ARC at (516) 571-3214.

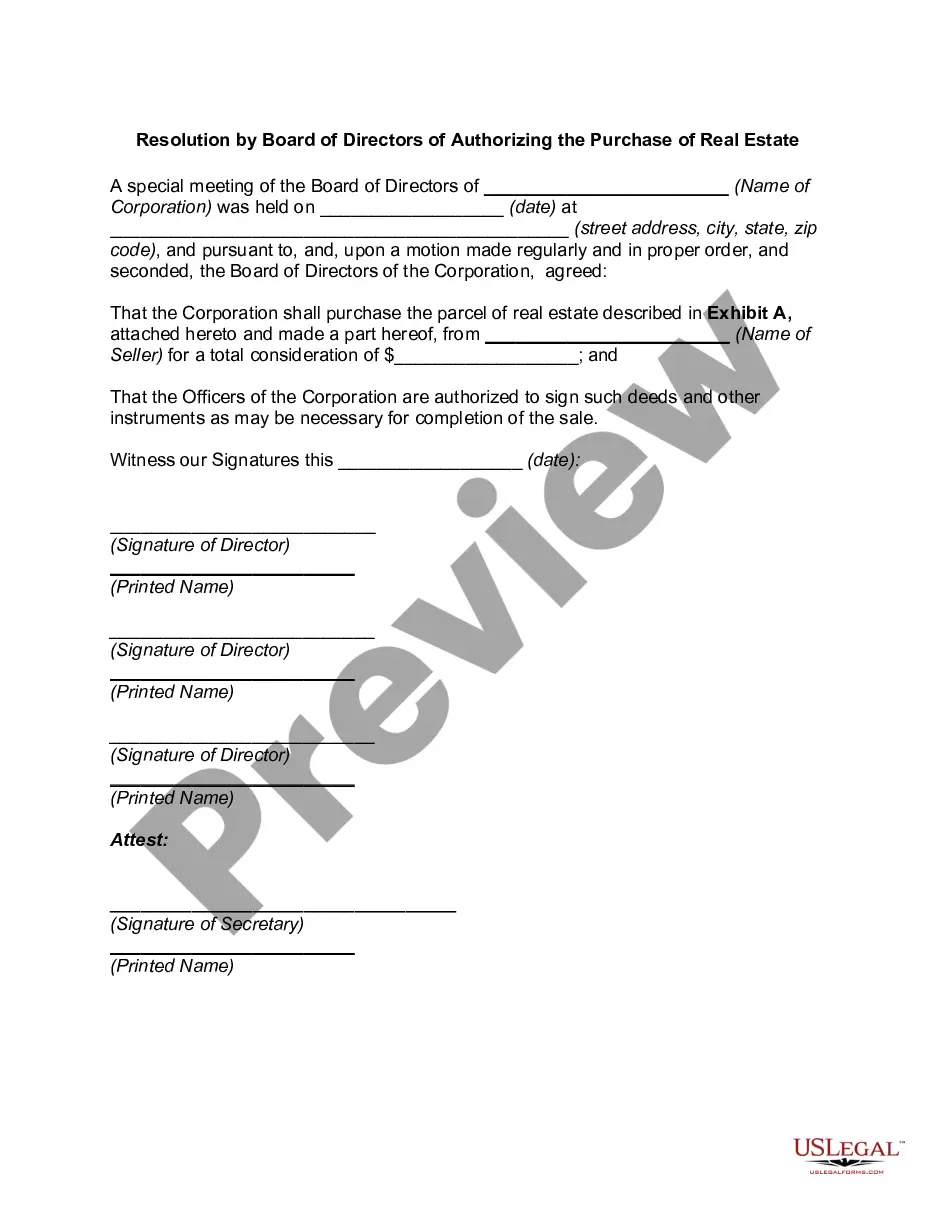

For savvy investors, the Bahamas can be a profitable venture. Investing in Bahamian real estate can yield promising returns thanks to its booming tourism industry, stable economy, and capital growth. From beachfront condos to luxury villas, a diverse range of properties suit your investment strategies.

Buying, Owning Or Selling Property In The Bahamas There are no restrictions on foreigners buying property in the Bahamas. Property purchasers are eligible for an annual Home Owners Resident Card, and those buying a property valued at $500,000 and above are given priority in permanent residence applications.

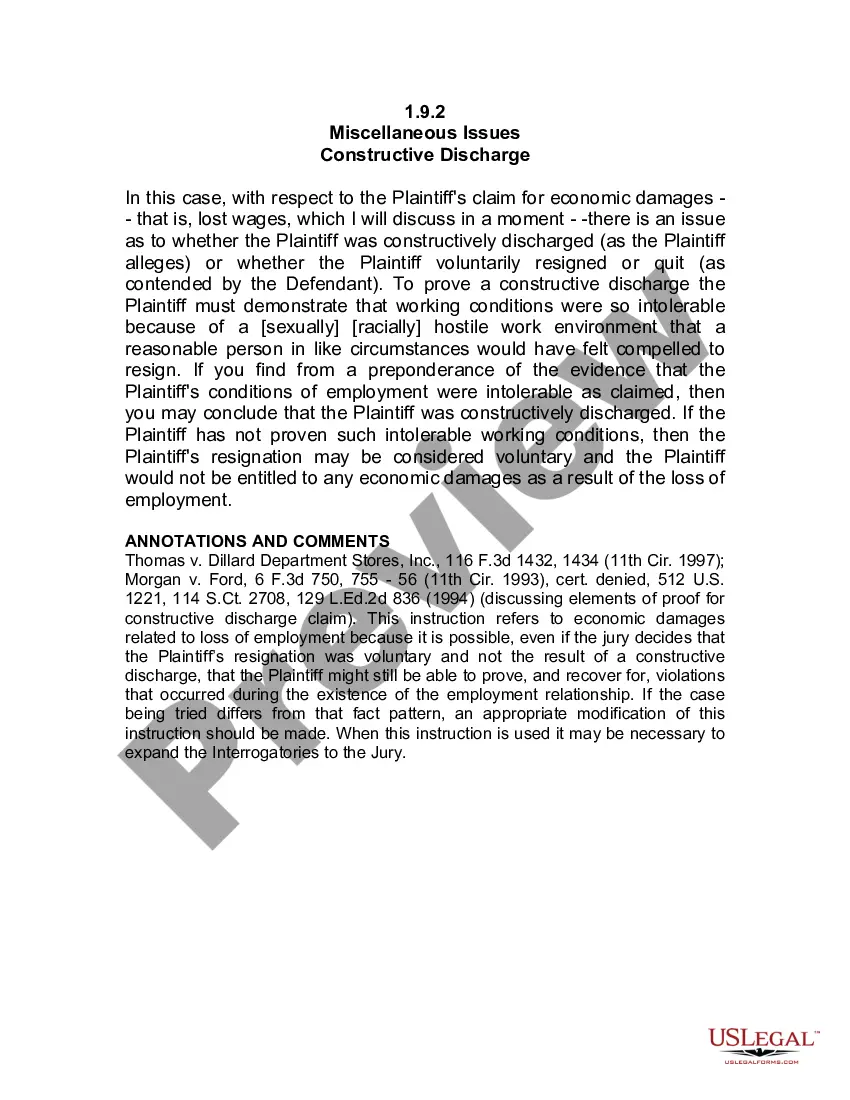

You might not know what eminent domain is, but this government power could force you to sell your home and the land on which it sits.